Latest Tax News for Small Business

Tax Relief for Small Businesses:

In 2017, NFIB and others worked with Congress to provide significant tax relief for small businesses. A survey on these tax changes confirmed that the overwhelming majority (78%) of small business owners believe the 2017 tax relief had a positive effect on the economy, prior to the COVID-19 pandemic. NFIB continues to educate members of Congress and small business owners on the importance of this tax relief and the need to make the benefits permanent.

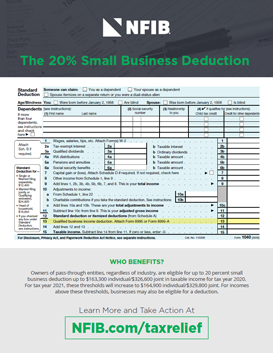

Small Business Deduction

The centerpiece of the pro-small business tax changes is Section 199A, the 20% Small Business Deduction. Approximately 75% of NFIB members are organized as pass-throughs (S corporations, LLCs, sole proprietorships, or partnerships), not as C corporations.

Pass-through business owners – regardless of the type of business they own – can claim up to a 20% tax deduction on their share of the business’ income up to $182,100 for individual filers and $364,200 for those filing jointly in tax year 2023. For tax year 2024, business income up to $191,950 (individual) or $383,900 (joint) is eligible for the full 20% Small Business Deduction. For small business owners whose qualified business income exceeds these thresholds, the deduction may be subject to limitations. For certain service businesses, the deduction phases out over $50,000 (individual filers) and $100,000 (joint filers) of taxable income. If your business is not a specified services business, you can still benefit from the deduction if your business is employee intensive, or you make capital expenditures.

More than 81% of small business owners believe the 20% Small Business Deduction is important to the health of their business. However, without additional congressional action, this important small business provision is scheduled to expire after 2025 alongside other helpful tax benefits. Read more about the Small Business Deduction here.

The Main Street Tax Certainty Act makes this critical deduction permanent. Please ask your Representative or Senators to co-sponsor this crucial legislation and be an advocate for small business tax relief.

TAKE ACTION

Corporate Tax Rate

Currently, the C corporation rate is 21%. In NFIB’s survey of small business owners, 77% view this as important. Read more from the tax relief survey here.

Estate Tax

For tax year 2023, the estate tax exemption is $12.92 million for single filers and $25.84 million for joint filers. For tax year 2024, the exemption is $13.61 million (individual) and $27.22 million (joint). This protects more small business owners from tax preparation expenses and issues created when business assets are passed on to children or other family members. Nearly 70% of small business owners see this increased exemption as important.

Talk to your financial advisor about how likely your business is to be affected by the estate tax and other taxes at death currently being considered by Congress – such as the repeal of the stepped-up basis and capital gains rate increase so you can be prepared. NFIB helped defeat these proposals which were threats during the Build Back Better Act and Inflation Reduction Act consideration, but they could return after the next election.

NFIB leads a coalition of stakeholders fighting to Repeal the Death Tax, learn more here.

Lowered Individual Tax Rates

Eighty-four percent of small business owners say the current, lower individual tax rates are important to them. Read more from NFIB’s full 2021 tax relief survey here.

Standard Tax Deduction

In 2018, the standard deduction nearly doubled to simplify filing taxes for Americans. For tax year 2023, the standard deduction is $13,850, or $27,700 if you’re filing jointly. For tax year 2024, it’s $14,600 (individual) and $29,200 (joint).

Expensing Equipment

Small business owners were already able to immediately deduct some of the costs of equipment purchased for use in their business. The maximum deduction in tax year 2022 is $1.08 million and the 2022 spending cap for purchases is $2.70 million. For tax year 2023, the maximum deduction is $1.16 million and the spending cap for purchases is $2.89 million. Unlike other tax relief, Section 179 is permanent.

Eligible assets that depreciate over time are now eligible for “bonus expensing” where instead of expensing a fraction of the price per year of use, you can expense the entire purchase at once. Bonus expensing phases out in 2024.

View the 2023 Fly-In Issue Sheet

See If You Benefit From the Small Business Deduction

Click to view the full-size flowchart

Get the Facts!

Our infographic below details how the 20% deduction means big savings for small business.

Click to view full-size infographic

Click to view full-size infographic