Topics:

October 4, 2023 Last Edit: June 5, 2025

MA, MD PFML Tax rates raise new questions about Minnesota PFML Tax.

NFIB Analysis: Is $1.5 Billion Enough for Minnesota’s PFML Program?

SAWW: statewide average weekly wage

Minnesota also relies on some key assumptions that differ from the figures found in Maryland’s estimates or Massachusetts’s experience. Average Weekly Benefit Payment: The most recent version of the Minnesota PFML fiscal note did not provide an estimated average weekly benefit payment. An approximate average weekly payment of $951.32 can be inferred by dividing the estimate for the total annual benefit payments ($1.16 billion) by the estimated total annual number of leave weeks taken (1,224,342). This may be higher than the other states, in part, because of Minnesota’s more expensive payment formula and higher weekly maximum. Average Length of Leave: Minnesota’s expectation that the average user will take only six weeks of PFML per year also differs from expectation and experience in other states. Despite a more generous benefit payment structure and cap than both states, Minnesota expects workers here to use 37% fewer leave weeks than workers take in Massachusetts and 44% fewer than workers are expected to take in Maryland.

Sources: Minnesota PFML Fiscal Note (SF 2), 4/25/2023; Maryland FMLI Fiscal & Policy Note (SB 275), 4/8/2022; Massachusetts PFML Annual Report FY 2023.

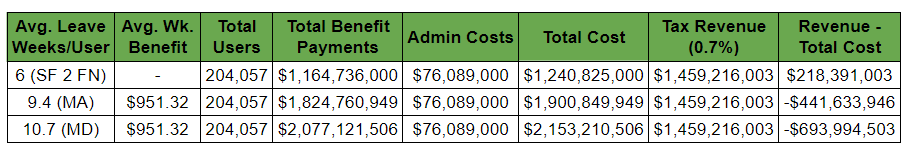

Changes in PFML benefits and utilization can result in significant financial shifts for the program. The cost of a PFML program depends on many factors, including how many people use the program, the duration for which they use program, and how much they are paid while using the program. Under the assumptions used in the Minnesota PFML fiscal note, a 0.7% payroll tax covers the first-year cost of the program and produces a surplus of $218 million. However, using Massachusetts’s average leave length of 9.4 weeks and the inferred average weekly payment of $951.32 changes the total cost of the program to $1.9 billion with a deficit of nearly $442 million at a 0.7% payroll tax. Using Maryland’s estimated average leave length of 10.7 weeks and the inferred average weekly payment of $951.32, the total cost of the program rises to $2.08 billion for a deficit of roughly $694 million at a 0.7% payroll tax. Higher payments and/or longer leave lengths require a higher payroll tax. The total cost of PFML benefits, administration, and operating surplus will determine the necessary payroll tax level. In the Minnesota PFML fiscal note, the state expects the program to run a surplus of $218 million, or 18.8%, in the first full fiscal year. The surplus is the difference between revenue from the 0.7% Payroll Tax and the total cost of benefits and administration. To realize the same surplus in the longer leave length scenarios, the payroll tax rate would need to be 1.08% to 1.23%. Even without a surplus, the tax rate would need to be 0.91% to 1.03% to break even. A lower average weekly benefit payment and/or shorter average leave length could make the program financially viable.- At a payroll tax of 0.7%, an average leave length of 9.4 weeks (MA), and an average weekly payment of $646.89, the program would run the same cost and surplus as the Minnesota PFML fiscal note.

- At payroll tax of 0.7%, an average leave length of 10.7 weeks (MD), and an average weekly payment of $568.30, the program would run the same cost and surplus as the Minnesota PFML fiscal note.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

July 11, 2025

ICYMI: Watch the Latest NFIB Minnesota Webinar

NFIB Minnesota recently held a webinar to discuss what happened during the…

Read More

July 10, 2025

Historic Legislation Becomes Law and Stops Massive Tax Hike on…

The One Big Beautiful Bill Act is signed into law, permanently extending th…

Read More

July 10, 2025

LISTEN: NFIB LA Director Talks Insurance Reform, Tax Relief, an…

Leah Long legislation making the 20% Small Business Deduction permanent was…

Read More

July 10, 2025

New Hampshire Supreme Court Weighs In on Statewide Property Tax

State Education Funding and Property Tax under have been under scrutiny for…

Read More