Doing bupkis about state’s unemployment insurance loan debt a big drawback.

FOR IMMEDIATE RELEASE

Contact: John Kabateck, California State Director, [email protected]

or Tony Malandra, Senior Media Manager, [email protected]

SACRAMENTO, Calif., Aug. 8, 2023—Today’s release of the National Federation of Independent Business’ (NFIB) monthly Small Business Economic Trends report showed a few tiny upticks in the outlook Main Street enterprises have for a better future, but nothing that would indicate the beginning of a reversal of its continuing two-year slide.

“A lot of what it will take to move small-business owners across the nation from this current era of just coping to one of thriving will depend on what Congress does with the Small Business Deduction on their federal tax forms: to let it expire or to make it permanent,” said John Kabateck NFIB’s California state director. “Closer to home, our Legislature has already rendered its decision on small business by doing absolutely nothing about its outstanding loan debt with the federal government over the unemployment insurance trust fund.

“When the pandemic surprised the nation, it was understandable California was one of 22 states that needed to borrow from the federal government to keep its unemployment insurance trust fund solvent and benefits going to those in need. What is not understandable is why it remains one of only two states (New York, the other) that has not paid its UI loans back, unless, of course, our state leaders don’t care about small business.”

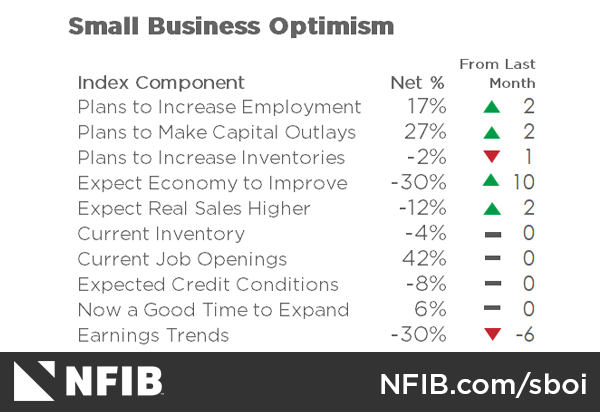

The SBET (Optimism Index) is a national snapshot of NFIB-member, small-business owners not broken down by state. The typical NFIB member employs between one and nine workers. This latest Index rose 0.9 points in July to 91.9, but it marked the 19th consecutive month below the survey’s 49-year average of 98. The SBET is released the second Tuesday of every month. A brief history of it can be read here.

From NFIB Chief Economist Bill Dunkelberg

“With small business owners’ views about future sales growth and business conditions dismal, owners want to hire and make money now from solid consumer spending. Inflation has eased slightly on Main Street, but difficulty hiring remains a top business concern.”

Highlights from today’s report

- Owners expecting better business conditions over the next six months improved 10 points from June to a net negative 30%, 31 percentage points better than last June’s reading of a net negative 61%. This is the highest reading since August 2021 but historically very negative.

- Forty-two percent of owners reported job openings that were hard to fill, unchanged from June but remaining historically very high.

- The net percent of owners raising average selling prices decreased four points to a net 25% seasonally adjusted, still a very inflationary level but trending down. This is the lowest reading since January 2021.

- The net percent of owners who expect real sales to be higher improved two points from June to a net negative 12%, a very pessimistic perspective.

Keep up with the latest on California small-business news at www.nfib.com/california or by following NFIB on Twitter @NFIB_CA or on Facebook @NFIB.CA.

###

For 80 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since its founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB California

915 L. Street, Suite C-411

Sacramento, CA 95814

916-448-9904

www.nfib.com/CA

Twitter: @NFIB_CA

Facebook: @NFIB.CA