NFIB Arizona’s efforts to help defeat crippling tax increase

Summary of NFIB’s Opposition to Prop. 208

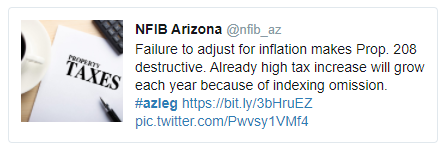

Since 2015 Arizona law has included an annual adjustment to the income tax code to account for inflation. This annual adjustment consists of increases to the nominal income dollar thresholds for each rate bracket in the income tax structure. Many states have similar provisions as does the federal government. These adjustments prevent inflation-induced increases in tax rates. For example, if an income tax rate bracket starts at $100 in a given year and the next year saw a 3% inflation increase, then the threshold for the tax rate bracket would be adjusted from $100 to $103. Making nominal adjustments like this on an annual basis prevents taxpayers from having an ever-larger portion of income subject to higher tax rates where, in real terms, there has been no income increase.

That the drafters of Prop 208 chose to ignore a well-established tenet of taxpayer protection drives a stake further into the hearts of Arizona small business owners. Without an annual adjustment for inflation, each year, more small business owners will continue to find themselves subject to the 77.7% increased income tax rate. Even those businesses with steady, but not increasing, business income will eventually be snared in the Prop 208 trap.

NFIB in the News

- Tucson Weekly, October 29—“By looking at IRS data, we know that there are roughly 50,000 small businesses in Arizona that would pay this additional tax. And so that’s 50,000 small businesses that will be shouldering the burden for this tax,” State Director Chad Heinrich tells publication for a story on Prop. 208.

- Cronkite News/Arizona PBS, October 27—State Director Chad Heinrich tells the online news service that Proposition 208 was written by people who never signed the front of a paycheck and, “If you’re taxing the best years of a business, you’re going to cripple their ability to purchase capital or hire new employees or sustain employees through bad years.” The story was also published in the Tucson Sentinel and in the Verde Independent.

- Phoenix Business Journal, October 26—Reporter Emily Schmidt refers to State Director Chad Heinrich’s October 2 guest editorial for the publication in her article on the fierce debate over Proposition 208.

- Parker Pioneer, October 7—Prop. 208 should be more accurately called “The Small Business Destruction Act,” says NFIB in a story about the ballot initiative.

- Prescott eNews, October 6—Heinrich’s guest editorial, Killing the Cash Cow That Funds Arizona Education, also runs on online news site.

- Phoenix Business Journal, October 2—State Director Chad Heinrich pens a guest editorial for the business publication on how Prop. 208 would kill the cash cow funding education.

- The State Press, September 30—In a story on Prop. 208, State Director Chad Heinrich reminds readers how small-business owners pay their taxes.

- Chamber Business News, September 15—State Director Chad Heinrich interviewed on the harm passage of Prop. 208 could do to small business.

- Arizona Chamber of Commerce & Industry YouTube Channel, September 9—For one of its Happy Hour with Hamer episodes, State Director Chad Heinrich is interviewed about Prop. 208 by host Garrick Taylor and Glenn Hamer, president and CEO of the Chamber.

- Yellow Sheet Report, September 8—State Director Chad Heinrich quoted about the pernicious effects Prop. 208 would have on the economy, including business closures.

NFIB News Releases

Resources

- Goldwater Institute study, Good for Special Interests and Unions, Bad for Arizona: The Economic Impacts of Proposition 208, released September 15.

- Arizona Tax Research Association—Special Report: Teachers Union Tax Increase Misguided and Cynical

- No on 208 Slide Deck—Want to make a PowerPoint presentation? These 12 slides make the convincing case against Prop. 208

- Editorial Opposition—The Arizona Republic, October 11: Proposition 208 hurts education-funding cause in Arizona, not help it. Vote no on Invest in Ed

- Guest Opinion: The Arizona Republic—Prop. 208 won’t deliver a billion dollars to schools. Jobs, tax revenue will shrink instead, by Kevin McCarthy, president of the Arizona Tax Research Association, and Jim Rounds, president of Rounds Consulting Group

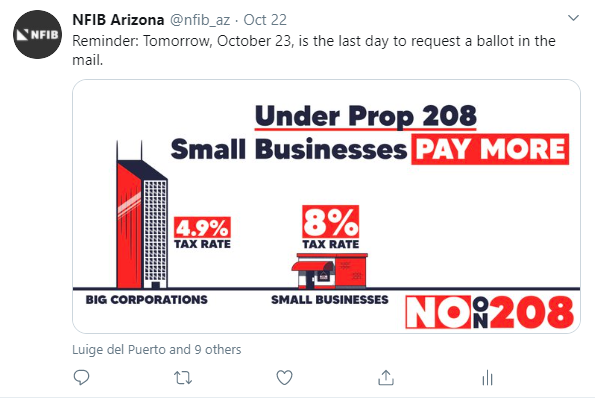

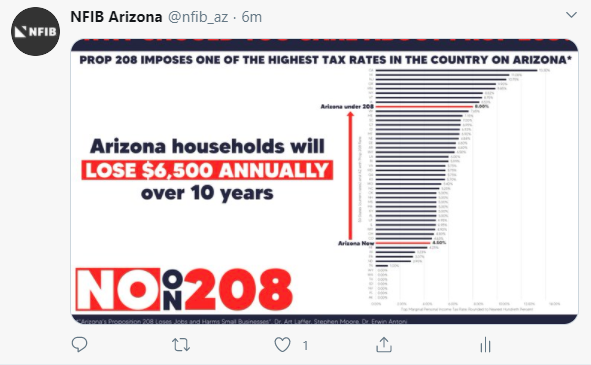

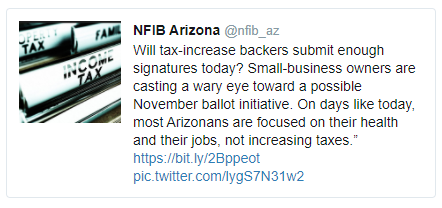

NFIB Tweets