For the legislative and political week February 20-24

Happy Presidents’ Day. Welcome to the February 20-24 edition of the NFIB California Main Street Minute from your NFIB small-business-advocacy team in Sacramento.

Legislative Deadline Passes

- Last Friday (February 17) was the final day for bills to be introduced. NFIB California will continue sorting through 2,741 bills (the words ‘small business’ appear in 691 of them) for the very worst, and the scant few good ones, to refine our lobbying strategy for the rest of the year.

$25 An Hour Minimum-Wage Bill Introduced

- Last Tuesday (February 14), Sen. Maria Elena Durazo introduced Senate Bill 525, which calls for raising the state’s minimum-wage rate for workers in the health-care industry to $25 an hour. But don’t think that industry is confined to just hospitals. A scroll down the bill to Section 1 (b)2 lists 21 locations that would be considered having health-care workers.

- One of the worries with any such bill is that it will not stop at just the industry it supposedly seeks to help but spread to all industries. See story below for a similar example.

Never Let a Good Pandemic Opportunity Go to Waste

- “Sen. Lena Gonzalez plans to introduce a bill today to make permanent a pandemic-era policy that extends the number of paid sick leave days from three to seven — or 24 hours to 56. Anyone who has worked 30 days within a year of being hired would be eligible, according to the bill language.”

- True to the above paragraph in a February 15 CalMatters report, Gonzalez introduced Senate Bill 616. This is the second attempt to extend the number of paid sick leave days. Last session, Assemblymember Lorena Gonzalez (no relation) introduced Assembly Bill 995, which would have extended the paid days to five.

- At the time, NFIB and its coalition partners succeeding in stopping AB 995, arguing, in this letter of opposition, that “those businesses that can afford to offer more than three days of sick leave are doing so, but not all businesses can absorb that cost right now. This is especially true given that Governor Newsom just signed SB 95, which imposes a burdensome new 80-hour COVID19 related leave requirement that is retroactive to January 1st. Businesses struggling to keep their doors open or hire back employees who were laid off due to COVID-19 closures need relief from this seemingly endless increase in leave mandates … While one more paid benefit may not seem significant in isolation, this mandate must be viewed in the context of all of California’s other leaves and paid benefits. California has numerous protected, overlapping leaves and benefits requirements.”

- Indeed, the Shouse Labor Law Group lists 16 leave mandates employers must grapple with. And, as the Fisher Phillips law group notes, “Californian employers are no stranger to complex protected leave laws—so it may come as no surprise that 2023 will bring even more changes to leave laws in the Golden State.”

- NFIB California members know the problem well. On their 2023 ballot, 93% said small businesses should be exempt from any new employee leave requirements. NFIB will continue to lobby against anymore leave mandates.

Wealth Tax Redux

- Because the typical NFIB member business reports gross sales of $500,000 a year, you’d think any profit (not always a certain thing) from those sales would put our members safely out of harm’s way from Assembly Bill 259 and Assembly Constitutional Amendment 3, which propose levying a wealth tax of 1.5% on worldwide net worth in excess of $1 billion.

- But NFIB isn’t buying that the wealth tax will not harm small businesses and middle-class taxpayers and, in this coalition letter of opposition, points out the many ways it can do damage indirectly.

- This is Assemblymember Alex Lee’s second attempt to institute a wealth tax, which California would be the first to have. He tried last session with Assembly Bill 2289, which never made it out of its first committee.

Universal Health Care Bill Returns

- Last session’s Assembly Bill 1400 and Assembly Constitutional Amendment 11 were inarguably the most audacious and ambitious attempts by any state – ever – to institute a single-payer, universal health care regime that would have seized control of all health-care decisions for the state of California to make by eliminating private insurance.

- Thanks to the intense lobbying of NFIB, its coalition partners, and our members, AB 1400’s author, Assemblymember Ash Kalra, eventually pulled his proposals back. More information about that effort can be read from this news release NFIB issued after the bill’s final legislative journey. Another news release NFIB sent to the media around the same time has a couple of very important factual nuggets about health care in general (94% of Californians have some form of insurance) and has some quotes from two veteran Capitol reporters who questioned the bill’s salability in the face of its enormous costs.

- Chastened but undaunted, Kalra is once again proposing a “universal, single-payer health care program.” This time, however, his Assembly Bill 1690 would only make it an “intent” of the Legislature to have such a system. AB 1690 is very short, “This bill would state the intent of the Legislature to guarantee accessible, affordable, equitable, and high-quality health care for all Californians through a comprehensive universal single-payer health care program that benefits every resident of the state.”

- NFIB members know the issue of health care too well; it’s been their No. 1 worry for more than three decades. This one-page, Talking Points Memorandum on health care has some bullet details that NFIB California recommends everyone who wants to engage on the issue read.

State Ban on Arbitration Agreements Struck Down

- In passing Assembly Bill 51 in 2019, which limited workplace arbitration agreements, then-Assemblymember Lorena Gonzalez, who now leads the California Labor Federation, AFL-CIO, thought she found a way around the Federal Arbitration Act (FAA), which encourages arbitration to settle private disputes.

- Reports Bloomberg Law, “Courts have been invoking the FAA to block state laws regulating arbitration for decades. But California designed AB 51 to avoid federal preemption. Rather than invalidate agreements to arbitrate certain types of claims, the state regulated employer conduct—prohibiting them from requiring employees to sign—as a way to ensure that the agreement to arbitrate was consensual.

- “But a pair of Ninth Circuit judges rejected California’s reasoning in Wednesday’s ruling, holding that the FAA still trumps the state’s law despite its design.”

- The U.S. Court of Appeals for the Ninth Circuit, based in San Francisco, issued its ruling last week, February 15. NFIB California opposed AB 51 and issued this news release criticizing Gov. Gavin Newsom for signing it into law.

National

Highlights from NFIB Legislative Program Manager Caitlin Lanzara’s weekly report

- On February 13, the Washington Examiner highlighted NFIB’s support of U.S. Rep. Vern Buchanan’s (R-FL) proposed legislation that would make permanent some of the nearly two dozen tax provisions from the Tax Cuts and Jobs Act that are set to expire in 2025, including the Small Business Deduction.— Learn more about the Small Business Deduction here. Tell Congress to make the Small Business Deduction permanent. Take Action Here.

- On February 15, NFIB joined a coalition statement applauding a Pharmacy Benefit Manager (PBM) transparency and accountability hearing in the U.S. Senate Committee on Commerce, Science and Transportation. Read the statement here.

- New Alert on Form I-9s: DHS has extended its COVID-19 Form I-9 flexibilities until July. 31, 2023, due to “continued safety precautions related to COVID-19.” NFIB has provided a summary here: Form I-9 Compliance for Small Businesses.

Next Main Street Minute February 27.

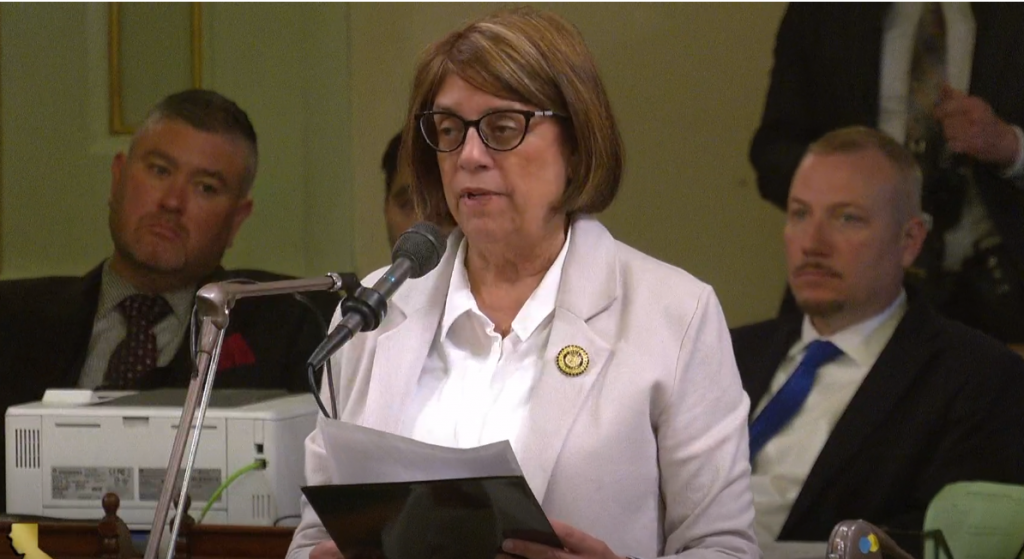

Photo snip courtesy of the California State Assembly website

Photo snip courtesy of the California State Assembly website