NFIB Small Business Jobs Report

The NFIB Research Foundation has collected Small Business Economic Trends data with quarterly surveys since 1974 and monthly surveys since 1986. Survey respondents are drawn from NFIB’s membership. The survey was conducted in March 2024 and reflects a random sample of 10,000 small-business owners/members.

NFIB Jobs Report: Small Business Job Openings Fall to Pre-Pandemic Levels

NFIB’s chief economist William C. Dunkelberg, issued the following comments on NFIB’s March 2024 Jobs Report

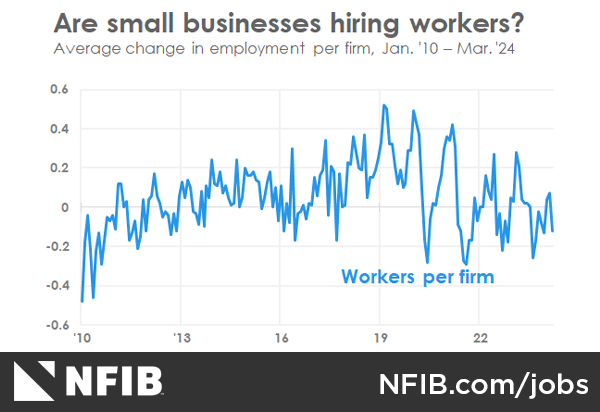

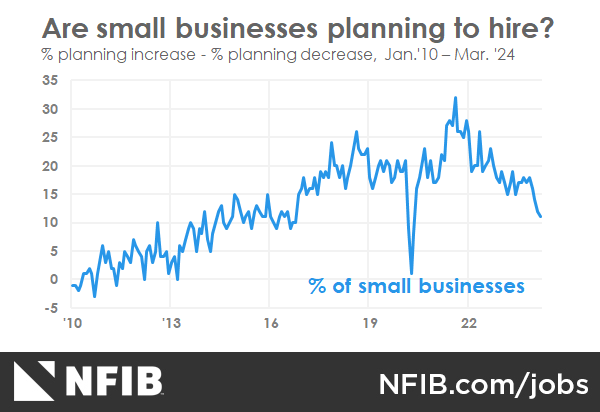

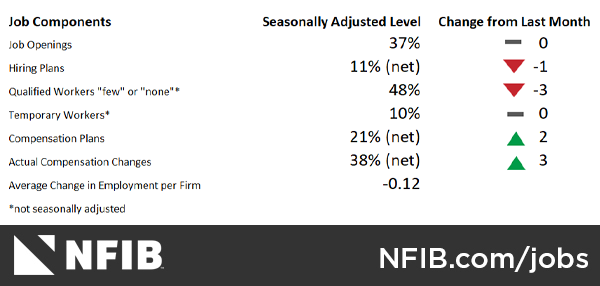

NFIB’s monthly jobs report shows a general slowdown in employment activity for small businesses in March, with a seasonally adjusted net 11% planning to create new jobs in the next three months, down one point from February and the lowest level since May 2020.

“Job openings on Main Street are now in line with the levels before the pandemic,” said NFIB Chief Economist Bill Dunkelberg. “Even with the slowdown in openings, the small business labor market remains tight, and owners continue to compete to retain and recruit employees.”

Overall, 56% of owners reported hiring or trying to hire in March, unchanged from February. Of those hiring or trying to hire, 86% of owners reported few or no qualified applicants. Twenty-nine percent of owners reported few qualified applicants for their open positions and 19% reported none.

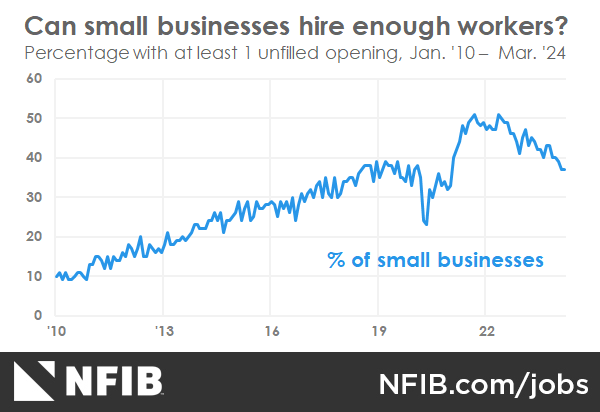

Unchanged from last month, 37% (seasonally adjusted) of all small business owners reported job openings they could not fill in the current period, the lowest reading since January 2021.

The percent of small business owners reporting labor quality as their top small business operating problem rose two points from February to 18%. Labor cost reported as the single most important problem for business owners decreased by one point to 10%, only three points below the highest reading of 13% reached in December 2021.

Seasonally adjusted, a net 38% reported raising compensation, up three points from February’s lowest reading since May 2021. A net 21% plan to raise compensation in the next three months, up two points from February.

Thirty-one percent of owners have job openings for skilled workers and 14% have openings for unskilled labor. Job openings in construction were down nine points from last month and almost half have a job opening they can’t fill. Job openings were the highest in the transportation, construction, and services sectors and the lowest in the finance and wholesale sectors.

Click here to view the entire NFIB Jobs Report

The full Small Business Economic Trends report will be released on Tuesday, April 9th.