Topics:

March 1, 2022 Last Edit: June 5, 2025

Proposals add millions to electric bills

Minnesota House Pushes Electric Vehicle Subsidies

- Allowing monopoly electric utilities to give out electric vehicle purchase and lease rebates, as well as electric vehicle charger subsidies. This includes incentives for electric cars, boats, and planes. Utilities would be allowed to charge their entire customer base for the cost of these incentives, raising prices for everyone while benefitting only a few.

- Millions more in electric vehicle charging subsidies and electric vehicle rebates paid for with taxpayer funds.

- Millions to install electric vehicles at state parks and county buildings, paid for by a tax on Xcel Energy customers.

- Placing electric vehicle charging stations at state-run highway rest stops (where commercial activity is currently prohibited in law). This puts them in conflict with existing service stations and other private businesses that will be most affected by the transition to electric vehicles.

- Requirement that all new or refurbished commercial buildings install electric vehicle chargers in parking lots.

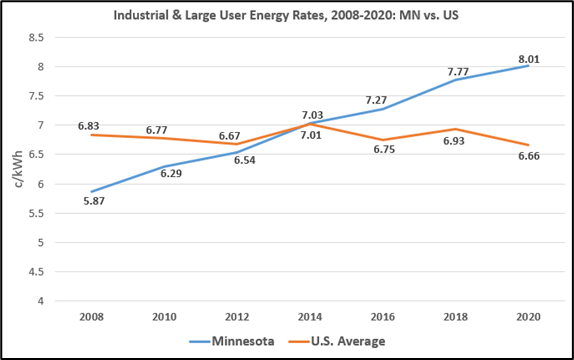

Minnesota’s industrial ratepayers have seen even larger rate increases, over 20 times more than average growth in the U.S.

Minnesota’s industrial ratepayers have seen even larger rate increases, over 20 times more than average growth in the U.S.

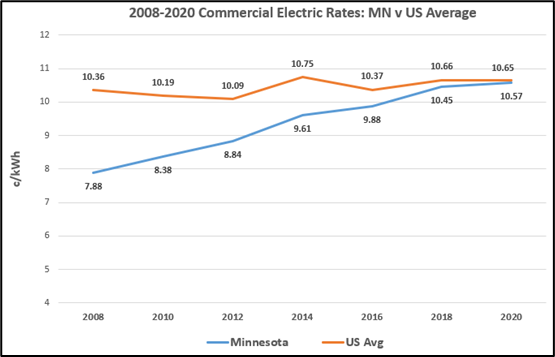

The steep rise in Minnesota’s electric rates coincides with the enactment of renewable energy mandates by the state. Over the years, legislators have created a complex set of renewable energy standards and goals intended to transition the electric grid to more carbon-free sources.

In 2005, the Legislature and Gov. Pawlenty created a Renewable Energy Standard, which required electric utilities to provide 25-30% of their power from renewable sources. All major utilities met or exceeded these goals. The state’s largest electric utilities, Minnesota Power and Xcel Energy, are more than 50% renewable, including wind, solar, and hydro power.

In 2007, the Next Generation Energy Act (NGEA) was signed into law and set the first statewide greenhouse gas (GHG) reduction goals. NGEA set goals of reducing GHG emissions by 30% below 2005 levels by 2025 and 80% by 2050.

In 2013, the Legislature and Gov. Dayton created “community solar gardens” (CSG), which are mid-size solar arrays that individuals and businesses can “subscribe” to for some of their power. Xcel Energy is subject to a unique mandate that requires them to purchase solar power produced from CSGs built within their service territory.

CSGs have become a significant driver of higher electric costs for Xcel customers because Xcel must pay a special price for CSG power that far exceeds the market price for electricity.

Effectively, all other Xcel Customers subsidize reduced energy costs for CSG customers. Many of the largest CSG customers are companies like Walmart and cities like Minneapolis. Investors in Minnesota CSGs include Berkshire Hathaway.

The combination of paying for early closure of existing coal plants, the construction of large amounts of new renewable electric generation facilities (often featuring premature technology), shorter life spans of wind and solar generation, and special interest programs like CSGs have all contributed to the large increase in electric prices.

In 2021, the Minnesota House passed legislation that would accelerate the renewable energy standards and time, including mandating 100% renewable energy by 2040 and “net-zero” GHG emissions by 2050. It did not become law.

Adopting expensive, infeasible energy mandates and potentially adding hundreds of millions in electric vehicle subsidies will only exacerbate the energy affordability problem in Minnesota.

The steep rise in Minnesota’s electric rates coincides with the enactment of renewable energy mandates by the state. Over the years, legislators have created a complex set of renewable energy standards and goals intended to transition the electric grid to more carbon-free sources.

In 2005, the Legislature and Gov. Pawlenty created a Renewable Energy Standard, which required electric utilities to provide 25-30% of their power from renewable sources. All major utilities met or exceeded these goals. The state’s largest electric utilities, Minnesota Power and Xcel Energy, are more than 50% renewable, including wind, solar, and hydro power.

In 2007, the Next Generation Energy Act (NGEA) was signed into law and set the first statewide greenhouse gas (GHG) reduction goals. NGEA set goals of reducing GHG emissions by 30% below 2005 levels by 2025 and 80% by 2050.

In 2013, the Legislature and Gov. Dayton created “community solar gardens” (CSG), which are mid-size solar arrays that individuals and businesses can “subscribe” to for some of their power. Xcel Energy is subject to a unique mandate that requires them to purchase solar power produced from CSGs built within their service territory.

CSGs have become a significant driver of higher electric costs for Xcel customers because Xcel must pay a special price for CSG power that far exceeds the market price for electricity.

Effectively, all other Xcel Customers subsidize reduced energy costs for CSG customers. Many of the largest CSG customers are companies like Walmart and cities like Minneapolis. Investors in Minnesota CSGs include Berkshire Hathaway.

The combination of paying for early closure of existing coal plants, the construction of large amounts of new renewable electric generation facilities (often featuring premature technology), shorter life spans of wind and solar generation, and special interest programs like CSGs have all contributed to the large increase in electric prices.

In 2021, the Minnesota House passed legislation that would accelerate the renewable energy standards and time, including mandating 100% renewable energy by 2040 and “net-zero” GHG emissions by 2050. It did not become law.

Adopting expensive, infeasible energy mandates and potentially adding hundreds of millions in electric vehicle subsidies will only exacerbate the energy affordability problem in Minnesota.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

February 13, 2026

Take Action: Stop Fraudulent Unemployment Claims!

The Florida Legislature is considering unemployment benefits legislation

Read More

February 13, 2026

Watch Now: NFIB Hosts Mid-Session Update Webinar

State Director Natalie Carroll gave a small business legislative update

Read More

February 13, 2026

Take Action Now on Minimum Wage Hikes & Excessive Government Spending

Pennsylvania small business owners are encouraged to take action

Read More

February 12, 2026

NFIB Wyoming Urges Lawmakers to Support “Right to Repair”

“Small business owners need the freedom to repair the equipment they rely on for their livelihoods.”

Read More