The Small Business Tax Hike Calculator offers small business owners a personalized estimate of how much more they could owe in federal income taxes in 2026 if the 20% Small Business Tax Deduction and other current tax relief policies expire at the end of this year.

Stop the Small Business Tax Hike

Stop the Small Business Tax Hike

Unless Congress acts this year, 9 out of 10 small businesses will see a significant tax increase

NEW FEATURE: TAX CALCULATOR

How Congress can protect America’s small businesses from a massive tax hike

The Small Business Tax Deduction allows small businesses to deduct up to 20% of their business income, empowering them to grow, hire, invest in their employees, and give back to their communities.

The Small Business Tax Deduction is set to expire this year.

Without Congressional action in 2025, nine out of 10 small businesses will see a massive tax hike.

Making this deduction permanent will protect small businesses and help level the playing field with their larger corporate competitors.

Contact your elected officials now to protect America’s small businesses by making the 20% Small Business Deduction permanent.

In the News

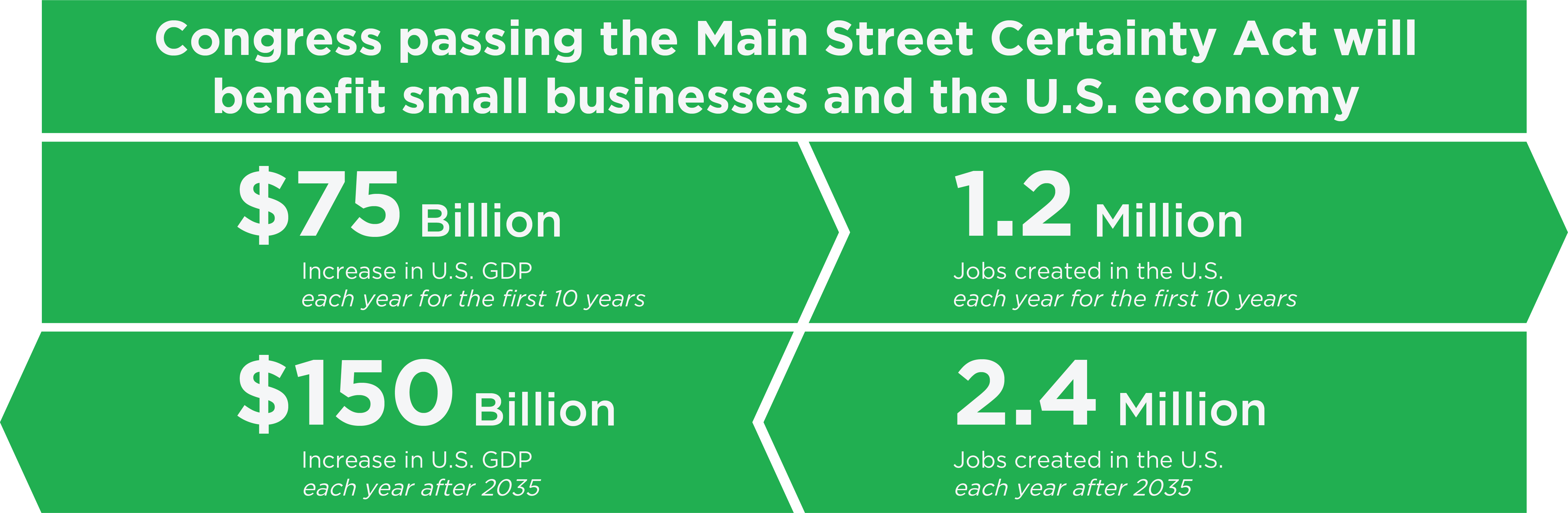

The Main Street Tax Certainty Act

This critical legislation makes the 20% Small Business Deduction permanent. What does this mean for small businesses?

Pass-through small businesses (Sole Proprietorships, S-Corporations, or Partnerships) can continue deducting up to 20% of qualified business income on line 13 of their federal 1040 tax form.

The nearly half (48%) of small business owners who currently report uncertainty regarding the expiring provision can feel confident in their current and future plans.

Small businesses can reinvest in their communities and employees – including focusing on hiring, raising wages, and growth.

Small businesses can keep their tax rates closer to that of their large, corporate competitors.

Help us make the Small Business Deduction permanent

Learn more about how we’re fighting for tax fairness on your behalf by scheduling a quick call with an NFIB Rep today.

SCHEDULE A CALL JOIN NFIBPodcasts

The small businesses that anchor our economy are about to face a devastating tax hike that will hurt workers and weaken communities. I’m calling on Washington, D.C., to wake up and protect the tax relief that small businesses desperately need.

– Nathan Garden, Kansas City Star, 7/12/24

The worst thing that could happen is if Washington lets the small-business deduction die. The moment that happens, I’m going to face some painful choices. The sooner Washington acts, the sooner Main Street will be saved from the coming crisis.

– Rodney Wideman, St. Louis Post-Dispatch, 7/12/24

Only Congress can save our small business, our team, and the customers and community we serve. Our representatives and senators should fight to make the Small Business Deduction permanent.

– Kyle Lindsey, West Virginia News, 7/23/24

Ohio lawmakers in Congress and the president —no matter who it is—must make the Small Business Deduction permanent. They have until the end of next year to act. Small businesses like mine are sounding the alarm. Washington should listen before it’s too late.

– Tim Maloney, The Canton Repository, 8/12/24