May 30, 2023

Taxes & Transportation Bills Include New Fees, Big Tax Hikes

The 2023 Minnesota Legislative Session concluded on May 23. In the coming weeks, we’ll explore the session’s impact on small businesses and the general business environment. The first part will address the major tax and fee hikes enacted into law this year.

Despite an $18 billion budget surplus – by far the largest in state history – Governor Walz and the Democrat-controlled Legislature were intent on raising taxes and fees to fund a gluttonous spending spree.

The next two-year state budget will increase by an eye-popping $20 billion over the current budget ($72 billion vs. $52 billion).

The DFL House and Gov. Walz were particularly bent on raising taxes on businesses and the “wealthy,” including proposals for a new 5th Tier Income Tax Rate that was as high as 12% at some points and a capital gains surcharge of 1.5% on all long-term gains between $500,000 – $1,000,000 and 4% on gains over $1 million.

NFIB Minnesota vigorously opposed new taxes and fees that hit small business owners. We were successful in stopping the 5th Tier Income Tax and Capital Gains Surcharge.

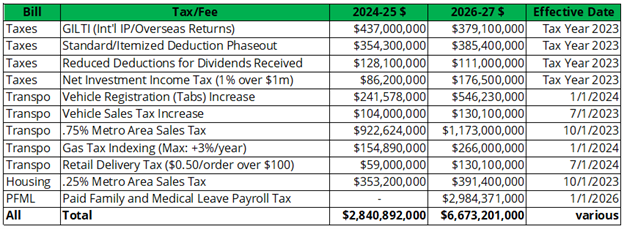

Unfortunately, the final budget included about $10 billion in tax and fee hikes over the next four years (FY 2024-25 and FY 2026-27).

In addition to tax hikes in the Omnibus Tax Bill, several new and increased taxes were included in the Omnibus Transportation Bill and Omnibus Housing Bill. Not to mention the $1.5 billion Paid Family and Medical Leave (PFML) payroll tax.

A look at some of the biggest tax increases in these bills is below:

A few notes on these tax hikes:

- Net Investment Income Tax does not apply to income from trade or business, including (per MN Revenue) the sale of a business or business assets

- Reduced Deduction on Dividends Received applies to dividends received from another corporation in which the receiving corporation holds 20% or more of the stock

- GILTI is a tax on supernormal overseas returns that is unlikely to hit many small businesses

- Metro Area Sales Tax increases apply to the 7-county metro area

- Retail Delivery Fee applies to deliveries of $100 or more containing taxable items; it excludes delivery of food and prepared meals; does not apply to a company with less than $1 million in annual retail sales

- Gas Tax Indexing requires the gas tax to be increased according to inflation as measured by the Minnesota Highway Construction Cost Index, up to a maximum of three percent per year; the gas tax cannot decline even if the index is negative

In addition to the tax hikes above, the Tax Bill contains a series of property tax adjustments. Some will benefit certain small businesses, such as an increase in the agricultural homestead first tier limit (from $1.14 million to $3.5 million).

However, on the whole will result in a shift taxes onto commercial and industrial properties. Lower value C/I properties will be impacted the most, with their bills likely to go up 1-2% as a result of the shifts.

Where does all the money go? The Tax Bill increases will go into the state’s General Fund to support the massive growth in state spending and a number of new or increased tax expenditures. The main tax expenditure items are:

- one-time rebate checks: $260 for individual under $75,000 or $520 married under $150,000 (FY 24-25: $1,152,000,000)

- child tax credit: $1,750 per dependent up to $35,000 household income (FY 24-25: $795,000,000)

- increase in the income thresholds for a 100% social security income subtraction to $100,000 filing jointly with subtraction phasing out at $140,000 (FY 24-25: $496,200,000)

- enhanced renter’s credit (FY 24-25: $378,600,000)

The gas tax and most of the registration fee increase goes to roads and bridges, the delivery tax is split among several different local road improvement accounts, and the bulk of the vehicle sales tax hike goes to roads and bridges. About 83% of the .75% metro area sales tax increase goes to the Met Council for transit projects.

Inexplicably, DFLers put $200 million toward the Northern Lights Express – a passenger train that will run between Minneapolis and Duluth. Long a fringe pet project of liberals, it will become a reality thanks to the persistence of Rep. Erin Koegel (DFL-Spring Lake Park). She defended spending more money on empty trains by saying: “I watch a lot of sci-fi movies and futuristic, you know, movies and there are always trains in the future.”

On a positive note, transportation bill does, over a period of 10 years, fully dedicate the motor vehicle repair and parts sales tax to road and bridge repairs. NFIB has long supported full dedication of this revenue for many years, but like other business groups we sought it as an alternative to higher taxes and fees.

The Housing sales tax goes into a new fund for housing assistance and affordable housing development.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles