The 20% Small Business Tax Deduction is now permanent with the successful signing of the One Big Beautiful Bill Act into law. This is a big win for small businesses nationwide, preventing a tax hike that would have decimated their ability to hire, grow, and invest in their communities.

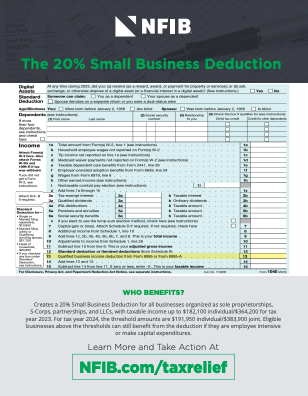

Without the action by Congress and the White House to provide a permanent extension of the Small Business Deduction, nine out of 10 small businesses would have seen a massive tax hike before the end of 2025. The deduction helps to level the playing field for small businesses and their larger competitors whose corporate tax rate was lowered and made permanent in 2017.

According to a recently published EY Study on the impact of the Small Business Deduction, permanently extending it is expected to increase jobs in the small business sector by 1.2 million jobs each year over the first 10 years and gradually increase to 2.4 million annually every year thereafter. The report also found that extending the Small Business Deduction would result in a $75 billion GDP increase each year over the first 10 years, and a $150 billion increase annually after that.

The Small Business Deduction was originally introduced through the 2017 Tax Cuts and Jobs Act (TCJA) and was set to expire at the end of 2025. The passing of the One Big Beautiful Bill Act is a historic victory for small businesses across the country.

NFIB’s nearly 300,000 members have been steadfast in supporting and advocating for the passing of this critical legislation and remain dedicated to protecting the interests of small businesses nationwide. For more information on what the deduction means for small businesses, visit SmallBusinessDeduction.com.