March 8, 2021

PPP Loan Amounts Adjusted for Self-Employed Small Business Owners

Update: On Tuesday, March 30, 2021, the PPP Extension Act of 2021 was signed into law. It extended the application deadline for PPP loans to May 31, 2021, or until funds run out.

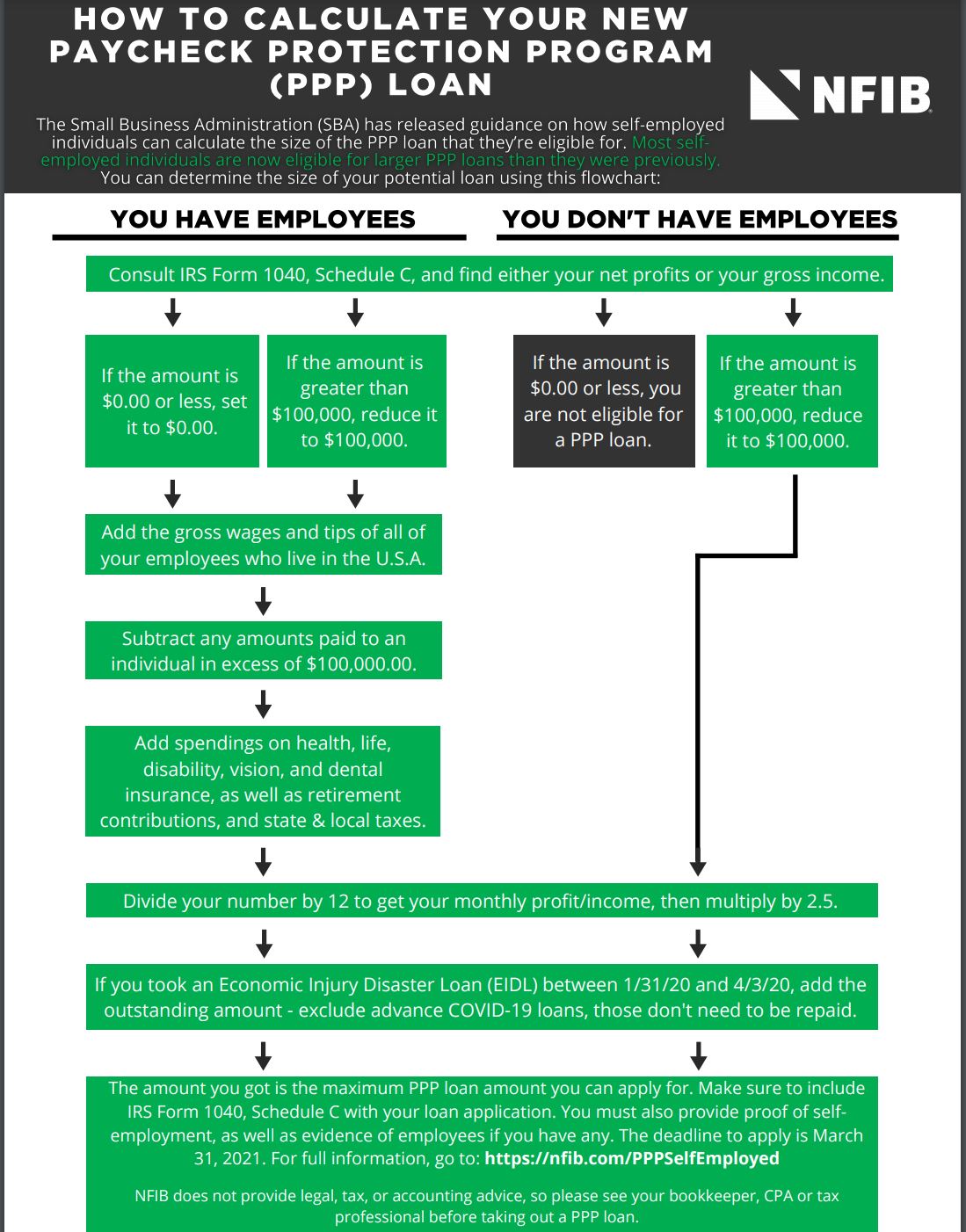

The Small Business Administration (SBA) has released guidance on how self-employed individuals can calculate the size of the Paycheck Protection Program (PPP) loan that they’re eligible for. Most self-employed individuals are now eligible for larger PPP loans than they were previously.

The current PPP application deadline is expected to be extended to May 31, 2021 with an additional 30 days after May 31 for processing of pending applications, to prevent any small business from being harmed by the processing delays that have been a shortcoming of the PPP. The U.S. Small Business Administration recently said funding could run out mid- to late-April, so small business owners considering applying should do so as soon as possible.

Note that these steps are valid for both 2019 and 2020 payroll. However, for 2020, if you have not filled out IRS Form 1040, Schedule C, make sure to do so before starting.

If you have no employees:

- Consult your IRS Form 1040, Schedule C. You can use either your net profits (line 31) or your gross income (line 7). If the amount is over $100,000 reduce it to $100,000. If the amount is $0.00 or less, you are not eligible for a PPP loan.

- Divide the number from step 1 by twelve to calculate your monthly profit/income.

- Multiply the number from step 2 by 2.5. If the amount exceeds $20,833.33, you may have forgotten to reduce the amount to $100,000.

- If you have took any Economic Injury Disaster Loans (EIDL) between January 31, 2020 and April 3, 2020, add the outstanding amount to the number from step 3. This does not include advances from an EIDL COVID-19 loan, because those do not need to be repaid.

- The amount you got in step 4 is the maximum PPP loan amount you can apply for. Make sure to include IRS Form 1040, Schedule C with your loan application. You must also include proof that you are self-employed, such as an IRS Form 1099-MISC detailing nonemployee compensation received (box 7 on the form), an invoice, a bank statement, or a book of record.

If you have employees:

- Consult your IRS Form 1040, Schedule C. You can use either your net profits (line 31) or your gross income (line 7, subtract employee payroll costs reported on lines 14, 19, and 26 of the same form). If the amount is over $100,000 reduce it to $100,000. If the amount is a negative number, set it to $0.00.

- Take the number you got in step 1 and add to it the gross wages and tips of all employees you have whose principal place of residence is in the United States. You can compute this using the number on IRS Form 941 Taxable Medicare wages & tips (line 5c, column 1) from each quarter and adding any pre-tax employee contributions for health insurance or other benefits that are excluded from Taxable Medicare wages & tips.

- Subtract any amounts paid to individual employees in excess of $100,000 per annum, as well as any amounts paid to employees whose principal place of residence is outside the United States.

- Add employer contributions to employee group health, life, disability, vision and dental insurance (line 14 of IRS Form 1040, Schedule C), as well as retirement contributions (line 19 of the same form) and state and local taxes (usually falls on state quarterly wage reporting forms).

- Divide the number from step 4 by twelve to calculate your total monthly profit/income.

- Multiply the number from step 5 by 2.5.

- If you have took any Economic Injury Disaster Loans (EIDL) between January 31, 2020 and April 3, 2020, add the outstanding amount to the number from step 6. This does not include advances from an EIDL COVID-19 loan, because those do not need to be repaid.

- The amount you got in step 7 is the maximum PPP loan amount you can apply for. Make sure to include IRS Form 1040, Schedule C, Form 941 with your loan application. You must also include either state quarterly wage unemployment tax reporting forms from each quarter, or equivalent payroll processor records. Furthermore, you must provide evidence of any retirement and health insurance contributions, and a payroll statement or similar documentation to prove you were in operation on February 15, 2020.

Those who wish to take advantage of PPP loans can download the First Draw PPP loan application here and the Second Draw PPP loan application here. You can also find a participating lender through the SBA Lender Match tool here.

You can also view NFIB’s fact sheet on the PPP here.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles