Nearly half of small-business owners expect to need additional assistance to survive the year

OLYMPIA, Wash., June 23, 2020—Results from a national survey of small-business owners released today by their leading association revealed a variety of information on such things as the use of the two federal loan programs, how many would be using the extended forgiveness period, how many will need more money, and awareness of the tax deferment provision.

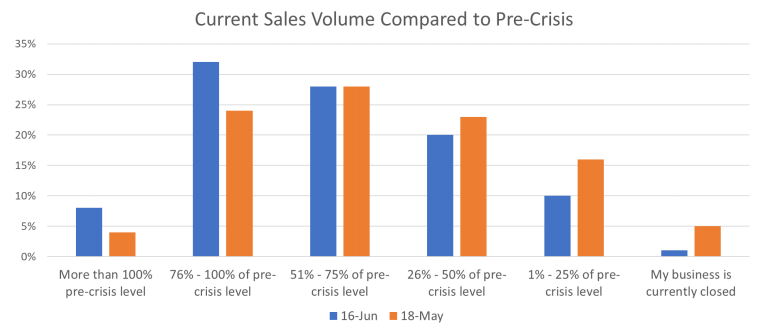

“While many small-business owners are breathing a sigh of relief thanks to the extra time and additional uses allowed under the PPP Flexibility Act of 2020, state and federal lawmakers must not lose sight of the fact that four months into this pandemic, and counting, 60% of Main Street businesses are still suffering from sales reductions of at least 25%, and nearly half expect to need additional financial assistance to survive the year,” said Patrick Connor, Washington state director for NFIB, which conducted the poll. “The best way to recharge our economy is to allow small businesses to safely resume operations and give them the help and protections needed to rebuild, reopen, and rehire without undue red tape or threats of new or higher taxes.

Key findings from the survey include:

- The number of small business owners applying for a Paycheck Protection Program (PPP) loan increased slightly over the last two weeks.

- Nearly all PPP applications (97%) have received their loans.

- Over half (59%) of PPP loan borrowers are taking advantage of the extended 24-week forgiveness period.

- Some owners report having to adjust their workforce to reflect the economic environment with 14% of PPP loan borrowers anticipating having to lay off employees after using the loan.

- Over one-third of owners (35%) have applied for an Economic Injury Disaster Loan (EIDL) and most are still waiting for their loan to be processed.

- Economic conditions have improved for many small business owners over the last month as states have eased business restrictions and stay at home orders.

- The economic and health crisis is lasting much longer than the PPP’s initial design of primarily supporting two months of payroll and limited non-payroll expenses, and of the EIDL’s reduced loan distributions.

- About 41% of respondents are familiar with the new tax deferment provision and about 6% of respondents have taken advantage of it.

- Most small business owners have had to adjust their business operations to some degree due to the COVID-19 health crisis.

“Small businesses are entering the fourth month of economic crisis and are still experiencing a heavy amount of uncertainty and complications,” said Holly Wade, NFIB Director of Research & Policy Analysis. “Now that owners have more flexibility in using their PPP loan, they can focus on adjusting business operation accordingly as states loosen business restrictions.”

Click here to read NFIB’s national news release on the survey results, or here to go right to the survey.

Keep up with the latest Washington state small-business news at www.nfib.com/washington or by following NFIB on Twitter @NFIB_WA or on Facebook @NFIB.WA

Contact: Patrick Connor, Washington State Director, [email protected] or Tony Malandra, Senior Media Manager, [email protected]

###

For more than 77 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since its founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB Washington

711 Capitol Way South

Suite 505

Olympia, WA 98501

360-786-8675

NFIB.com/WA

Twitter: @NFIB_WA