August 17 meeting will tell

Business property tax rates are no small matter to small business.

NFIB Research finds that only 20 percent of small-business owners are also the property owner. However, with that in mind, property tax increases like those that the Maricopa County Board of Supervisors has proposed will impact 100 percent of business owners who use real and personal property as part of their business, whether owned or leased. The 20 percent of small business owners who are also property owners will see the increase directly on their property tax bills, while the 80 percent who lease the property where their businesses operate will pay higher rents and leases as the cost of the increased taxes will undoubtedly be passed on to them. When considering the increase in taxes, plus insurance, and maintenance of the property – in addition to the base lease –it’s easy to see how costs can lead business owners to question why they are in business. Layer on the impact that all businesses are weathering because of the COVID-19 pandemic and disaster likely awaits.

The Maricopa County Board of Supervisors wants to increase property taxes and at an August 17 meeting will establish final rates. Including the proposed increase, the Board will have exceeded the “truth in taxation rate” for each of the last five years for its primary and secondary taxes. Exceeding the “truth in taxation rate” means the government is increasing your taxes! Furthermore, this year, the county received $400 million in federal money from the CARES Act so the county is not light on cash in their coffers.

Not so fortunate will be struggling small-business owners. As Kevin McCarthy, president of the Arizona Tax Research Association (ATRA), put it to Maricopa supervisors, “Many Arizona businesses and individuals are desperately trying to maintain a bridge to a full economic recovery. State and local governments should be doing everything possible at this time to help taxpayers survive this crisis and remain contributing taxpayers in the future. Of the $741 million in primary and secondary property taxes the county is on course to levy this year, allowing taxpayers to keep $23 million of their own money could go a long way during this pandemic.”

McCarthy also reminded the board of a fundamental economic lesson too easily forgotten: If you’re keeping the tax rate the same from year to year, but the value of my property keeps rising, you’re getting more tax revenue and I’m paying more taxes. “By keeping tax rates constant, the county’s primary and secondary taxes will generate an additional $41 million in taxes, the majority of which will come from increased values on existing property.”

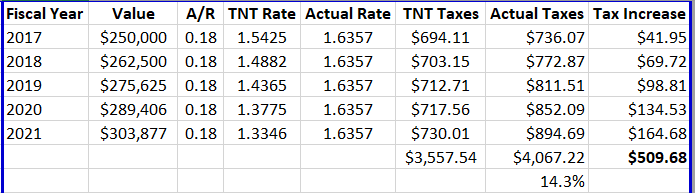

The chart below illustrates one example between the TNT and actual rates had Maricopa County adopted the former.

For property values of $500,000 the five-year difference is $1,019.36 and for property values of $1 million, the difference is $2,038.72. No need to explain to small-business owners, who make mathematical calculations every day, how important the savings is.

And if it doesn’t sound like much to John Q. Public it’s because John Q. Public has never had to meet a payroll or been put into the position of having to decide when to just throw up your hands and shut your shop for good.

For more information:

- This link will take you to the Board of Supervisors for any questions on how a property tax increase will affect your business.

- If you need to determine whom your board member is, click here for a district locator.

- If you would like to download a copy of your business property tax statement, the Assessor’s website has a search bar available. After selecting your business property from the search results, click “View/Pay Tax Bill” which will direct you to the Treasurer’s website to view your 2019 tax details and past years.