Topics:

March 2, 2022 Last Edit: June 5, 2025

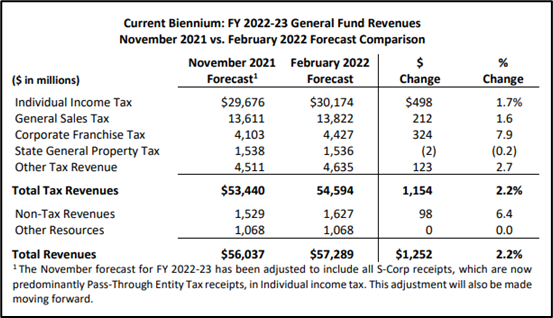

Up $1.5 billion since November

Minnesota Budget Surplus Grows to $9.25 billion

Without action this session, the surplus will grow to an astounding $15 billion in coming years.

It couldn’t be clearer that Minnesotans are badly overtaxed and major reform is needed now to give small businesses relief and spur economic growth.

Heading into 2022, the nonpartisan Tax Foundation ranked Minnesota’s business tax climate 6th worst in the country, worse than Illinois and by far the lowest in the upper Midwest.

Our neighbors in Iowa were the next worst business tax climate – 13th worst – but their state has taken a markedly different course this year.

In late February, Iowa enacted a major tax reform package that lowers the individual income tax to a flat rate of 3.9% and reduces their corporate rate from 9.8% (t-3rd highest, with Minnesota) to 5.5%. They also eliminated taxes on retirement income.

Around the country, other states are also using surpluses to pursue massive tax relief packages.

There have been several proposals for large scale tax reform this year, but so far Minnesotans are still waiting for relief.

The complete budget forecast is available here: MMB February 2022 Budget and Economic Forecast.

Read more about the original projected surplus here: State Announces Massive Budget Surplus (nfib.com).

Without action this session, the surplus will grow to an astounding $15 billion in coming years.

It couldn’t be clearer that Minnesotans are badly overtaxed and major reform is needed now to give small businesses relief and spur economic growth.

Heading into 2022, the nonpartisan Tax Foundation ranked Minnesota’s business tax climate 6th worst in the country, worse than Illinois and by far the lowest in the upper Midwest.

Our neighbors in Iowa were the next worst business tax climate – 13th worst – but their state has taken a markedly different course this year.

In late February, Iowa enacted a major tax reform package that lowers the individual income tax to a flat rate of 3.9% and reduces their corporate rate from 9.8% (t-3rd highest, with Minnesota) to 5.5%. They also eliminated taxes on retirement income.

Around the country, other states are also using surpluses to pursue massive tax relief packages.

There have been several proposals for large scale tax reform this year, but so far Minnesotans are still waiting for relief.

The complete budget forecast is available here: MMB February 2022 Budget and Economic Forecast.

Read more about the original projected surplus here: State Announces Massive Budget Surplus (nfib.com).

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

March 5, 2026

Colorado Small Business Community Applauds Effort to Eliminate Credit Card Swipe Fees on Sales Taxes

NFIB supports SB 134, which would exclude sales tax from costly swipe fees (also known as interchange fees) charged by credit card networks.

Read More

March 4, 2026

Small Businesses Commend Ohio Legislature for Passing Critical Tax Conformity Legislation

NFIB encourages Gov. DeWine to sign SB 9 into law quickly

Read More

March 4, 2026

NFIB Warns Senate File 4126 Will Raise Minnesota Energy Costs

Senate File 4126 would retroactively penalize Minnesota companies for decades old, legal emissions

Read More

March 3, 2026

Small Business Deduction Champion Award Presented to Sen. Roger “Doc” Marshall

NFIB presented the award to members of Congress who played a crucial role in making the 20% Small Business Deduction permanent

Read More