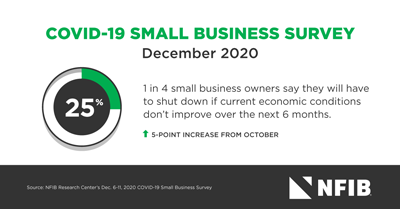

New NFIB Research Shows 25% Of Small Businesses Won’t Survive Another 6 Months

Congressional leaders continue to negotiate a new round of coronavirus relief, though the details are yet to be seen. The legislative package, which could be passed in the next few days, is expected to include a second, targeted round of forgivable loans for small businesses through the Paycheck Protection Program (PPP).

NFIB Vice President of Federal Government Relations Kevin Kuhlman expressed cautious optimism about the expected deal: “We’re encouraged by the positive momentum regarding additional COVID-19 small business recovery legislation before the end of the year. The challenges facing small businesses continue to mount, and small businesses need financial relief quickly as further pandemic-related shutdowns and restrictions escalate.”

New NFIB research released this week shows that 25% of small businesses won’t survive another 6 months under the current economic conditions, up from 20% in November. A further 22% of small businesses anticipate closing within the next 12 months if there is no economic change.

NFIB and active small business owners continue to advocate for the following COVID-19 recovery priorities for Main Street:

-

Offer a targeted second round of Paycheck Protection Program loans.

NFIB’s latest research shows that 45% of small businesses would apply or re-apply for a PPP loan. An additional 33% would consider it in the coming months.

NFIB has been lobbying Congress to offer a second round of Paycheck Protection Program (PPP) loans since the program closed on August 8th and thousands of NFIB members have talked with and sent messages to their members of Congress urging legislators to put aside partisan disagreements and take action before the end of the year.

More than 90% of small businesses that received PPP loans have already spent the funds. Without further relief, many have been forced to make tough decisions about employment and future growth plans, and 22% anticipate laying off employees without additional relief.

Further difficulties are on the horizon as large-scale economic shutdowns loom in California and other states. Many states are also re-implementing or tightening restrictions on small business operations, causing untold harm to owners and workers.

Brian, an NFIB member in Oregon says, “We employ about 20 full-time employees and have struggled over the last several months with COVID-19 issues. We have lost some of our customer-base as some have gone bankrupt, we have lost business opportunities because of quarantines, and we have lost future potential business as companies postpone projects. All this combined and higher operating expenses has put an extreme burden on our company staying solvent. Please pass another round of PPP for companies that lost 35% or more revenue compared to last year. We desperately needed the first round and because of the extended duration of the pandemic, desperately need a second PPP.”

-

Restore tax-deductibility of PPP loan forgiven expenses.

Small business owners must be protected from surprise tax increases. On April 30, after most businesses applied for PPP loans, the IRS issued Notice 2020-32, which disallows the deductibility of forgiven expenses. In November, the IRS reiterated their position disallowing deductibility of expenses in 2020 if a loan recipient “reasonably expects” forgiveness in 2021. Restoring the tax-deductibility for qualified business expenses will protect owners from surprise tax increases as they try to recover from the pandemic. An unexpected tax burden would severely limit their ability to operate and threaten the fragile small business economic recovery.

Jean, an NFIB member in Minnesota, said of the need for tax-deductibility of forgiven PPP expenses, “When Congress created the PPP loan it was not intended to hurt small business. If PPP expenses are not allowed to be deducted that is exactly what will happen and this program will have been a complete failure and frankly a slap in the face to business owners like me who through no fault of our own have been negatively impacted by the mandates and orders and closures/restrictions due to COVID-19. I spent 100% of the loan dollars on my staff and keeping them employed. I took no money for me as the business owner and paid no other business expenses with it. I urge you to uphold the original intent of the legislation and allow the deduction of business expenses paid with PPP loan dollars.” See what more NFIB members are saying about the importance restoring deductibility.

-

Streamline the PPP loan forgiveness process.

Small business owners need streamlined forgiveness and clarity in the PPP forgiveness process. More than 90% of small businesses that received PPP loans have already spent the funds and many are beginning to apply for forgiveness. NFIB supports bipartisan legislation that simplifies the PPP loan forgiveness process, allowing small businesses who received a loan of $150,000 or less to attest to a good faith effort to comply with PPP loan requirements and obtain forgiveness.

-

Forgive PPP loans and Economic Injury Disaster Loan (EIDL) emergency advance grants.

Twenty-seven percent of those who received a PPP loan also received an EIDL emergency advance grant. These distinct programs received two different appropriations and are managed by two separate offices within SBA. By itself, the EIDL emergency advance is a grant, and recipients do not have to pay it back. However, small business owners are not allowed to benefit from both the EIDL emergency advance grant and PPP loan forgiveness. NFIB supports legislation from both chambers that would allow forgiveness for PPP loans and EIDL emergency advance grants, preventing small business owners with being left with unexpected PPP loan balances to repay.

Kevin Kuhlman continued: “Congress’ work is not done. While the expected progress is encouraging, small businesses can’t wait. Additional financial assistance, tax-deductibility of PPP forgiven expenses, and simplified PPP forgiveness are more urgent than ever if we want to see Main Street survive in 2021.”