October 14, 2022 Last Edit: June 5, 2025

Minnesota Tax Collections Top Projections Again

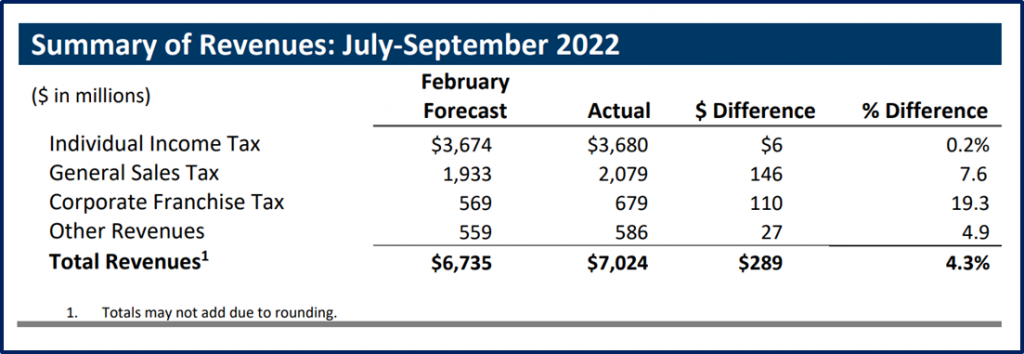

Earlier this month, Minnesota Management and Budget (MMB) – the state’s budget office – announced that revenue collections for the first quarter of State Fiscal Year (SFY) 2023 exceeded projections by $289 million. The state’s fiscal year runs from July 1 to June 30.

The variance is largely attributable to greater than expected general sales tax (+$146 million) and corporate tax (+$110 million) revenues. Individual income tax revenue exceeded projections by $6 million and “Other Revenues” exceeded estimates by $27 million.

MMB also provided an update on total collections during SFY 2022, which ended on June 30, 2022. Actual revenue topped earlier estimates by over $2.9 billion for the fiscal year.

In June, MMB projected a $12.1 billion surplus and $2.7 billion reserve for the next budget cycle (SFY 2024-25). We’ll get a full update on the expected surplus in December. Lawmakers will return in January 2023 with big decisions to make about that surplus and the future of our state.

NFIB has and will continue to fight for major cuts in small business taxes. We must make our state more competitive and attractive to small businesses and workers, or we risk a perpetually tight labor market, stagnant population, and losing more ground nationally and internationally.

Labor Force Still Down

The MMB report notes that, nationally, the labor force was ~100,000 smaller today than in February 2020. That’s reflected in NFIB’s data and the small business experience: finding workers, especially qualified workers, is harder than ever.

The distribution of worker gains and losses is not even among states. For instance, in August 2022, Minnesota’s labor force was about 82,000 less than February 2020.

Florida’s labor force, however, was about 411,000 larger than February 2020.

Minnesota’s oppressive tax and regulatory climate is driving workers and entrepreneurs to more hospitable climates.

More Near-Term Headwinds

Looking forward, MMB anticipates a three-quarter recession beginning in the current quarter. The state’s outside economic consultant – IHS Markit – expects real state GDP to decline 0.5% in 2023, a downward revision from its earlier +2.7% projection for 2023.

Similarly, IHS revised down its annual GDP growth projection for 2022 from 3.7% to 1.7%.

You can see the full quarterly update here: October 2022 Revenue and Economic Update (mn.gov).

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles