Topics:

December 15, 2022 Last Edit: June 5, 2025

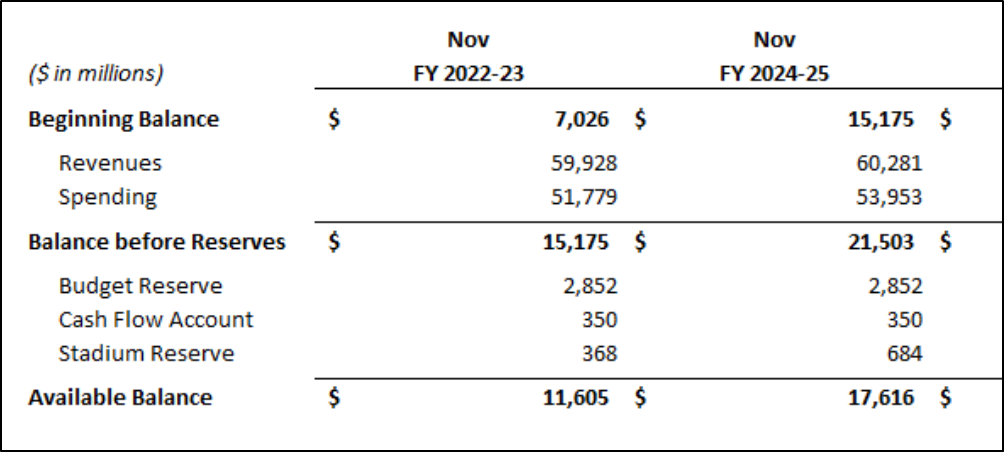

State of Minnesota Announces $17.6 Billion Budget Surplus

Source: Minnesota Management & Budget, Dec. 2022

NFIB Minnesota’s position on the surplus is clear: small businesses are chronically overtaxed and deserve permanent relief.

We’ll work to educate lawmakers on the importance of reducing individual and corporate tax rates, reducing or eliminating the statewide general property tax, conforming to the federal estate tax exemption, and more.

With Democrats in control of state government, tax relief faces an uncertain future. Already, DFL-allied groups are making requests that would eat up the entire surplus and add record levels of permanent new spending.

For his party, Gov. Walz has so far taken a cautious tone towards surplus. Given the turbulent economy, he has expressed greater interest in one-time outlays instead of long-term spending increases or revenue reductions. To this end, Walz is again proposing one-time rebate checks instead of permanent relief from some of the highest tax rates in the country.

While he hasn’t yet released the details, a similar proposal from last summer included checks of $1,000 to individuals making up to $164,000 and $2,000 to married couples making up to $273,470.

The rebate proposal largely received a cool reception from Democrats and Republicans alike in the Legislature last session and some key Democrats remain skeptical.

Source: Minnesota Management & Budget, Dec. 2022

NFIB Minnesota’s position on the surplus is clear: small businesses are chronically overtaxed and deserve permanent relief.

We’ll work to educate lawmakers on the importance of reducing individual and corporate tax rates, reducing or eliminating the statewide general property tax, conforming to the federal estate tax exemption, and more.

With Democrats in control of state government, tax relief faces an uncertain future. Already, DFL-allied groups are making requests that would eat up the entire surplus and add record levels of permanent new spending.

For his party, Gov. Walz has so far taken a cautious tone towards surplus. Given the turbulent economy, he has expressed greater interest in one-time outlays instead of long-term spending increases or revenue reductions. To this end, Walz is again proposing one-time rebate checks instead of permanent relief from some of the highest tax rates in the country.

While he hasn’t yet released the details, a similar proposal from last summer included checks of $1,000 to individuals making up to $164,000 and $2,000 to married couples making up to $273,470.

The rebate proposal largely received a cool reception from Democrats and Republicans alike in the Legislature last session and some key Democrats remain skeptical.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

January 30, 2026

Iowa January Legislative Update

Legislative updates on bills that impact Iowa small businesses

Read More

January 29, 2026

Small Business Releases 2026 Main Street Legislative Agenda

NFIB highlights top legislative priorities for small businesses

Read More

January 29, 2026

Oklahoma Small Business Owners Outline Top Priorities Ahead of 2026 Legislative Session

NFIB Oklahoma calls on the Legislature to prioritize reforms that reduce cost pressures on small business owners.

Read More

January 29, 2026

NFIB to Colorado Lawmakers: Treat Main Street as Partner

“Small-business owners are counting on lawmakers to see Main Street, not as a source of revenue or a problem to micromanage, but as a partner in Colorado’s fut…

Read More