Taxes

Taxes

Tax Issues & Small Business

Your Chance to Influence

The 20% Small Business Deduction Will Be Permanent

Tell Congress what having certainty means for your small business because of the permanent 20% Small Business Deduction.

Take Action

Repeal the Death Tax!

Tell Congress that taxing small business owners at death is wrong.

Take Action

Featured

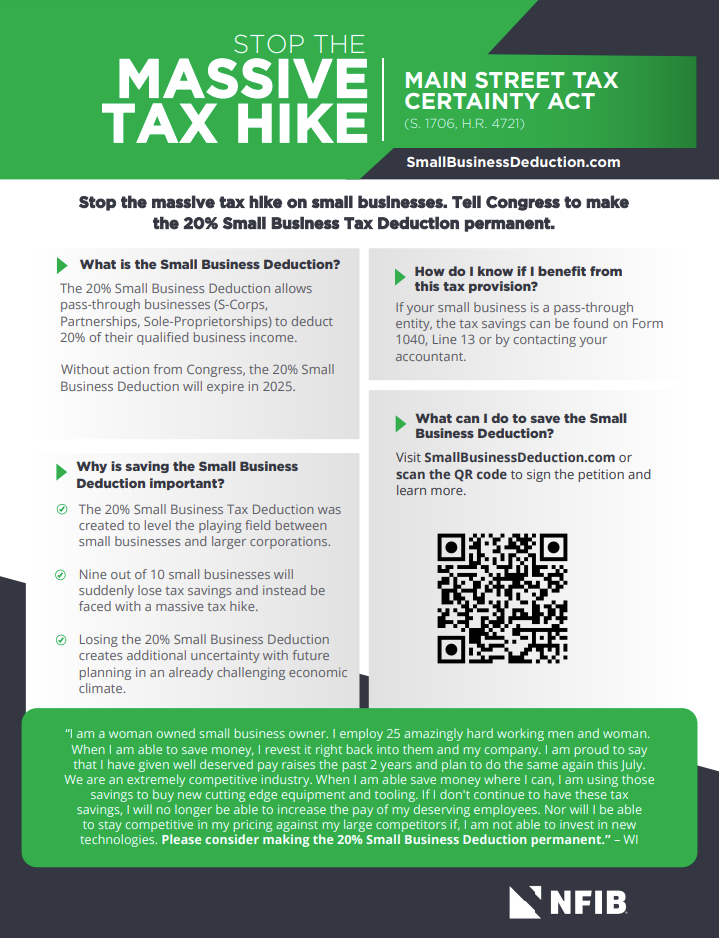

Main Street Tax Certainty Act

The 20% Small Business Deduction is a crucial tax provision, but its 2025…

View PDF

Are you eligible for the Small Business Deduction?

In 2017, NFIB fought for the Small Business Deduction (Section 199A) that a…

View PDF

Get the Facts!

Our infographic below details how the 20% deduction means big savings for s…

View PDF

Tax Relief: Small Business Deduction

The 20 percent deduction for pass-through

entities, one of the key provisi…

View PDF