Nation’s Small Businesses Set Record for Uncertainty

Nation’s Small Businesses Set Record for Uncertainty

October 8, 2024

Nation's Small Businesses Set Record for Uncertainty

Nevada comment on NFIB’s latest Optimism Index findings

FOR IMMEDIATE RELEASE

Contact: Tray Abney, Nevada State Director, tray@abneytauchen.com

or Tony Malandra, Senior Media Manager, anthony.malandra@nfib.org

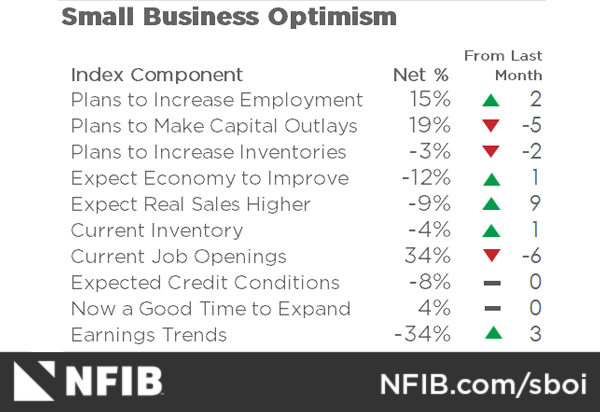

CARSON CITY, Nev., Oct. 8, 2024—There was not much optimism to be found in NFIB’s Optimism Index, also known as the Small Business Economic Trends report, released today. In addition to the Index recording its 33rd consecutive month below its 50-year average, the uncertainty component rose 11 points to 103—the highest reading recorded.

“Small business job creators crave stability,” said Tray Abney, Nevada state director for the National Federation of Independent Business (NFIB), which produces the Optimism Index. “They need certainty as they plan for the months and years ahead. But in this final stretch of the election season, they are finding anything but. Policy proposals from politicians of every level, interest rates, supply chain disruptions and shortages, credit card fees, and increased wages are all in flux. And small business owners are the least equipped to deal with each of these, much less all of them at the same time.”

From NFIB Chief Economist Bill Dunkelberg

“Small business owners are feeling more uncertain than ever. Uncertainty makes owners hesitant to invest in capital spending and inventory, especially as inflation and financing costs continue to put pressure on their bottom lines. Although some hope lies ahead in the holiday sales season, many Main Street owners are left questioning whether future business conditions will improve.”

Other Highlights from the Latest SBET Report

- The average rate paid on short maturity loans was 10.1%, up 0.6 of a point from August. The last time it was this high was February 2001.

- Thirty-four percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down six points from August and the lowest reading since January 2021.

- Seasonally adjusted, a net 32% reported raising compensation, down one point from August and remaining the lowest reading since April 2021.

- Twenty-three percent of owners reported that inflation was their single most important problem in operating their business (higher input and labor costs), down one point from August but remaining the top issue.

NFIB’s monthly (SBET) report is the gold standard measurement of America’s small business economy. Used by the Federal Reserve, Congressional leaders, administration officials, and state legislatures across the nation, it’s regarded as the bellwether on the health and welfare of the Main Street enterprises that employ half of all workers, generate more net new jobs than large corporations, and gave most of us the first start in our working life. The SBET (aka the Optimism Index) is a national snapshot of NFIB-member, small-business owners not broken down by state. More about the Uncertainty Index can be read here. The typical NFIB member employs between one and nine people and reports gross sales of about $500,000 a year.

Keep up with the latest Nevada small-business news at www.nfib.com/nevada. Follow us on X @NFIB_NV.

###

For 80 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since our founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB Nevada

Abney Tauchen Group

775-443-5561

Reno, NV

NFIB.com/NV

Twitter: @NFIB_NV

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles