April 4, 2023

Minnesota Paid Family and Medical Leave Tax Swells to $1.5 Billion

On March 21, Minnesota budget officials finally released a long-awaited cost estimate for the 24-week Paid Family and Medical Leave (PFML) proposal (SF2/HF2).

In a highly unusual move, this bill traveled through the Minnesota Legislature’s committee process for two months without any official fiscal note – the document created by state agencies and used by legislators to evaluate the financial impact of legislation.

Digging into the PFML fiscal note details is revealing and may explain why the Walz Administration didn’t want to release it earlier in the process.

The fiscal note revealed some surprises, most notably that the program will cost about $1.3 billion and the 0.7% payroll tax will bring in about $1.5 billion in the program’s first year.

The tax, which can be split 50/50 between employer and employee, regulators can increase the tax every year if the program costs more than expected. The Senate capped the tax at 1.2% of payroll per year; there is no cap in the House version.

Does the math add up? Probably not.

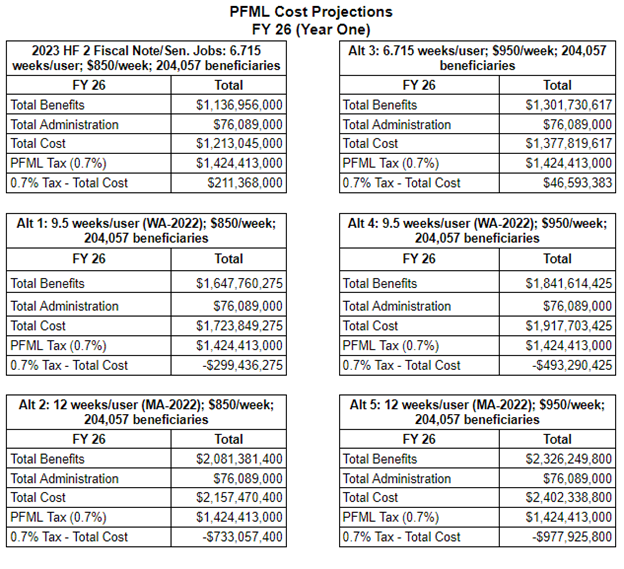

Budget officials offered a few key assumptions that inform us how they arrived at a total cost of $1.3 billion. They estimate:

– 204,057 people will use the program per year (less than 6% of the state’s workforce)

– the average person will receive $850 per week in wage replacement benefits

– program administration costs will run as high as $76 million per year with over 400 new state workers

To make that math work, the average program user would have to use only 6.7 weeks of the 24 weeks available to them every year.

Accepting the other assumptions at face value – not a sure thing – such a low average leave length is highly unlikely when workers are getting a very high level of pay to stay home.

In Washington, which offers 16-18 weeks total, the average leave length per customer was 9.5 weeks in 2022. In Massachusetts, which offers up to 26 weeks per year, the average leave length was 12 weeks (2022 MA PFML Annual Report). Both states offer a less generous weekly benefit than what’s proposed in Minnesota.

If the average leave length matches Washington or Massachusetts, the PFML program will run a deficit of $265 million to $700 million in the first year.

The deficit gets worse if the average payment estimate is too low.

Ultimately, the payroll tax may need to be as high as 1.4% – double the projected level – to sustain the program.

In late March, the Democratic-controlled Minnesota Senate made some changes to their version of the PFML bill. Some were modest improvements; some made the bill worse:

- Reduce the total leave duration from 24 weeks to 20 weeks per year;

- Exempt seasonal employees (those employed for 150 days or fewer/year);

- Reduce small employer (<30 employees) PFML tax liability by up to 30%

- Broaden definition of family for caregiving leave to anyone selected by a person in need of care or who needs to give care

- Eliminate 90 day waiting period before a new employee can take PFML leave

- More difficult process to offer private plan option

The House version retains the core elements of the original proposal: 24 weeks, no exemptions, no small business relief.

The bill has a few more committee stops before heading to floor votes.

Concerned? Take a few minutes to contact your state lawmakers here!

The chart below compares the cost of the program at the state’s estimated utilization and benefit payment levels to comparable figures from other states’ programs.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles