November 4, 2024

Minnesota Tax Competitiveness Ranks 7th Worst in U.S.

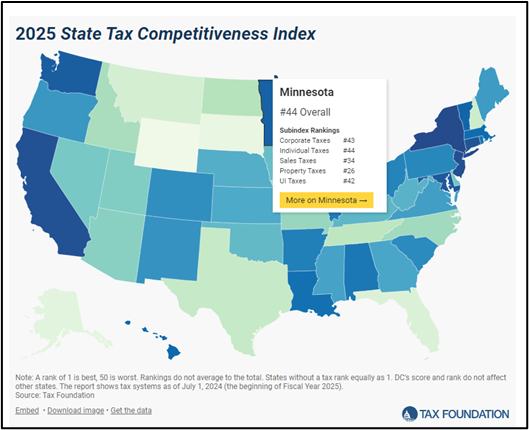

Last month, the nonpartisan Tax Foundation released its annual report on state tax competitiveness, and the results will not surprise small business owners in Minnesota. Our state ranks 44th – sixth from the bottom – in the 2025 State Tax Competitiveness Index.

See the full report and rankings here: 2025 State Tax Competitiveness Index | Full Study

See the Minnesota report here: 2025 State Tax Competitiveness Index | Full Study

Minnesota has long struggled in the Tax Foundation’s rankings and consistently ranked in the bottom ten. As noted in the report, Minnesota ranks in the bottom ten for corporate, individual, and unemployment taxes and in the bottom half for sales and property taxes.

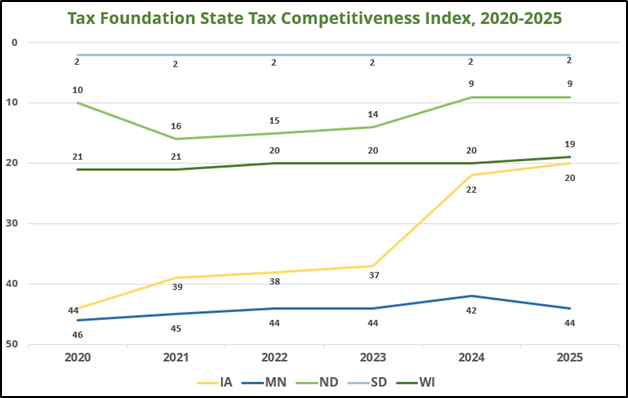

Minnesota’s neighbors drastically improved their tax competitiveness over the past fifteen years. North Dakota and Wisconsin implemented pro-growth reforms in the early 2010s, with Wisconsin moving from the bottom ten into the top twenty states for tax competitiveness.

More recently, Iowa undertook a series of pro-growth reforms, including reducing the corporate tax rate to 5.5% and moving to a low, flat individual income tax rate of 3.9%. Iowa Governor Kim Reynolds and some lawmakers are seeking to further reduce the individual income tax rate or eliminate it altogether.

The results in the Hawkeye State speak for themselves:

For now, Minnesota remains in the company of deep blue coastal states.

Pro-growth, pro-small business reform is needed here now more than ever, and NFIB Minnesota will continue fighting for a fairer tax environment for Main Street.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles