July 1, 2025

Education Funding Overhaul Will Have Major Impact on Property Taxes

In Part V of the 2025 Vermont Legislative Recap, we look at significant changes to property taxes and state income taxes approved by lawmakers and Gov. Scott this year.

In mid-June, the governor and lawmakers made good on their promise to return to Montpelier for a vote on an overhaul of the state’s education governance and funding system. They also approved a package of tax cuts aimed at reducing the financial burden on retirees and military veterans.

Education Funding and Property Tax Reform (Signed Into Law). The bipartisan education funding and governance overhaul (H.454) will be the biggest change to schools and the statewide education property tax in decades.

By most measures, Vermont’s per student spending is among the top three states in the country. School funding comes primarily from a statewide property tax, with additional revenue coming from sales and hospitality taxes, as well as lottery proceeds.

Governor Scott and lawmakers who backed the new law hope that it will stabilize and lower property tax bills, while improving education outcomes. That hope rests on the adoption of a “foundation formula” with a fixed amount of state funding for local schools and more efficient governance structure.

However, a more complete picture of its impact on communities and property tax bills won’t be known until next year, at the earliest.

While many lawmakers were spooked by an early look at the property tax impacts based on current districts, the changes will vary greatly depending on previous local school spending levels, the extent to which consolidation occurs, and what new school district maps look like.

Below is a look at some of the key elements, variables, and timeline of the new law.

FOUNDATION FORMULA. The law moves the state to a foundation formula beginning in the 2028-29 school year.

The base amount is set at $15,033 and will be adjusted annually for inflation. The formula contains a number of weights to adjust for factors such as students with learning disabilities and English language learners.

Districts may spend in excess of the foundation formula through a supplemental spending property tax, but only up to a certain percentage above the formula’s base amount. In fiscal years 2029-33, supplemental spending is capped at 10% above base. The supplemental spending allowance reduces one percent per year from 2034 to 2037. Thereafter, supplemental spending is limited to 5% above base.

The foundation formula and related policy are effective 7/1/2028.

PROPERTY TAXES. The final agreement does not include the more complex property tax schemes proposed earlier in the year by the Vermont House. NFIB VT opposed those plans because they would likely have shifted more of the tax burden onto businesses

In the end, lawmakers added only one new property tax class: nonhomestead residential. This is intended to allow second homes to be taxed at a higher rate than full-time residences.

The other two classes remain homestead and nonhomestead nonresidential.

The agreement replaces the existing income-based property tax credit with an income-based valuation exclusion that will be adjusted annually for inflation.

The exclusion basis is $425,000 and starts at 95% ($403,750) for households with income up to $25,000 and 90% for incomes between $25,001 – $40,000. The exclusion decreases by approximately 10% for every $10,000 in income until reaching 10% for households between $110,001- $115,000.

Households earning less than $47,000 continue to receive an additional credit against municipal taxes owed.

Unfortunately, lawmakers did not include a market value exclusion for small businesses. NFIB VT supported this mechanism as a way of shielding Main Street from any potential short-term upward spike in property taxes in certain areas during the law’s first years.

DISTRICT CONSOLIDATION. Beginning no later than 8/1/2025 and with a final report due by 12/1/2025, a new task force must present the governor and legislators with up to three options for new school district boundaries.

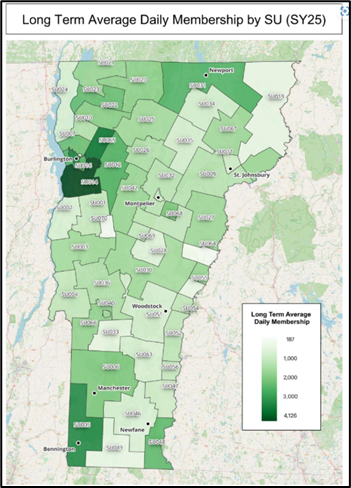

The options must satisfy a lengthy list of criteria, including a key requirement that districts should contain between 4,000 and 8,000 students. This alone will trigger significant consolidation of school governance.

Currently, the Champlain Valley School District (~4,400 students across Williston, Shelburne, Charlotte, Hinesburg and St. George) is the only district with more than 4,000 students in Vermont.

Map: Vermont Public, 6/18/25 (VT Agency of Education data)

The task force also must prioritize geographic continuity, consider geographic features and transportation routes, and minimize student disruption.

The new law directs lawmakers to adopt a new school district map, along with new voting wards for school district governance, during the 2026 legislative session. The legislative intent is to have new maps adopted by 7/1/2026.

Groups ranging from local school officials to the teacher’s union to a coalition of rural districts expressed dissatisfaction (for different reasons) with the final agreement. They’re certain to lobby for changes to the underlying law and how it’s implemented next year.

CLASS SIZE MINIMUMS: The agreement lays out class size minimums by grade, which also acts to encourage district consolidation:

– Grade 1: 10 students

– Grades 2-5: 12 students

– Grades 6-8: 15 students

– Grades 9-12: 18 students

Pre-K, kindergarten, career and technical, advanced placement, driver’s ed, special ED, ESL, specialized education, and other classes are exempt from minimums.

A school would have to fail to meet the minimums for three consecutive years before closure could be on the table.

Even then, failure to meet the minimum class sizes will not automatically result in closure. School boards may seek a waiver from class size minimums from the State Board of Education due to geographic isolation or because it has an implementation plan ready to meet the requirements.

Building constraints and capital outlays triggered by consolidation may also result in suspension of class size minimums.

Class sizes and related policy are effective on 7/1/2026.

INDEPENDENT SCHOOLS. Criteria for which independent schools can qualify to receive students using public funds (tuitioning) was a massive sticking point, with all three sides holding different perspectives.

The new law requires the school to, in addition to existing standards:

– be in Vermont (previously no restriction)

– be in a district that did not operate a public school for some or all grades as of 7/1/2024

– have had at least 25% enrollment from tuitioning students during the 2023-24 school year

– comply with same class size minimums as public schools

Tax Breaks for Veterans, Seniors, Parents (Signed Into Law). Fortunately, no business or individual tax increases were seriously considered during the 2025 legislative session. Most major state revenues continue coming in above projections for this fiscal year, putting the state budget on solid footing.

While lawmakers did not lower Vermont’s heavy business tax burden, they passed a trio of tax reductions (S.51) aimed at maintaining the state’s population and growing its workforce:

MILITARY PENSIONS: U.S. military retirement income and survivor benefit income is fully excluded from state income taxes if the taxpayer’s AGI is $125,000 or less.

The agreement includes a partial, phased-down exclusion for those with AGI between $125,000 and $175,000.

This was a long-held priority of Governor Scott, who argued that military retirees generally have years or decades of productive work ahead of them. With Vermont being one of the few states to fully tax military pensions, the state has been a less financially attractive place for veterans to start their next chapter.

An additional tax credit of $250 was included for military veterans with AGI under $25,000. A phased-out credit is available for those with AGI up to $30,000.

SOCIAL SECURITY: Increases the threshold for full exemption from state income tax from adjusted gross income (AGI) of $50,000 to $55,000 for single, married filing separately, head of household, and surviving spouses and from AGI of $65,000 to $70,000 for joint filers.

The partial exclusion thresholds are also increased: single filers with AGI between $55,000 and $65,000 and joint filers with AGI between $70,000 and $80,000 will see a reduction in the amount of tax owed on social security income.

CHILD TAX CREDIT: Lawmakers also extended the age of a child for which a resident can claim the state’s $1,000 credit per child from five to six years old.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles