Topics:

October 17, 2023 Last Edit: June 5, 2025

Projected surplus grows by 50+% over earlier estimates

Minnesota’s Revenue Collection Exceeds – Again

Source: Minnesota Management & Budget

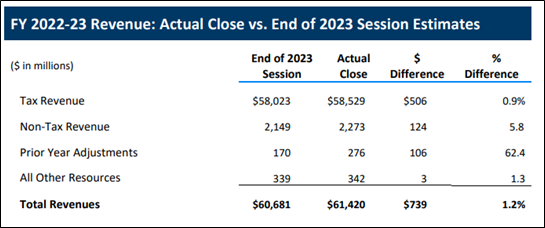

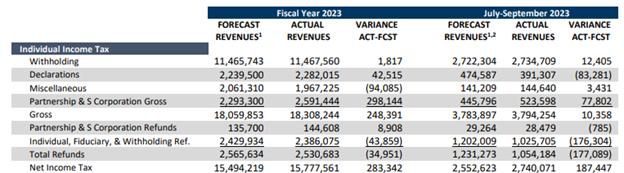

Read the FY2022-23 Budget Close Report here: FY 2022-2023 Biennium Budget Close Report (mn.gov) Earlier in October, Minnesota Management & Budget (MMB) released an update on the final collections for Fiscal Year 2023 and the first quarterly budget update for Fiscal Year 2024. Higher collections from partnerships and S corporation taxes accounted for the largest portion of the revised estimates for FY22-23 (+$298 million) and continued to exceed expectations in FY24 Q1 (+$78 million).

Source: Minnesota Management & Budget

While the current surplus pales in comparison to the $18 billion surplus that fueled a massive 40% increase in state spending during the 2023 Minnesota Legislative Session, it remains large by historical standards. NFIB Minnesota will continue our fight to return surplus tax revenue to hardworking small business owners that paid them and to permanently reduce the tax burden on Main Street.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

July 14, 2025

NFIB: Alabama Sales Tax Holiday Could Be a Boon to Main Street…

This year’s tax-free weekend is July 18-20.

Read More

July 14, 2025

Reminder: 2025 Ohio Sales Tax Holiday Extension

Ohio’s sales tax weekend extends to two full weeks in August

Read More

July 11, 2025

ICYMI: Watch the Latest NFIB Minnesota Webinar

NFIB Minnesota recently held a webinar to discuss what happened during the…

Read More

July 10, 2025

Historic Legislation Becomes Law and Stops Massive Tax Hike on…

The One Big Beautiful Bill Act is signed into law, permanently extending th…

Read More