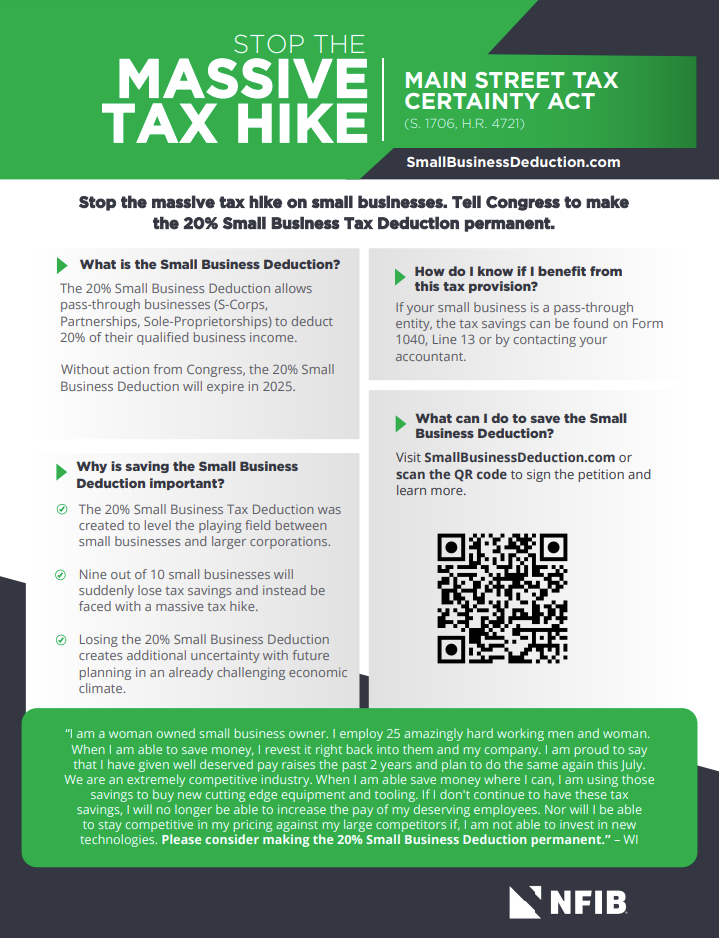

NFIB advocates to protect small business owners from tax increases, burdensome paperwork, and unnecessary audits. The federal tax burden consistently ranks as a top issue for small businesses of all kinds. Around 80% of small employers are organized as “pass-through” businesses, meaning, their business income passes through to their individual tax rates. These types of businesses include S-Corporations, Sole-proprietorships, and partnerships.

These pass-through businesses are sensitive to any changes to the individual income tax brackets.

Small business owners are affected by a variety of other tax issues including, but not limited to, payroll tax, the estate tax, and industry-specific tax credits and deductions.