February 10, 2021

Crucial Small Business Tax Relief Bill Passes State Senate

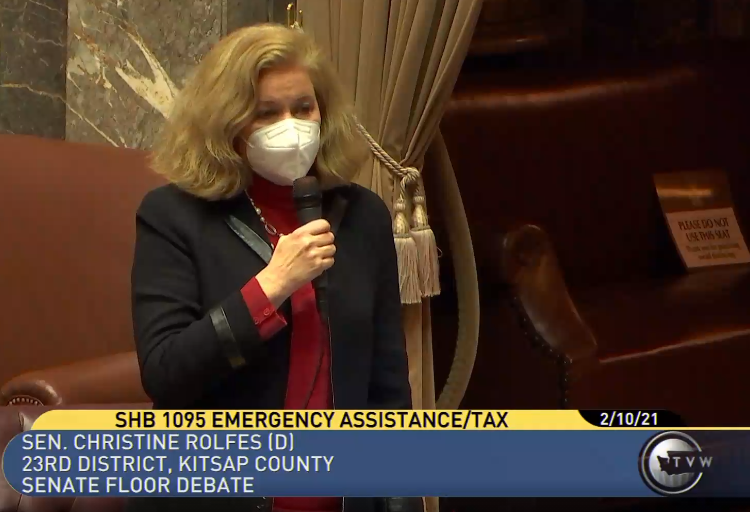

OLYMPIA, Wash., Feb. 10, 2021—Washington’s largest and leading small-business association thanked the State Senate for passing HB 1095 today. The legislation prevents the arrival of unexpected tax bills for assistance received through federal and state COVID-19 relief programs.

The State House of Representatives passed the bill on January 22. It now heads to Gov. Jay Inslee for signature.

“Protecting the more than 100,000 Washington businesses that relied upon a federal PPP loan or other government funding to continue sending paychecks to their employees, make rent and lease payments, and keep the lights on during this pandemic is among NFIB‘s highest priorities this legislative session,” said Patrick Connor, Washington state director for NFIB.

“NFIB thanks the bill’s prime sponsor, Rep. Amy Walen, and her bipartisan cosponsors, for introducing this important state agency requested legislation. We commend the state House and Senate for taking quick action to approve the bill. And, we urge Gov. Inslee to sign the bill as soon as it comes to his desk.”

HB 1095 would exempt small business assistance grants issued by government entities during a declared emergency, including PPP, EIDL advances, Working Washington Small Business Grants, etc., from state business and occupation (B&O) taxes.

In the Senate staff summary of public testimony on the bill, which Connor contributed to, it noted, “Over 100,000 businesses in Washington took a federal Paycheck Protection Program (PPP) loan or received a state grant of some kind … To try to retroactively tax these employers would be very difficult on those employers. Those dollars are not there to pay a retroactive tax. At least 5,000 businesses have closed in the state due to the pandemic. This bill will help protect remaining businesses. This legislation just makes good sense … This legislation helps businesses by taking an administrative and financial burden off their plate and allows the funds to be used exactly as intended to keep people employed and keep Washington business doors open.”

NFIB inquired about the potential taxability of these types of small business assistance programs with the Department of Revenue earlier this summer. The department indicated that existing law could be construed to make these types of grants taxable. The department worked with NFIB and others to craft a legislative solution to this problem.

Contact: Patrick Connor, Washington State Director, patrick.connor@nfib.org

or Tony Malandra, Senior Media Manager, anthony.malandra@nfib.org

Keep up with the latest Washington state small-business news at www.nfib.com/washington or by following NFIB on Twitter @NFIB_WA or on Facebook @NFIB.WA

###

For more than 77 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since our founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB Washington

Suite 505

711 Capitol Way South

Olympia, WA 98501

360-786-8675

NFIB.com/WA

Twitter: @NFIB_WA

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles