Topics:

March 2, 2022 Last Edit: June 5, 2025

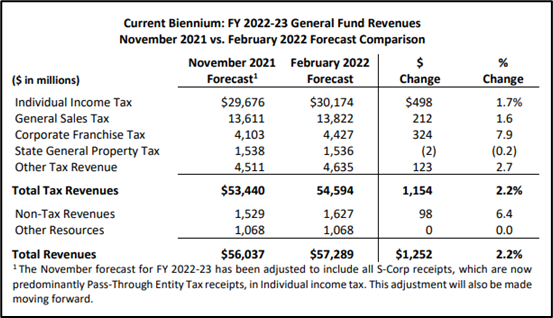

Up $1.5 billion since November

Minnesota Budget Surplus Grows to $9.25 billion

Without action this session, the surplus will grow to an astounding $15 billion in coming years.

It couldn’t be clearer that Minnesotans are badly overtaxed and major reform is needed now to give small businesses relief and spur economic growth.

Heading into 2022, the nonpartisan Tax Foundation ranked Minnesota’s business tax climate 6th worst in the country, worse than Illinois and by far the lowest in the upper Midwest.

Our neighbors in Iowa were the next worst business tax climate – 13th worst – but their state has taken a markedly different course this year.

In late February, Iowa enacted a major tax reform package that lowers the individual income tax to a flat rate of 3.9% and reduces their corporate rate from 9.8% (t-3rd highest, with Minnesota) to 5.5%. They also eliminated taxes on retirement income.

Around the country, other states are also using surpluses to pursue massive tax relief packages.

There have been several proposals for large scale tax reform this year, but so far Minnesotans are still waiting for relief.

The complete budget forecast is available here: MMB February 2022 Budget and Economic Forecast.

Read more about the original projected surplus here: State Announces Massive Budget Surplus (nfib.com).

Without action this session, the surplus will grow to an astounding $15 billion in coming years.

It couldn’t be clearer that Minnesotans are badly overtaxed and major reform is needed now to give small businesses relief and spur economic growth.

Heading into 2022, the nonpartisan Tax Foundation ranked Minnesota’s business tax climate 6th worst in the country, worse than Illinois and by far the lowest in the upper Midwest.

Our neighbors in Iowa were the next worst business tax climate – 13th worst – but their state has taken a markedly different course this year.

In late February, Iowa enacted a major tax reform package that lowers the individual income tax to a flat rate of 3.9% and reduces their corporate rate from 9.8% (t-3rd highest, with Minnesota) to 5.5%. They also eliminated taxes on retirement income.

Around the country, other states are also using surpluses to pursue massive tax relief packages.

There have been several proposals for large scale tax reform this year, but so far Minnesotans are still waiting for relief.

The complete budget forecast is available here: MMB February 2022 Budget and Economic Forecast.

Read more about the original projected surplus here: State Announces Massive Budget Surplus (nfib.com).

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

February 12, 2026

Arizona Small Business Owners Disappointed in Governor Hobbs’ Second Veto of Tax Conformity Bill

“…we’re urging Governor Hobbs to get serious, quit playing games with Arizonans pocketbooks…”

Read More

February 12, 2026

Elik, Turner File Legislation to Benefit Illinois Small Businesses

Legislation would grant Illinois small businesses more flexibility when timing investment decisions

Read More

February 11, 2026

NFIB Minnesota State Director Reacts to January’s Small Business Optimism Report

NFIB Minnesota State Director Jon Boesche reacts to January’s Small Business Optimism Report and the increase in uncertainty

Read More

February 11, 2026

Small Business Owners Thank SC House for Passing Key Property Tax Bill

NFIB is urging the Senate to pass the measure and ease the financial pressure on Main Street,

Read More