Historic Business and Occupation (B&O) Tax Relief a Crowning Achievement

From the 2023 Half of the 68th Legislative Session

Won Health insurance Prior Authorization Modernization

Access to affordable, quality health care and health insurance have remained NFIB members’ top concern for decades. This law requires health insurers to allow electronic transmission of medical-provider requests for approval of patient medical procedures, which will greatly expedite review and approval (or rejection) compared to the current, antiquated fax or phone process.

Secured Homeowner Recovery Fund

NFIB was a stakeholder in a multi-year effort to address remedies for homeowners suffering significant financial losses due to shoddy, incomplete, incorrect workmanship or instances of fly-by-night registered contractors who demanded significant deposits or prepayment but failed to perform the work at all. The Department of Labor and Industries (L&I) will administer a new program that provides some additional financial relief to homeowners who have obtained a final judgment against a contractor and its bond. The program will be funded by a one-time transfer from the Contractor Registration Account, a portion of slightly increased contractor registration and renewal fees, and modestly increased fines imposed on unregistered contractors, which haven’t changed in 30 years. Homebuilders also agreed to raising the minimum general contractor bond amount from $12,000 to $30,000 – the first increase in 20 years.

Obtained Business Licensing Penalty Waivers

NFIB supported Department of Revenue request legislation allowing the agency to waive or reduce fines and penalties on “late” payments of business license renewals. As COVID demonstrated, there are circumstances beyond a small-business owner’s control that may result in their decision to delay renewing a business license, such as (temporary) state-ordered business closures, the owner’s death or retirement or that of other business leadership or key personnel.

From the 2022 Half Session of the 67th Legislature

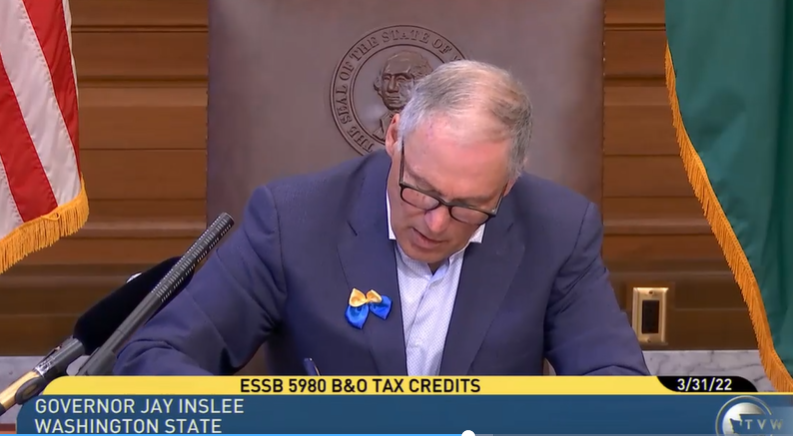

Won Historic Business and Occupation (B&O) Tax Relief

NFIB fought for B&O tax relief that will benefit 276,000 firms by substantially increasing the B&O Small Business Tax Credit. Starting in 2023, businesses with gross receipts up to $125,000 will be exempt from B&O; a partial tax credit will apply to businesses earning roughly double that amount.

Secured Unemployment Insurance Tax Relief

NFIB was able to obtain $250 million in unemployment insurance tax relief for small employers who had few or no layoffs during the pandemic. Firms with 10 or fewer workers should see the greatest savings due to a temporary cap on the social tax modifier. NFIB has saved small employers $750 million in UI costs over two years.

Defeated an Attempt to Bring Back Ergonomics

NFIB helped defeat a proposal that would have allowed the Department of Labor & Industries (L&I) to limit the number and types of repetitive motions a worker could complete during a shift. Voters expressly prohibited this billion-dollar regulatory burden on employers by passing Initiative 841 nearly 20 years ago.

Delayed WA Cares Payroll Tax from Taking Effect

Bowing to pressure from NFIB and other employer groups, the Legislature approved an 18-month delay in implementing a new payroll tax to fund a long-term care benefit program. NFIB will continue working to repeal this law during the 2023 session.

From the 2021 Half Session of the Legislature

Won Paycheck Protection Program (PPP) Tax Exemption

NFIB helped secure unanimous approval of a bill exempting Paycheck Protection Program forgivable loans, Economic Injury Disaster Loan advances, Working Washington Small Business Grants, and other pandemic-related government assistance from the state’s B&O tax. This saves the average PPP recipient between $775 and $1,500 in B&O taxes that would otherwise be owed to the state.

Obtained Unemployment Insurance Tax Relief

NFIB’s insistence on shoring up the state’s Unemployment Insurance Trust Fund, to replace money stolen through fraud, led to $500 million being set aside to reduce employer charges in 2022. A sizable portion of those dollars are designated for businesses with 20 or fewer employees, consistent with NFIB’s position.

Defeated Health Insurance Tax

NFIB, along with other business groups and labor unions, defeated Gov. Jay Inslee’s proposal to add nearly $40 per year to every health-insurance policy sold in Washington state.

Killed Proposal Allowing Bounty Hunter Lawsuits

NFIB succeeded in helping defeat a bad California idea from taking root in Washington that would have allowed qui tam/PAGA lawsuits against employers for alleged violations of nearly a dozen workplace statutes. The proposal’s author admitted the purpose of the bill was to allow unions or other third parties to sue employers so workers don’t have file complaints or lawsuits themselves. This would have circumvented the state’s own complaint process and denied employers the right to face their accusers directly.

From the 2019-2022 66th Washington State Legislature

Low Carbon Fuel Standard and Carbon Tax

NFIB helped defeat statewide low carbon fuel standard (LCFS), carbon tax, and cap-and-trade proposals that would increase the price of fuel at the pump and electricity at the shop. The LCFS alone was estimated to increase gasoline and diesel prices by roughly 60¢ per gallon.

State Business Licensing Fees

NFIB led the successful effort to keep the state Business Licensing Service account solvent by restructuring licensing fees. Thanks to NFIB, the fee increase will affect start-ups while protecting existing firms that have already paid to build the system. The state processing fee to renew existing licenses will be reduced by $1, and the $19 processing fee to add a local license during the year will be eliminated. In addition, once the account reaches $1 million in reserve, the Department of Revenue must reduce the state business license or processing fees.

B&O Tax Penalties

NFIB also led business community efforts to fix an error in law that would have required the Department of Revenue to apply penalties and interest for late filing of annual B&O tax returns retroactively to January, despite the new April 15 due date.

Health Insurer Surpluses

Beginning with the 2021 plan year, the Insurance Commissioner will be able to consider health carriers’ surplus or profits, and capital or cash reserves, when those insurers request to increase health-insurance policy costs for the individual and small group markets. NFIB has long supported granting the Commissioner this authority, particularly due to the state’s three largest nonprofit health insurers amassing some $4.5 billion in unrestricted cash surpluses while requesting double-digit rate increases on small business owners, your employees, and the families they support.

Won Municipal Business Licenses Reform

Thanks to NFIB’s efforts, Washington cities will no longer charge a local business-license fee to nonresident firms whose sales are $2,000 or less annually. Other regulatory licenses or a no-charge city registration may be required. This should save small businesses making periodic deliveries or service calls an average of $45 per city per year.

Secured Change in B&O Annual-Filer Deadline

Beginning in 2020, the deadline for small businesses that only file B&O taxes annually will be April 15, instead of January 31. This will allow adequate time for small firms to receive IRS Form 1099 from corporate customers, and better align state and federal tax filing due dates.

Defeated Easier Local Property Tax Levies

NFIB was the only group to publicly oppose legislation that would have allowed a simple majority vote to increase local property taxes. That change would have put commercial and industrial property at risk of higher taxes approved by renters or voters not subject to the property tax themselves.

Advanced a Small Business Bill of Rights

NFIB secured funding and language in the state operating budget directing agencies to work with us to establish a small business bill of rights. The goal is to better inform and protect small business owners when subject to audit, inspection, or other enforcement actions by state agencies. A report is due to the Legislature in November 2019, in advance of the 2020 legislative session.

From the 2017-2018 65th Washington State Legislature

Defeated $200 Million Health-Care Reinsurance Tax

NFIB was the first to oppose a new state-run reinsurance program to subsidize insurance companies for high-cost medical claims. The scheme would have been funded by a $200 million annual tax on health insurance policies. This proposed windfall for insurance companies contained no requirement for them to reduce premiums or offer coverage in every county.

Secured Swifter Resolution of Legal Claims

NFIB again stood up to insurance companies and won, this time supporting legislation increasing the value of legal disputes that can go directly to arbitration to $100,000. The bill also expedites the discovery timeline while preserving both parties’ right to a jury trial if they’re unsatisfied with the results of arbitration. This bill should allow small business owners to resolve contract, payment, trademark, and other disputes in a matter of months, not years, ending the long waits for jury trials, drawn-out discovery and depositions, and costly attorney fees that can force small business owners into “settle or starve” decisions, even when their position is the right one.

Won Workers’ Compensation Change

NFIB worked with the Department of Labor & Industries (L&I), the self-insured employers’ association, and organized labor to forge agreement on a plan to change how L&I calculates expected investment returns for certain workers’ compensation pension accounts. The resulting bill, which passed the legislature unanimously, allows L&I to transfer surplus reserves to the pension account, eliminating a key driver of what otherwise could have been a decade-long increase in workers’ compensation taxes.

Won Streamlining Municipal Business Licensing

The more than 250 Washington cities and towns requiring a local business license must now join one of two online portals where small businesses can obtain or renew those licenses, saving them time and money. Those cities also have two years to establish a statewide standard for requiring local business licenses, with the goal of eliminating them for infrequent out-of-town sales, deliveries, service calls, or other activities.

Secured a Small Business Bill of Rights Inventory

NFIB is working to ensure small businesses know their rights when the government comes knocking at their door. NFIB wrote and passed a bill requiring six agencies to identify a small business’s rights and protections when subject to audit, inspection, or other enforcement action. The state attorney general will also recommend ways to improve and standardize the notice you receive in advance or at the time of an agency visit.

Obtained Regulatory Fairness Act Improvements

NFIB helped shepherd into law a measure addressing several deficiencies identified by a performance audit on how agencies apply Small Business Economic Impact Statement (SBEIS) requirements and provide mitigation during rule-making. In addition to the bill, the Gov. Jay Inslee’s office convened an interagency workgroup to develop new tools and standards to assist agencies with the SBEIS process. NFIB was part of that workgroup.

Defeated ‘Ban the Box’ Proposals

NFIB again defeated legislation to prohibit small-business owners from inquiring about an applicant’s felony history on job applications. These bills are sure to be back next year, and NFIB will continue to defend small businesses’ ability to manage their workforce and protect their employees and customers.

From the 2015-2016 64th Washington State Legislature

Defeated Minimum-Wage Increase and Paid Sick and Safe Leave Proposals

Despite pressure from the Washington Restaurant Association and Association of Washington Business, the Senate was unwilling to approve a statewide minimum-wage hike and paid-leave mandate, due to NFIB’s opposition. Those groups sought a legislative referendum phasing-in a $12 statewide minimum wage, along with 24 hours of paid leave, as an alternative to an initiative expected to qualify for the November ballot that would ramp up to a $13.50 statewide minimum wage, with a paid sick leave mandate.

Stopped Needless Regulation on Pregnancy Accommodation

Based on data showing 90 percent or more of employers already make pregnancy accommodations when requested, NFIB in concert with pro-small-business House members, drafted a bill identifying the rights and responsibilities of employers and their workers needing pregnancy accommodations. An alternative measure called for dragging small-business-owners into court for perceived discrimination. The Senate unanimously passed a bill based on NFIB’s draft. Unfortunately, the House amended that bill, this time exposing employers to litigation not just from an aggrieved worker, but from the attorney general as well. NFIB opposed the House version, which died when the Legislature adjourned.

Revised New Rule on Food Trucks

Due to NFIB’s opposition, the Department of Labor & Industries (L&I) was forced to negotiate substantial changes to House Bill 2443, its bill to require plan-review for all food trucks purchased out-of-state. Ten drafts later, NFIB and L&I finally reached agreement on language requiring plan-review only under certain conditions. An advisory committee will review the requirements to further reduce the list over the next year. L&I credited NFIB’s work for winning legislative approval of the bill.

Won Seat on New Task Force to Streamline B&O Taxes, Licensing

Thanks to House Finance Committee Chairwoman Kristine Lytton and NFIB member Sen. John Braun, the Legislature passed and the governor signed House Bill 2959, establishing a task force to recommend ways to streamline and consolidate local business and occupation (B&O) tax administration and local business licensing processes. Lytton announced the plan during NFIB’s Small Business Day in January. NFIB is specifically named as a task force member, guaranteeing The Voice of Small Business will be heard on this issue.

Won Greater Transparency of Health-Care Costs

NFIB led a statewide coalition of health-care providers, insurers, consumers, patient advocates, and small businesses to win passage of Senate Bill 5084, which now allows the state to begin building an effective All-Payer Claims Database that will empower everyone to compare quality and costs. APCDs are large-scale databases that systematically collect medical claims, pharmacy claims, dental claims (typically, but not always), and eligibility and provider files from private and public payers. NFIB was thanked for its leadership by Gov. Jay Inslee, who signed the bill into law on May 14. You can read more here.

Defeated Minimum Wage Increase

NFIB was instrumental in stopping House Bill 1355 in the state senate. The measure called for raising the state’s minimum-wage rate to $12 an hour over four years. NFIB succeeded in reminding legislators that the minimum wage is an entry-level wage, earned primarily by teens and young adults just starting their work lives, and that increasing it only eliminates opportunities to enter the workforce. NFIB also produced research showing the loss of 16,000 jobs if HB 1355 were to pass.

Stopped Paid “Sick and Safe” Leave

House Bill 1356 would have given employees at least 40 hours of accrued paid sick or safe leave per year, and for businesses with more than 50 full-time employees even “greater amounts of paid leave.” NFIB showed lawmakers the unaffordability of this to small-business owners and reminded them that leave time for any reason has always been accommodated between employer and employee. HB 1356 died in committee.

Killed Attempt To Silence Questions About Criminal History

NFIB testified against a pair of so-called “Ban the Box” bills, which would prohibit employers from asking about a job-applicant’s criminal history prior to determining they are “otherwise qualified” for a position. NFIB pointed out that the bills (House Bill 1701 and Senate Bill 5608) add time and cost to the hiring process and are an open invitation for litigation against small employers whose only crime is trying to do business in the state of Washington. Both measures were defeated.

Secured Protections for Independent Contractors

NFIB helped win passage of House Bill 1447, which Governor Inslee signed into law. It now allows the Dept. of Enterprise Services to fine poorly performing vendors in lieu of disbarring them from all contracting opportunities. NFIB Leadership Council member Dean Hartman and his brother Don led the way by crafting questions for DES to answer in order for the bill to proceed.

Preserved Right to Recover Attorney Fees

NFIB was asked by Rep. Mark Harmsworth to review House Bill 1094, a measure on biometric identifiers, not a topic NFIB would usually watch. After examining it, however, NFIB found it would strip small-business defendants who are vindicated at trial of their ability to recover attorney fees and costs under the state’s Consumer Protection Act. Working with Harmsworth and Rep. Jeff Morris, NFIB succeeded in amending House Bill 1094 to preserve a small-business owner’s right to recover attorney fees. The measure was then able to pass the House. The senate failed to act on the bill before the session ended.

From the 2013-2014 63rd Washington State Legislature

- a statewide sick-and-safe leave mandate, modeled on Seattle’s ordinance

- a new payroll tax to fund an expanded paid-family-leave mandate

- excessive restrictions that would nearly outlaw the use of independent contractors

- and severe new penalties, including jail time, on small business owners for their workers’ on-the-job injuries and workplace safety violations.

Stopped statewide paid sick and safe leave mandate

NFIB Leadership Council members successfully testified against legislation that would have required small employers to provide each worker at least 52 hours of paid leave each year. The bills also contained onerous recordkeeping and reporting requirements; exposed employers to lawsuits from workers, unions and advocacy groups; and could have required employers to pay medical and transportation costs if they requested a note from a health care provider to ensure leave was taken for medical reasons.

Won a seven-day waiting period to allow for corrections of minor rule infractions

NFIB pushed for passage of House Bill 1150, which will now allow small businesses seven days to correct most minor rule infractions. This bill builds on last year’s successful measure to give businesses two days to correct minor regulatory infractions, before a state agency can impose a fine or other penalty.

Stopped unemployment insurance tax hike

NFIB helped persuade the Legislature to pass Senate Bill 5135, which will avoid most of a $303 million unemployment tax hike that was scheduled to take effect this year. SB 5135 provides for a one-year tax reduction for small business while ensuring nearly 70,000 unemployed Washingtonians remain eligible for federal extended unemployment benefits.

Put more teeth into state’s rule-making law as it impacts small business

NFIB continued its fight to put more small-business teeth into the state’s rule-making law by lobbying for passage of Senate Bill 5500. Under current law, all state agencies and local governments with rule-making authority have to consider economic values in the rule-making process. Under Senate Bill 5500 agencies also have to consider suggestions from small businesses or small-business advocates for reducing the impact of a proposed rule on small businesses.

Won workers’ compensation transparency bill

NFIB fought and won passage of Substitute Senate Bill 5278 requiring the state to disclose in rate notices to employers all the programs and services using workers’ compensation funds. In addition to paying workers’ compensation benefits and administrative costs, premiums have been used to fund other programs and services, including:

- the Department of Health’s farm worker housing program to conduct housing inspection

- L&I’s Specialty Compliance Service Division’s grain elevator

- apprenticeship

- contractor registration programs

- and other programs and services.

From the 2009-2010 61st Washington State Legislature

Supported ballot initiatives that reinstated a two-thirds vote requirement for the Legislature to raise taxes and that repealed various sales and B&O tax increases. NFIB also helped defeated ballot measures that would have imposed a state income tax and that would have funded short-term capital projects with permanent sales tax increases (2010)

NFIB supported Initiative 1053, which reinstated the requirement that the Legislature may only increase taxes by a two-thirds vote in both the state House and Senate, or with a vote of the people. We also supported Initiative 1107, which repealed new or increased sales taxes on candy, bottled water, and soda pop, as well as increased business and occupation taxes on certain processed food products. Voters approved I-1053 and 1107 in November 2010. NFIB opposed Initiative 1098, which would have established a state income tax, and Referendum 52 that sought to pay for $500 million dollars worth of short-term energy efficiency projects at public schools using a permanent tax on bottled water to repay nearly $1 billion in bonds over 30 years. I-1098 and R-52 were rejected by voters in November 2010.

Passed regulatory relief bill giving small businesses two business days to correct most minor rule violations (2010)

Building on successful legislation in 2009 that requires agencies to waive fines for first-time paperwork violations by small businesses, NFIB supported Rep. Norma Smith’s (R-Clinton) House Bill 2603. The bill requires state inspectors to provide small business owners with a copy of the regulation the business is accused of violating and give the owner two working days to correct most minor infractions before a fine or other penalty can be issued. The new law took effect June 10, 2010.

Defeated several bills that would have allowed unemployment benefits for workers who quit their job or only wanted part-time work (2009, 2010)

A number of bills were introduced in 2010 to give the Employment Security Department broad discretion to allow benefits to workers who voluntarily quit their job and to provide benefits to unemployed workers only looking for part-time work. These bills would have cost $18 million to $40 million more per year, driving up unemployment taxes on employers. Similar legislation is expected again in 2011.

Successfully fought against bills that would have tied employers’ hands on employee leave policies (2010)

Employers would have been forced to allow unlimited leave for workers claiming to have “influenza-like symptoms” under House Bill 2764. Similarly, employers would have been required to allow workers four hours of annual, unpaid leave to attend children’s educational activities had House Bill 2444 been approved. In both cases, the leave would have been in addition to any vacation, sick leave, personal days, or floating holidays already offered by the employer.

Passed important Unemployment Insurance reform legislation

Perhaps the biggest success of the 2009 half of the session was the passage of Substitute Senate Bill 5963, the UI conformity bill. This bill was necessary to bring our UI system back into conformity with federal law, maintaining over $300 million in federal tax credits for Washington employers. It also included modest tax relief for employers at every rate class in exchange for going back to two-quarter averaging (charging employers for an employee’s two highest earning quarters instead of four). These changes would also prevent overcharging employers and stop excessive reserves from building up in the UI trust fund.

Defeated big labor’s “Employer Gag Rule” legislation

The biggest assault on the rights of small business owners this session was the so-called “Workplace Privacy Act,” more accurately called the employer gag rule. Lawmakers introduced Substitute House Bill 1528 and Substitute Senate Bill 5446, which would have prohibited employers from holding mandatory meetings or sending employee communications about religious or political issues. Never mind that state and federal laws already protect workers from these issues, or that the state’s own attorney general clearly stated that these bills were unconstitutional. In reality, the thrust of this legislation was to prohibit employers from talking to their employees about union issues and tie an employer’s hands during a unionization drive.

Won a waiver for first-time paperwork violations

We joined with state Sen. Derek Kilmer to pass Substitute Senate Bill 5042, which gives small business owners a waiver of fines for first-time paperwork violations. Oftentimes, there are so many rules affecting a small business owner’s shop that they may not find out about a particular rule or regulation until they’re fined for breaking it. SSB 5042 sends a strong message to small business owners that the state recognizes the importance of small businesses in our economy and we want to encourage them – not punish them – for minor mistakes.

Secured a “safe harbor” for the new destination-based sales tax

One of the most difficult adjustments for small business owners has been complying with the state’s new destination-based sales and use tax. The new law went into effect last July, and it requires employers who ship products to other local jurisdictions to charge sales tax based on the product’s destination, rather than the business location. Small business owners are burdened the most with this change because they don’t have sophisticated accounting software or accounting departments to help comply with the new law. We were able to amend Substitute Senate Bill 5566 to include a safe-harbor provision that exempts businesses with gross incomes below $500,000 from interest and penalties on inadvertent errors made in a good faith effort to comply with the new law.

Previous Years’ NFIB/Washington Legislative Victories

Increased personal property tax exemption, reducing or eliminating this tax

NFIB led the charge to pass legislation raising the exemption for personal property tax from $3,000 of total value to $15,000. This exemption applies to all sole proprietors in Washington.

Saved employers from increased payroll costs by stopping paid leave proposals

NFIB helped defeat legislation that would have required all employers in the state to have mandated paid sick leave. One small business estimated that this would be an automatic seven percent increase in payroll costs and would reduce the flexibility needed to ensure efficient production in his business. NFIB also stopped all other paid leave proposals.

Provided cash flow relief by moving sales tax remittance date to 25th

NFIB helped pass legislation which moves the sales tax remittance date back to the 25th of the month rather than the 20th and allows a waiver of the 5 percent mandatory penalty enacted in 2003.

Protected business owner rights by requiring the Department of Labor & Industries to get permission before doing inspections

NFIB helped pass legislation requiring the Department of Labor & Industries to ask for your permission to be on site prior to conducting a safety inspection. It also requires them to enter your business through a designated or recognizable public entry point. If you deny entry, they will have to get a search warrant.

Saved thousands in payroll costs by defeating a proposal to force employers to pay “on call” workers for hours they don’t work

NFIB defeated legislation that would have required employers to pay at least minimum wage to all “on call” workers or workers whose jobs require them to reside at the place of employment, regardless of whether the employee was “working.” This would have cost plumbers, apartment owners, and many other employers thousands of dollars as they would be forced to pay workers who weren’t working.

Defeated paid family leave

NFIB/Washington State led the charge to defeat a paid family leave proposal that would have cost the average employer between $6,050 and $17,300 in direct and indirect costs. Ninety-six percent of our members opposed this proposal. The grassroots efforts of thousands of NFIB members making phone calls backed up by our successful lobbying ensured the defeat of this costly mandate.

Defeat of state ergonomics rule

In addition to leading the charge to defeat the federal ergonomics rule, NFIB was a leader in the fight to pass Initiative 841, which eliminated the onerous state ergonomics rule that was passed in 2001. Using the grassroots power of its membership, NFIB mobilized small businesses across the state to get out and vote and help educate their friends, family and neighbors about the devastating impact of the regulation. NFIB’s state director served as a spokesperson for the campaign. Initiative 841 passed overwhelmingly in November 2003.

Elimination of mandate that employers provide health care

Washington State was the only state left with this burdensome regulation. It was estimated to cost employers an average of $2100 per employee, per year. We worked with multiple business associations to pass an initiative which repealed the regulation.

Unemployment reform

Streamlining of permit proces

Our state’s permitting processes and workers compensation fraud cost businesses thousands of dollars and make our state less competitive. Legislation passed by NFIB helps reduce the costs of these expensive systems. In addition, the confusion of multiple cities trying to collect B&O taxes on the same activities was costing businesses thousands of dollars. Legislation passed by NFIB fixes this problem and requires cities to use identical ordinances for B&O taxes and prohibits duplicate taxation.

VICTORY: 2004: NFIB led the fight to stop a paid family leave proposal that would have levied a per-hour tax on employers.

NFIB was instrumental in passing a bill (HB 3088) to stop workers’ compensation fraud.

NFIB led the fight to pass a bill that allows court actions against agencies to be filed in three other areas around the state rather than just Thurston County (HB 2598). This will save small businesses several hundred dollars in travel costs if forced to take action against a state agency.

VICTORY: Spring 2003 — NFIB Helps Pass Unemployment Insurance Reform Legislation — Senate Bill 6097, supported by NFIB and signed into law, will overhaul our expensive unemployment insurance system and includes many changes long advocated by NFIB. With Washington’s unemployment rate one of the highest in the country and the costs of our unemployment insurance system more than three times the national average, the business community realized it needed to band together and work on systemic reforms. Momentum for the unemployment insurance reform bill was helped by Boeing’s announcement that the 7E7 might not be built in Washington state. Our forces were also joined by the Boeing Machinist’s Union.

The new law specifically will remove $65 million in benefits being paid to people who voluntarily quit their job — people who should not be collecting benefits in the first place. It tightens the definition of misconduct so that it will be more difficult for someone who is fired for cause to collect benefits. It also sets up a definition for “gross misconduct” so that people who are fired for breaking the law lose their credits for the year. It tightens work search requirements and requires the Employment Security Department to better check Social Security numbers to reduce fraud. It takes away the statutory language that forces employment security decisions to favor the employee rather than the employer. Now those decisions must be balanced. It changes the benefit calculation so that people will be paid benefits on what they earned in a year and not just over the two highest quarters. It reduces the duration of unemployment benefits from 30 weeks to 26 weeks. It freezes our maximum weekly benefit amount until it is at 63 percent of the state’s average wage. It sets up a new tax system that will allow employers to pay unemployment insurance taxes that better reflect their actual experience and reduces overall socialized costs.

Due to the complex nature of these reforms, they will be phased in, with benefit changes phased in first and the tax changes happening in 2005. The overall savings are expected to fall around $200 million per year after the new law is fully implemented, making our state far more competitive.

VICTORY: November 2003 — NFIB Repeals Ergonomics Rule at the Polls — NFIB helped lead the fight to repeal the most punitive, unproven and costly rule in state history. If implemented, the ergonomics rule would have cost Washington businesses as much as $725 million a year to comply! Washington state would have been the only state in the nation with such a broad rule.

After helping collect and submit 260,000 signatures to qualify Initiative 841 for the November election, NFIB and its members undertook a massive grassroots campaign to repeal the ergo rule. Joining with the WECARE Coalition (Washington Employers Concerned About Regulating Ergonomics), NFIB mobilized its 15,000 members, their employees, families and friends and successfully passed I-841. Repeal of this rule will help make Washington state more competitive.

VICTORY: Fall 2003 — NFIB Successful in Lowering Workers’ Compensation Rate Increase — Over 1,000 small-business owners and concerned citizens turned out across the state at seven public hearings to voice their strong opposition to the Department of Labor and Industries proposed 19.4 percent average workers’ comp rate increase.

NFIB and a coalition of employer groups successfully organized pre-hearing meetings to prepare business owners to testify. Obviously the strong opposition had an impact as the department decided to lower the final rate increase to 9.8 percent on average. NFIB members argued that this is not the time to raise rates, when their businesses are being hit with increases in their health care insurance, liability insurance, unemployment insurance and other operating costs. All this while the Washington economy continues to struggle. NFIB members also sited many instances where unscrupulous employees knowingly took advantage of the workers’ compensation system and were not investigated and punished in a swift manner by the department.

While getting L & I to back off from a 19.4 percent average increase is a victory, any increase is too much. NFIB will continue efforts to overhaul our expensive and inefficient workers’ compensation system. Please visit the Issues section of the NFIB/Washington web page for more information.

VICTORY: May 14, 2003 — NFIB Celebrates Two Regulatory Reform Victories–This week, Governor Locke signed two important regulatory reform bills that passed due to NFIB’s efforts. Engrossed Senate Bill 5256 will require agencies to provide a cost benefit analysis early in the rule making process and Engrossed Substitute Senate Bill 5766 will require agencies to notify businesses that a rule has been changed or adopted. ESB 5256 will provide small business owners more timely information that will allow them to better assess the impacts of new rules on their businesses and provide necessary and valuable input to the state agency. ESSB 5766 will give small business owners a greater understanding of the rule requirements and what is required for compliance. This should lessen enforcement and technical assistance costs for state agencies and help achieve the state’s goals of the proposed rules. If you would like more information about these two new laws, please contact NFIB/Washington Headquarters.

VICTORY: 2003 — Small Businesses Victorious in Halting Verizon $27.9 Million Rate Hike — After receiving testimony from NFIB lobbyist Mark Johnson, the Washington State Attorney General’s Consumer Protection Division and other stakeholder groups, the Utilities and Transportation Commission wisely halted the unwarranted $27.9 million dollar rate increase requested by Verizon. This rate increase would have meant a huge increase in rates for Verizon business customers. For example, the rejected proposal would have increased two-wire rates to $29.15 and four-wire rates to $45.47. If you have digital data service your rates would have gone to $105.25. Directory assistance would have increased to $1.25 per call. This would have amounted to a 15 percent average increase for business customers.

Most alarming about the rate increase proposal was that it did not go through the normal rate increase process of public hearings and stakeholder comments. Verizon tied to increase rates through a settlement agreement reached with AT &T and WorldCom.

Verizon will now have to file a formal rate increase proposal with the necessary documentation supporting their request to the Utilities and Transportation Commission. This rate request will be subject to public hearings and stakeholder participation. NFIB will continue to closely follow Verizon’s request and intervene where appropriate.

Special thanks to the NFIB members who contacted the Utilities and Transportation Commission in opposition to Verizon’s original request.

In the 2002-2003 session, we worked with many other groups to get one of the state’s most radical unemployment reform packages through. This will save state employers approximately $200 million in unemployment costs. This will drop Washington state from three time the national average to about 2.5.

Streamlined state’s permit process

VICTORY: 2002 — With your help, NFIB helped defeat a bill that would have allowed the Department of Labor and Industries to spend $5 million of your workers comp premiums for totally unrelated programs.

VICTORY: 2002 — In addition, NFIB/Washington opposed and soundly defeated Referendum 53, which would have increased most small business owners’ unemployment insurance rates.

Other Victories

Despite the weird session (earthquakes, Boeing, drought, energy crisis, locusts, plagues…), NFIB has managed to compile some significant victories and save small businesses a lot in terms of money and paperwork. Here is a list:

- Defeated several expensive health care mandates which would have added costs to health care premiums. This includes SB 5211, a bill that would have required mental health parity for children. While this sounds like a good concept, the reality is it would have added at least 3 percent to health care premiums.

- Defeated HB 1330 and SB 5728 which would have allowed workers compensation benefits to be paid while the employer was appealing the benefits. This would have significantly increased costs to the workers compensation system.

- Defeated legislation that would have allowed unemployment benefits to be paid to domestic violence victims. This would have added at least $160,000 in additional costs to the UI trust fund, even though our state already has some of the highest costs in the nation. NFIB tried to convince the supporters to look for more general fund sources but they insisted on the UI trust fund — thus making employers be the only ones paying for a problem that is not theirs to solve.

- Defeated legislation that would have allowed for victims of crimes to be eligible for special leave. Currently, many crime victims would already find themselves eligible for leave under the Family & Medical Leave Act. SB 5329 would have created a very loose leave policy that would have subjected employers to a mandate for something they already have concern for and often help employees with.

- Defeated a bill that would have allowed state employees to collectively bargain thus tying up our state budget even further.

- Defeated SB 5420 which would have created a new government program and tax to provide paid leave for people on family leave.

- Passed legislation (SB 5317) which brings our state laws into conformity with federal Unemployment laws thus avoiding a $1.6 billion dollar expense to our unemployment trust fund.

- Passed legislation (HB 1287) that extends the prohibition on local measured telephone service. Without this legislation, small businesses would be forced to pay for each local call rather than pay a flat fee.

- Passed legislation (HB 2049) which requires state agencies to not charge a fine or penalty when they find a business in violation of something that was not identified in a previous technical assistance visit.

- Passed legislation (HB 1458) that establishes local government timelines for final decisions on permit applications.

PROJECT LABOR AGREEMENTS: MAJOR VICTORY FOR SMALL BUSINESS–Thanks to the earthquake (there is always a silver lining), the Project Labor Agreement which would have required union agreements only on the Capitol renovation work, has been scrapped. President Bush issued an executive order that stated no federal money would go to projects with these agreements which discriminate against non-union contractors. This includes the money Washington state needs from FEMA to help with state Capitol earthquake repairs. Because the earthquake repairs and the planned renovations could not be separated, Governor Locke was forced to rescind the PLA!

2000 Victories

Unemployment Compensation Tax

NFIB was a key player in stopping an unemployment compensation tax increase. This increase would have raised most employer unemployment taxes between 20 percent and 70 percent. NFIB also succeeded in making it harder to collect unemployment if an employee voluntarily quits his or her job.

Health Care

NFIB successfully worked for a compromise bill that will begin stabilizing the individual health insurance market and bring private insurance back to that market. Cost pressures will be relieved on the small group market by increasing the pre-existing condition limit on both markets.

Workers’ Compensation

NFIB defeated several bills that would have increased workers’ compensation premiums. Among these was a bill, defeated for the second year in a row, that would have allowed workers’ compensation benefits to be paid during appeals. NFIB also defeated a bill which would have allowed workers’ compensation claims to be re-opened indefinitely.

Privacy Liability

NFIB was successful in changing language in a privacy bill to remove onerous and costly liability for marketing actions. Under the original provisions of the bill, small business owners who marketed to existing customers through direct mail could have potentially faced fines and liability if certain disclosure requirements were not met.

1999 Victories

- NFIB lead the way to defeat several costly health care mandated benefits.

- NFIB worked to defeat bills that would have provided unemployment insurance benefits to striking workers, victims of domestic violence and part-time workers, saving employers millions in increased unemployment insurance costs.

- NFIB helped defeat a bill which would have eliminated thousands of small contractors from the public works bidding process.

1998 Victories

- Eliminated an onerous paperwork reporting requirement that kept many small businesses from taking advantage of the machinery & equipment sales tax exemption for manufacturers.

- Defeated an unemployment insurance rate increase that would have raised taxes for many small and seasonal businesses by as much as 84 percent.

- Successfully redirected transportation discussions away from a gas tax increase.

- Defeated several additional health care insurance mandates.

1997 Victories

- Reduced the 1993 B&O tax increase so that July 1, 1998 ALL B&O taxes will be back to pre-1993 levels.

- Passed strong regulatory reforms and convinced Governor Locke to review all agency rules.

- Passed a bill exempting intangibles such as permits, licenses, franchise agreements, customer lists and goodwill from property taxation.

- Passed a bill to reduce the threat of penalty when an employee’s wages must be garnished.

- Eliminated $59 million in socialized costs from the state’s Unemployment Insurance Fund.

- Defeated several attempts to increase the minimum wage as high as $6.90 per hour indexed to inflation.

1996 Victories

- NFIB led the efforts to override the governor’s veto of SB 6117, a bill which reduced the 1993 business and occupation tax increases by 50 percent. Our efforts will bring a 30 percent tax reduction for thousands of NFIB members.

- Helped defeat several minimum wage proposals in 1996, including one which would have increased the minimum wage to $6.90 per hour by the year 2000 and would have thereafter indexed the minimum wage to inflation, triggering automatic increases.

- Helped defeat legislation to provide striking workers unemployment insurance in cases where unfair labor practices are found.

- Helped pass legislation which will require state agencies to provide business owners with verbatim rule language when a violation is found. This will allow business owners to actually read the rule they are supposedly violation and deal with any interpretation discrepancies on-site.

- Helped pass legislation which will further control workers’ compensation costs by allowing the Department of Labor and Industries to collect claim expenses from illegally uninsured employers through liens rather than putting the burden on these claims on legally insured employers.