April 16, 2021

How To Check if You’re Benefiting From The Small Business Deduction

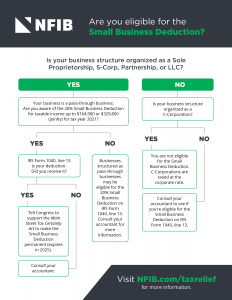

Since it became law in 2017, the Small Business Deduction has allowed small businesses organized as pass-through entities like Sole proprietorships, S-Corporations, Partnerships, or LLCs, to deduct up to 20% of their qualified business income. You can use the following resources to check if this is you:

- Follow our simple graphic to determine if you benefit from the Small Business Deduction.

- Watch our short step-by-step explainer video

- See a sample 2020 IRS Form 1040 including Small Business Deduction line 13 here.

But right now, the White House is eyeing the Small Business Deduction as a source for tax increases to fund “human infrastructure” proposals. NFIB is working to protect small businesses from these tax hikes and NFIB members are telling their stories: The Small Business Deduction is essential for their employees, community, and their recovery from the pandemic and its government-mandated shutdowns. NFIB wants to hear from you on how your business, employees, and community benefit from the Small Business Deduction. Click here to answer a few short questions.

Here’s what some NFIB members are saying about the crucial ways they’re putting the Small Business Deduction to use:

“I have been able to increase my employees’ wages by 25% over the past few years and beginning in January of 2021, I began offering paid time off to all eligible employees. Additionally, we have been able to invest in a new $60,000 conveyor system that will automate the sorting of material, which will further increase productivity.” – Randy, Michigan

“Tax relief allowed our business to purchase $400,000 of new equipment, expand our staff by 20%, and diversify our business offerings. This in turn allowed us to remain in business when the economy took a hit due to COVID-19. Without the investment in new equipment, our COVID-19 experience would have been far less favorable.” – Tim, New Hampshire

“The tax cuts passed in 2017 has allowed us to make capital expenditures as well as expand our business. The new Section 179 rules resulted in us purchasing a 4-post car lift, AC machine, tire machine, and a tire balancer. On top of that, we recently purchased the building we had previously been renting. We are now in the process of demolishing the old building and will soon be constructing a new building with an additional wing to expand our shop capacity.” – Chelsea, Missouri

“The tax cuts were a great advantage for us. We were able to use some of that tax savings to expand and remodel. If we were to lose that, it would slow down expansion and our ability to offer more job opportunities to people, just as we’re all working to get people back to work.” – Jerry, Iowa & Nebraska

Make your voice heard. You can urge Congress and the White House to protect the small businesses from tax increases at this critical time.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles