July 22, 2025

Small Business and Individual Health Insurance Prices Are Going Up – Again

Despite Vermont generally ranking among the healthiest states in the country and having a high rate of health coverage, Vermont’s health insurance market is struggling and premiums are rising.

This is a result of many factors, including state and federal policy choices and many of the same demographic challenges that contribute to the broader affordability crisis in the state.

There is no silver bullet to fix health care at the state level. Layers of state and federal laws, rules, and regulations, along with the bureaucratic business processes of insurers and hospitals, put the problems beyond a simple fix.

In Part I, we look at some of the underlying trends and reasons for why healthcare keeps getting more expensive.

In Part II, we recommend a policy change to allow small businesses to utilize the same health coverage options as big corporations.

Fewer Small Businesses Can Afford Health Coverage. Every four years, NFIB publishes Small Business Problems and Priorities. In last year’s edition and every edition for nearly forty years, the cost of health insurance has ranked as the number one problem. Small businesses deserve every option to offer affordable health coverage, a crucial benefit for attracting and retaining employees.

Health insurance prices have increased significantly in Vermont’s state-regulated markets that serve small businesses and their employees. According to the Kaiser Family Foundation, the average full price individual market “benchmark plan” premium increased by 153% from 2018 to 2025.

In the small group market, the average silver plan employee premium increased approximately 37% from 2018 to 2024. For 2025, the state’s two largest small group insurance carriers were granted average increases of 11% and 23%, respectively.

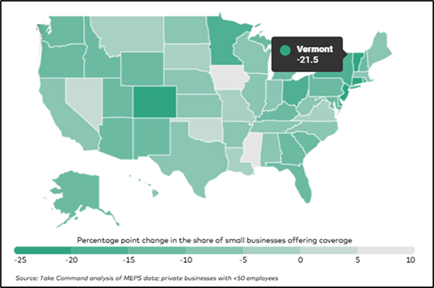

The drastic rise in premiums has contributed to a steep drop in the number of small businesses offering health insurance. According to analysis of changes in small business health coverage from Take Command, a healthcare solutions software company, Vermont saw the third largest decline of any state between 2009 and 2023.

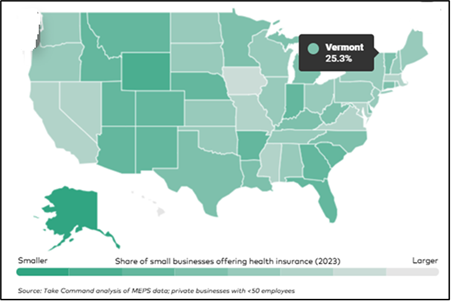

The same analysis found the share of Vermont small businesses that offer health coverage is the lowest in the Northeast.

Proposed Premium Hikes for 2026. The affordability problem is getting worse.

In May, the state’s Green Mountain Care Board (GMCB) released preliminary premium increases requested by health insurance companies for coverage in the individual and small group health insurance markets for 2026:

Small Group (1-100 Employees)

BCBS VT: +13.7%

MVP: +7.5%

Individual

BCBS VT: +23.3%

MVP: +6.2%

Premiums for next year will not be finalized until August, after GCMB has completed its review and considered public comments.

In a hopeful sign for individuals and small businesses, GMCB announced in mid-June that BCBS VT’s large group rates for 2026 would be 3.6% lower than initially requested – but still 13.7% higher than last year.

This is attributable, in part, to new limitations imposed by the legislature on the markups hospitals can charge for specialty drugs.

If you’d like to comment on the proposed individual or small group health insurance rate increases, click here: GMCB Rate Review Home Page | Rate Review.

Why Is Health Insurance Getting More Expensive? The staggering premium increases requested by BCBS VT are largely a reflection of the high cost of health care in Vermont, which is driven in part by public policy and management decisions, as well as rising labor costs, labor scarcity, decades of slow population growth, a lack of housing, and other factors that influence the cost of everything in the state.

It’s also reflective of a lack of competition among providers and major hospital systems, where the University of Vermont Medical Center is by far the largest and most expensive hospital in the state. UVM Medical Center has long been noted as comparatively expensive within Vermont and nationally.

Some of the factors that drive higher costs, like people using expensive ER visits for relatively simple primary care needs, are largely outside of hospitals’ control.

Another factor is the decline in commercial health insurance coverage and the rise in government health plan enrollment. From 2000 to 2021, the number of people covered by private insurance declined from 366,000 (60% of all coverage) to 305,000 (49% of all coverage).

During the same period, combined enrollment in Medicaid and Medicare plans in the state grew from 185,600 (30.5%) to 278,000 (45%). The number of uninsured decreased from 51,400 (8.4%) to 19,400 (3%).

The increase in Medicare coverage is largely attributable to the state’s aging population, while a large spike in Medicaid coverage occurred after eligibility was expanded under the Affordable Care Act (ACA) in 2014.

Between 2012 (two years before the Medicaid expansion) and 2021, the number of Medicaid enrollees in Vermont increased by 37% and its share of primary health coverage rose from 18% to 24%.

The growing share of enrollees in public health plans impacts the price of private health plans because Medicare and Medicaid pay doctors and hospitals significantly less than private insurance for the same services.

Nationally, private coverage pays double the Medicare rate for hospital services and over 40% more than Medicare for physician services (KFF, 2020). Recent research indicates the cost shift in Vermont is higher than the national average.

Medicaid reimbursement is even lower (30% less) than Medicare, putting further pressure on private coverage.

When the share of reimbursement from public health plans increases, health providers make up the difference by charging higher prices to private health plans.

This increases commercial insurance premiums, which in turn reduces enrollment in private coverage. For every one percent increase in health insurance premiums, there’s a four to six percent reduction in demand for employer-based individual and family coverage.

And even with large markups on commercial payers, many hospitals still struggle to maintain services and keep afloat financially.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles