NFIB, other advocacy groups are now in a frenetic push until Sunday, June 25, to defeat bills they oppose and salvage the ones they support

State Director Anthony Smith reports from Salem on the small-business agenda for the legislative and political week ending June 16.

June 16 was Day 151 of the 2023 regular session of the 82nd Oregon Legislative Assembly, which means there are just nine days left until the Legislature must adjourn.

Two weeks ago, it looked like the session was over and a special session to finalize the state’s next two-year budget would be necessary, but with a handful of Senate Republicans returning to the Senate floor, the entire Legislature is back in action – and at full speed.

Deal Brings Handful of Republicans Back to Senate Floor

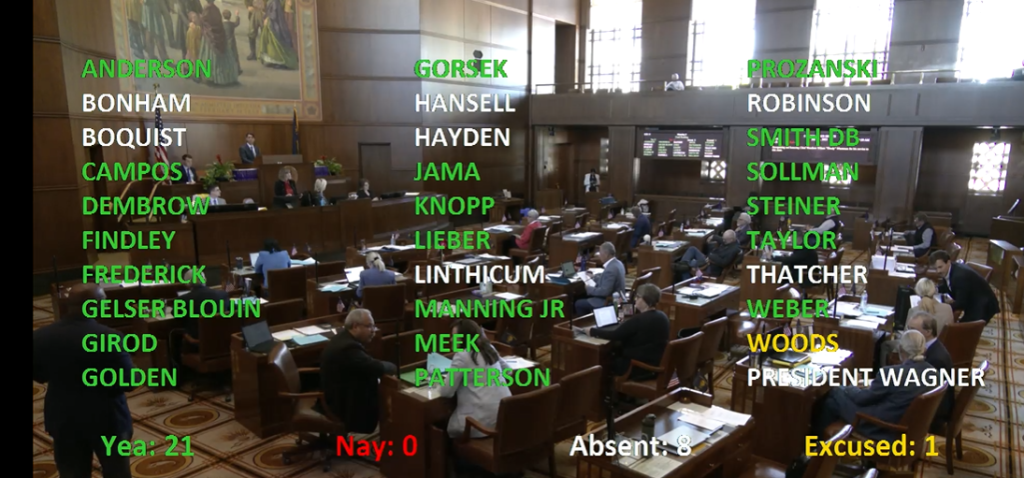

After the longest walkout in state history, which lasted more than 40 days, the stalemate in the Oregon Senate ended on Thursday, June 16, 2023, with the return of three additional Republican senators, bringing the number of senators present on the floor to 22, two more than the 20 required for a quorum in the senate.

Senators Tim Knopp (R-Bend), Bill Hansell (R-Athena), and Lynn Findley (R-Vale) returned from their protest to join Senators Dick Anderson (R-Lincoln City) and David Brock Smith (R-Port Orford), the only two Republican senators regularly attending floor sessions during the walkout – and still (unquestionably) eligible to run for reelection, if they so choose. Sen. Fred Girod (R-Stayton) returned the following day from an extended medical leave for which he was excused during his absence and thus not subject to the consequences of Ballot Measure 113.

Those choosing not to return thus far include Senators Daniel Bonham (R-The Dalles), Brian Boquist (I-Dallas), Cedric Hayden (R-Fall Creek), Dennis Linthicum (R-Klamath Falls), Art Robinson (R-Cave Junction), Kim Thatcher (R-Keizer), and Suzanne Weber (R-Tillamook). They, along with Knopp and Findley (Hansell has already announced his retirement), will have to wait for a court of law to determine their political futures in light of Ballot Measure 113 since “the deal” made between Democrats and Republicans to bring them back did not include retroactively excusing their absences.

The major components of “the deal” have been widely reported by the media – you can read more from Oregon Capital Insider, Oregon Capital Chronicle, and OPB. And while the most contentious issues that prompted the walkout have now been settled, it’s far from clear what else, if anything, was a part of “the deal”. Most advocacy groups, including NFIB, now find themselves in a frenetic push from now until Sunday, June 25, to defeat the bills they oppose and salvage the ones they support.

Bad Bills, Once Thought Dead, Find New Life

Unfortunately, with the Senate back in action, several bad-for-business bills that would have otherwise died with the end the 2023 legislative session are now back under consideration, including several bills that NFIB is opposing.

Two of these bills deal with insurance – more specifically, they run the risk of increasing insurance rates at a time when Oregonians and their businesses cannot afford any more cost burdens. Our members rely on affordable insurance rates to protect their businesses, their employees, and the customers they serve.

HB 3242 and HB 3243 would move Oregon’s insurance market away from a proven model that is working for most Oregonians to one that incentivizes litigation. HB 3242 would authorize the award of triple actual damages and attorneys’ fees, shifting from prompt claims resolution to rewarding lengthy litigation. HB 3243 would add insurance to the Unlawful Trade Practices Act (UTPA), allowing private lawsuits against insurers and awards of both actual and punitive damages, in addition to attorney fees.

Both bills would lead to higher litigation costs to resolve claims, which creates market pressure to increase premiums. For many Oregon consumers and businesses, this would mean policyholders will have to pay more for the same coverage – and if they cannot afford to pay more, they risk leaving themselves under-insured.

HB 3242 and HB 3243 are currently awaiting a final vote in the Senate. These bills have already been passed in the House, but HB 3242 was amended in the Senate and would require a concurrence vote in the House to become law.

SB 1089 is another bill that is suddenly alive again – this one is related to heath care. The legislation would establish a Universal Health Plan Governance Board and direct the board to create a comprehensive plan for implementing a Universal Health Plan for the Legislature’s consideration.

In 2019, the Oregon Legislature passed SB 770, which established a Task Force on Universal Health Care. This task force was charged with recommending a universal health care system that is equitable, affordable, and comprehensive, provides high quality health care, is publicly funded, and is available to every individual residing in Oregon. The task force submitted its final proposal to the Legislature in late 2022 but did not include a final recommendation for funding the program.

During its work on the proposal, the task force considered two new taxes to pay for the program: an employer payroll tax designed to generate $12.85 billion per year and a personal income tax (in addition to the existing state personal income tax Oregonians already pay) designed to generate $8.5 billion per year, for a total of $21.35 billion in new taxes per year. This would place an unprecedented tax burden on all employers, including the smallest of small businesses, and increase middle class income tax rates to among the highest in the nation.

Even if the program successfully operates as intended, this cost is far too great for Oregon’s small businesses and far from equitable – clearly picking winners and losers, as noted by the aggregate financial impacts and distributional impacts presented to the task force on May 19, 2022.

A 2023 survey of NFIB’s membership in Oregon found that 89.6% of our small business members oppose replacing private insurance plans with a government-run “single-payer” health care system.

The state is as close as it’s ever been to achieving universal health coverage for all Oregonians. The Legislature’s efforts would be better directed towards identifying innovative, affordable, and responsible ways to provide coverage options for the relatively small number of Oregonians who are still uninsured, not moving forward with a governance board whose final product would be irrelevant without a $20 billion per year tax that will force thousands of small businesses to close or relocate out of state.

SB 1089 is currently awaiting a final vote in the Senate. If passed by the Senate, it would also need to pass in the House.

A Bright Spot for Multigenerational Family Businesses

Having the Senate back isn’t all bad news though. NFIB has been working all session long on estate tax reform – and just when it looked like we’d have nothing to show for it, SB 498 reemerged with a viable pathway to passage. It sets a $15 million estate tax exemption threshold for small businesses in the farm, forestry, and fishing industries.

As many of our members are well aware, at its worst the estate tax can tax a family right out of business. For estates comprised mainly of illiquid assets, like land or a building, coming up with the cash to pay the tax can be a major challenge.

NFIB has hundreds of Oregon members engaged in agriculture and the natural resources sector – and this bill is a great first step in addressing an inevitable problem for multigenerational family businesses. The legislation will simplify a very complicated process for these taxpayers – and for their heirs who want to continue operating the family business but are unprepared to pay a sizable estate tax.

Over the last decade, estate tax revenues in Oregon have doubled – and not because a steady influx of billionaires moved to Oregon to enjoy their retirement years. Rather, during that same timeframe, the number of Oregon taxpayers subject to the tax has also nearly doubled, meaning more and more Oregonians are paying a tax that was once paid only by a small number of very wealthy individuals.

A key factor driving this stark increase is surging real property values, especially homes and other forms of real property, which have an outsized impact on the overall value of estates – and that’s true for small business owners, including those engaged in agriculture, but also for Oregonians in general.

Eighty-eight percent of NFIB members in Oregon support the complete elimination of Oregon’s estate tax. SB 498 takes a different approach, but it’s a step in the right direction and, hopefully, the beginning of a continuing dialogue about reforming Oregon’s estate tax.

SB 498 is currently awaiting a final vote in the Senate. If passed by the Senate, it will also need to pass in the House.

Previous Legislative Reports and Related Information

- March 24—Estate Tax Reform Back in Spotlight

- February 15—NFIB Oregon Small Business Day, April 18

Photo snip courtesy of the Oregon State Legislature website

Photo snip courtesy of the Oregon State Legislature website