NFIB Research: 200,000 Additional Jobs if Small Business Expensing Bill Becomes Law

US economy could add 200K jobs and boost output by $18 billion if Sec. 179 expensing provision is made permanent

Executive Summary

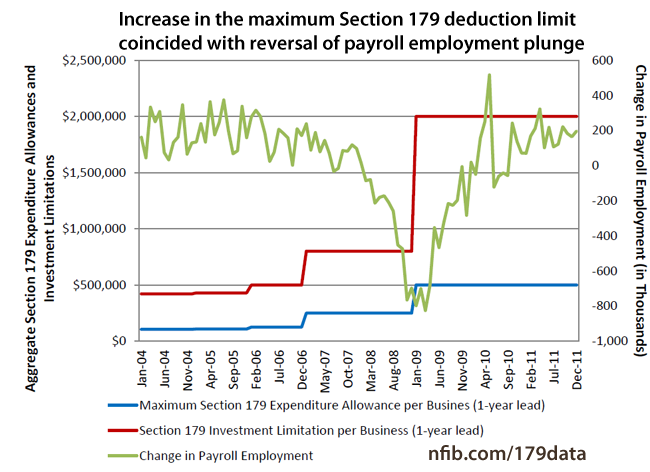

This brief report analyzes the potential economic impact a permanent expansion of the Section 179 deduction allowance limit to $500,000 may have on the U.S. economy. Section 179 of the federal tax code currently permits firms to expense up to a fixed amount of the total cost of new and used qualified assets purchased and placed in service. The fixed amount firms are permitted to expense is referred to as the deduction allowance limit. Currently, the allowance limit is set at $25,000 per year, down from $500,000 in recent years. Since investment is generally viewed as a function of the cost of capital, a higher Section 179 deduction allowance limit should reduce the cost of capital and increase investment, subsequently increasing employment due to higher levels of production.

This brief report analyzes the potential economic impact a permanent expansion of the Section 179 deduction allowance limit to $500,000 may have on the U.S. economy. Section 179 of the federal tax code currently permits firms to expense up to a fixed amount of the total cost of new and used qualified assets purchased and placed in service. The fixed amount firms are permitted to expense is referred to as the deduction allowance limit. Currently, the allowance limit is set at $25,000 per year, down from $500,000 in recent years. Since investment is generally viewed as a function of the cost of capital, a higher Section 179 deduction allowance limit should reduce the cost of capital and increase investment, subsequently increasing employment due to higher levels of production.

To quantify the gains in employment and production due to a permanent expansion of the allowance limit to $500,000, the NFIB Research Foundation used the REMI PI+ model (a widely-used econometric forecasting model) to estimate the impact the higher deduction allowance limit might have on the U.S. economy using historical data on the amount of Section 179 deductions actually taken by employers year-over-year. The results suggest that a permanent expansion of the Section 179 deduction allowance limit to $500,000 could increase employment by as much as 197,000 jobs during the ten-year window following implementation. U.S. real output could also increase by as much as $18.6 billion during the ten-year window.