Small Business Optimism Index

Small Business Optimism Index

Overview

The NFIB Research Foundation has collected Small Business Economic Trends data with quarterly surveys since the 4th quarter of 1973 and monthly surveys since 1986. Survey respondents are drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in June 2025.

June 2025: Small Business Optimism Remains Steady in June

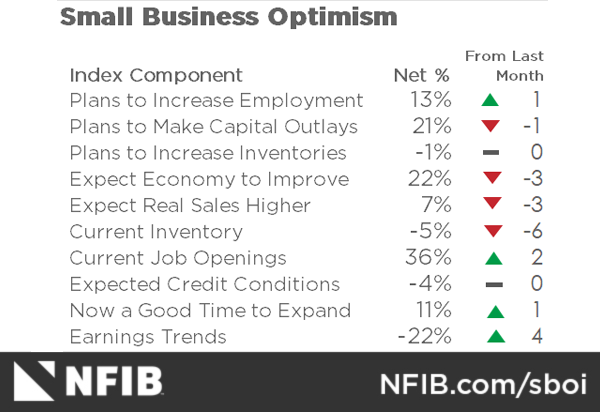

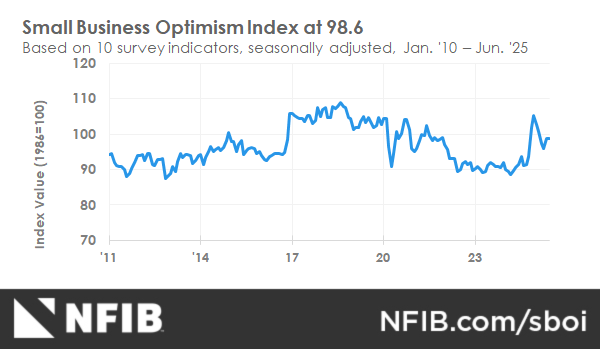

The NFIB Small Business Optimism Index remained steady in June, edging down 0.2 of a point to 98.6, slightly above the 51-year average of 98. A substantial increase in respondents reporting excess inventories contributed the most to the decline in the index. The Uncertainty Index decreased by five points from May to 89. Nineteen percent of small business owners reported taxes as their single most important problem, up one point from May and ranking as the top problem again. The last time taxes reached 19 percent was in July 2021.

Small business optimism remained steady in June while uncertainty fell. Taxes remain the top issue on Main Street, but many others are still concerned about labor quality and high labor costs.

NFIB Chief Economist Bill Dunkelberg

A net negative 5% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in June, down six points from May. This signals a net increase in inventories, with 7% reporting inventories “too low” in June compared to 8% in May. Twelve percent reported current inventories “too high” in June compared to 7% in May. This component contributed the most to the Optimism Index’s decline.

The net percent of owners expecting better business conditions fell three points from May to a net 22% (seasonally adjusted). Historically, this is still a positive reading with the 51-year average at a net 3%.

The net percent of owners expecting better business conditions fell three points from May to a net 22% (seasonally adjusted). Historically, this is still a positive reading with the 51-year average at a net 3%.

The net percent of owners expecting higher real sales volumes fell three points from May to a net 7% (seasonally adjusted).

The net percent of owners expecting higher real sales volumes fell three points from May to a net 7% (seasonally adjusted).

Twenty-one percent (seasonally adjusted) plan capital outlays in the next six months, down one point from May.

Twenty-one percent (seasonally adjusted) plan capital outlays in the next six months, down one point from May.

The percent of small business owners reporting labor quality as the single most important problem for business remained at 16%, unchanged from May. The last time complaints about labor quality fell below 16% was in April 2020. Fewer small business owners reporting labor as their top problem aligns with other data suggesting a more tempered labor market economy-wide.

The percent of small business owners reporting labor quality as the single most important problem for business remained at 16%, unchanged from May. The last time complaints about labor quality fell below 16% was in April 2020. Fewer small business owners reporting labor as their top problem aligns with other data suggesting a more tempered labor market economy-wide.

Eleven percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), down three points from May and the lowest reading since September 2021. Inflation pressures continue to ease on Main Street.

Eleven percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), down three points from May and the lowest reading since September 2021. Inflation pressures continue to ease on Main Street.

The data on overall health of respondents’ business showed substantial deterioration, with declines in the percentages reporting their business was in excellent or good health. When asked to rate the overall health of their business, 8% reported excellent (down six points), and 49% reported good (down six points). Thirty-five percent reported the health of their business was fair (up seven points), and 7% reported poor (up three points).

The data on overall health of respondents’ business showed substantial deterioration, with declines in the percentages reporting their business was in excellent or good health. When asked to rate the overall health of their business, 8% reported excellent (down six points), and 49% reported good (down six points). Thirty-five percent reported the health of their business was fair (up seven points), and 7% reported poor (up three points).

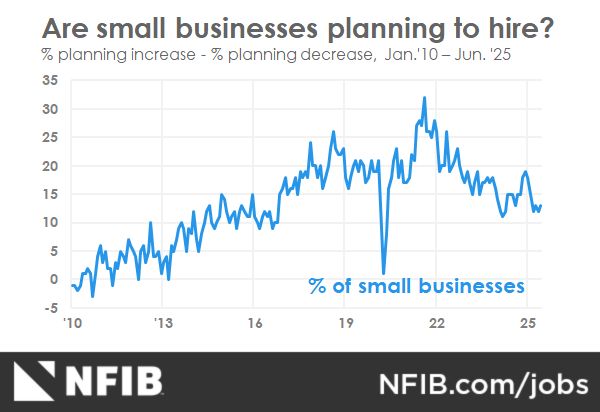

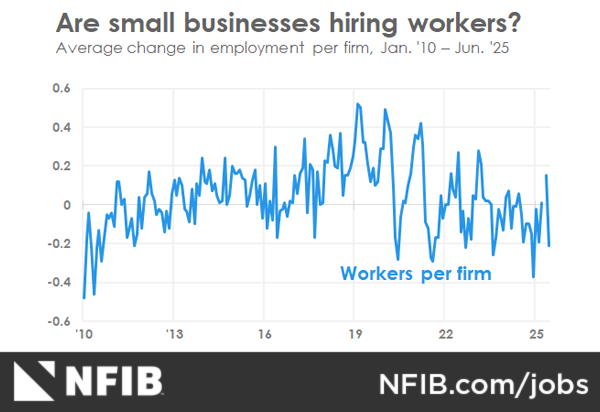

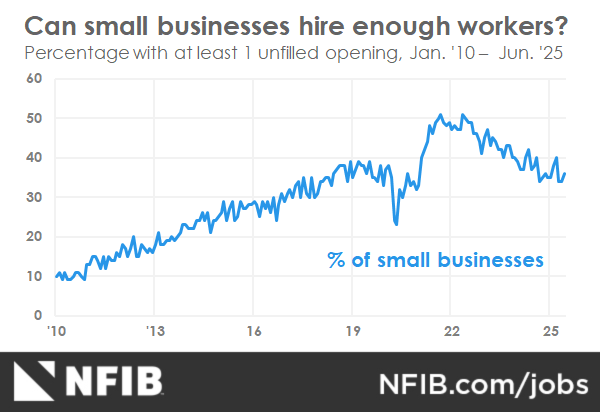

As reported in NFIB’s monthly jobs report, a seasonally adjusted 36% of all small business owners reported job openings they could not fill in June, up two points from May. Of the 58% of owners hiring or trying to hire in June, 86% reported few or no qualified applicants for the positions they were trying to fill. A seasonally adjusted net 13% of owners plan to create new jobs in the next three months, up one point from May.

Labor costs reported as the single most important problem for business owners rose one point in May to 10%.

Seasonally adjusted, a net 33% reported raising compensation, up seven points from May and the largest monthly increase since January 2020. A seasonally adjusted net 19% plan to raise compensation in the next three months, down one point from May.

Fifty percent of owners reported capital outlays in the last six months, down six points from May and the lowest reading since August 2020.

Of those making expenditures, 33% reported spending on new equipment, 18% acquired vehicles, and 13% improved or expanded facilities. Nine percent spent money on new fixtures and furniture and 3% acquired new buildings or land for expansion.

In June, the percent of small business owners reporting poor sales as their top business problem rose one point to 10%, after five consecutive months of remaining unchanged. A net negative 5% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, up eight points from May. This is the highest reading since January 2023 and the largest monthly jump since April 2021.

The net percent of owners reporting inventory gains fell three points from May to a net negative 8%, seasonally adjusted. Not seasonally adjusted, 14% reported increases in stocks and 18% reported reductions. A net negative 5% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in June, down six points from May. This component contributed the most to the Optimism Index’s decline.

Seasonally adjusted, a net 32% plan to increase prices, up one point from May and the highest reading since March of last year. The net percent of owners raising average selling prices rose four points from May to a net 29%, seasonally adjusted. Unadjusted, 11% of owners reported lower average selling prices, and 42% reported higher average prices.

The frequency of reports of positive profit trends was a net negative 22% (seasonally adjusted) in June, four points better than in May. Among owners reporting lower profits, 40% blamed weaker sales, 17% cited the rise in the cost of materials, 10% cited price change for their product(s) or service(s), and 7% cited labor costs. For owners reporting higher profits, 42% credited sales volumes, 32% cited usual seasonal change, and 7% cited higher selling prices.

Three percent of owners reported that financing and interest rates were their top business problem in June, down two points from May. Twenty-six percent of all owners reported borrowing on a regular basis, up one point from May. A net 5% reported their last loan was harder to get than in previous attempts, up one point from May. A net 9% reported paying a higher rate on their most recent loan, up two points from May.

Eleven percent (seasonally adjusted) of owners reported that it is a good time to expand their business, up one point from May. Despite the increase, this remains a low reading historically.

Nineteen percent of small business owners reported taxes as their single most important problem, up one point from May and ranking as the top problem. The last time taxes reached 19 percent was in July 2021. The percent of small business owners reporting government regulations and red tape as their single most important problem remained at 9% for the third consecutive month. Seven percent reported competition from large businesses as their single most important problem, up three points from May.

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in June 2025.

Labor Markets

In June, 36 percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, up 2 points from May. Thirty percent had openings for skilled workers (unchanged), and 13 percent had openings for unskilled labor (unchanged for the fifth consecutive month). The difficulty in filling open positions is particularly acute in the construction, manufacturing, and transportation industries. Openings were the lowest in the finance and agriculture industries. Job openings in construction were up 5 points from last month, and up 2 points from June 2024. A seasonally adjusted net 13 percent of owners plan to create new jobs in the next three months, up 1 point from May. Job creation plans remain weak compared to recent history. Overall, 58 percent reported hiring or trying to hire in June, up 3 points from May. Fifty percent (86 percent of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill (up 2 points). Twenty-five percent of owners reported few qualified applicants for their open positions (down 4 points), and 25 percent reported none (up 6 points). The percent of small business owners reporting labor quality as the single most important problem for their business remained at 16 percent, unchanged from May. The last time complaints about labor quality fell below 16 percent was in April 2020. Labor costs reported as the single most important problem for business owners rose 1 point from May to 10 percent.

Capitol Spending

Fifty percent of small business owners reported capital outlays in the last six months, down 6 points from May and the lowest reading since August 2020. Of those making expenditures, 33 percent reported spending on new equipment (down 7 points), 18 percent acquired vehicles (down 8 points), and 13 percent improved or expanded facilities (down 2 points). Nine percent spent money on new fixtures and furniture (down 1 point), and 3 percent acquired new buildings or land for expansion (down 2 points). Twenty-one percent (seasonally adjusted) plan capital outlays in the next six months, down 1 point from May. Historically, this remains a weak reading.

Inflation

The net percent of owners raising average selling prices rose 4 points from May to a net 29 percent seasonally adjusted. Actual price increases still remain too high to achieve and maintain the Federal Reserve’s 2 percent inflation target but are closing in on a range of greater price stability. About half of the CPI is “imputed,” not based on a direct measure of market prices. Eleven percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), down 3 points from May and the lowest reading since September 2021. Unadjusted, 11 percent (up 1 point) reported lower average selling prices, and 42 percent (up 4 points) reported higher average prices. Price hikes were most frequent in the finance (52 percent higher, 10 percent lower), wholesale (50 percent higher, 6 percent lower), retail (49 percent higher, 7 percent lower), and construction (48 percent higher, 8 percent lower) industries. Seasonally adjusted, a net 32 percent plan to increase prices, up 1 point from May and the highest reading since March of last year.

Credit Markets

A net 5 percent reported their last loan was harder to get than in previous attempts, up 1 point from May. Three percent reported that financing and interest rates were their top business problem in June, down 2 points from May. In June, a net 9 percent of owners reported paying a higher rate on their most recent loan, up 2 points from May. The percent reporting paying a higher rate on their most recent loan has been increasing since the beginning of this year. The average rate paid on short maturity loans was 8.8 percent, up 0.1 of a point from May. Twenty-six percent of all owners reported borrowing on a regular basis, up 1 point from May. High mortgage rates have slowed housing activity, a damper on GDP growth. But loan availability is good.

Compensation and Earnings

Seasonally adjusted, a net 33 percent reported raising compensation, up 7 points from May and the largest monthly increase since January 2020. A seasonally adjusted net 19 percent plan to raise compensation in the next three months, down 1 point from May. Clearly, the pressure of labor costs on inflation is easing. The frequency of reports of positive profit trends was a net negative 22 percent (seasonally adjusted) in June, 4 points better than May’s reading. Even with the increase, earning trends are relatively poor historically. Among owners reporting lower profits, 40 percent blamed weaker sales, 17 percent cited the rise in the cost of materials, 10 percent cited price change for their product(s) or service(s), and 7 percent cited labor costs. Among owners reporting higher profits, 42 percent cited sales volume, 32 percent cited usual seasonal change, and 7 percent cited higher selling prices.

Sales and Inventories

A net negative 5 percent of all owners (seasonally adjusted) reported higher nominal sales in the past three months, up 8 points from May. This is the highest reading since January 2023 and the largest monthly jump since April 2021. The net percent of owners expecting higher real sales volumes fell 3 points from May to a net 7 percent (seasonally adjusted). The net percent of owners reporting inventory gains fell 3 points from May to a net negative 8 percent (seasonally adjusted). Not seasonally adjusted, 14 percent reported increases in stocks (unchanged) and 18 percent reported reductions (up 2 points). A net negative 5 percent (seasonally adjusted) of owners viewed current inventory stocks as “too low” in June, down 6 points from May. This component contributed the most to the Optimism Index’s decline. A net negative 1 percent (seasonally adjusted) of owners plan inventory investment in the coming months, unchanged from May.

Commentary

The Uncertainty Index remains at elevated levels, with politics and more politics dominating the news. Real spending on investment is falling and spending plans remain depressed. Investments today impact our ability to produce more “tomorrow.” Job creation has been wobbling downward and will continue to do so.

Inflation remains stubbornly above the Federal Reserve’s target, therefore the policy rate remains over 4 percent with the possibility of cuts getting pushed down the road. The President wants a lower rate, and sometime this fall, market conditions will likely justify a rate cut by the FOMC. Lower mortgage rates would provide some support to a slowing housing market and reduce borrowing costs for small businesses, but supply remains the bigger problem. Owners face high labor costs with many continuing to raise compensation, a cost that will be passed on in higher selling prices, not helpful for the inflation fight.

Consumer spending will be the key to growth over the next 12 months. Sentiment is in the tank, consumers are sharply divided on their political affiliation. Democrats are depressed, Republicans jubilant. Just how this will shape their spending is less clear. As Uncertainty is resolved, the outlook will become clearer.