May 6, 2021

What is the Stepped-Up Basis and Why it Matters

Not everyone has heard of the Stepped-Up Basis, but to family-owned businesses across the nation, it’s crucial to their continued well-being. But right now, policy proposals in Washington threaten to end this important and longstanding policy.

What’s basis?

Basis refers to the value of a piece of property, used to determine how it will be taxed. If the property’s value increases or decreases, then the basis changes.

For example, imagine a farm that was purchased in 1985 for $1,000 an acre; the basis would be that same price, $1,000 per acre.

In 2020, the aging owner decides to sell the farm for $4,000 an acre. The basis is now $4,000 per acre, which means it increased by $3,000 since the initial purchase. The seller would pay capital gains tax on the increase in value of $3,000 per acre.

Is it changing?

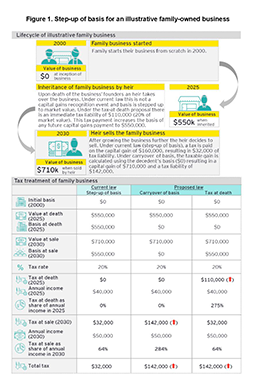

On April 28, 2021, President Biden unveiled the American Families Plan (AFP), a $1.8 trillion “human infrastructure” spending proposal. Among the plan’s many pieces is a promise to end the stepped-up basis and replace it with a different model, the “Carry-Over” Basis. With the stepped-up basis, the inherited property has its basis increased, or “stepped up” to match current market value.

For example: Take the same farm from above. Let’s say that instead of selling the farm in 2020, the owner passes away and their child inherits it. The stepped-up basis for the new owner would be $4,000 an acre, the value of the farmland at the time it was inherited. If the child decides to immediately sell the farm at $4,000 per acre, they would not pay any capital gains taxes because the basis is the same as it was when they inherited the property. If they waited until 2030 to sell the farmland and it sold at $4,500 per acre, they would pay capital gains taxes on the increase in value since 2020 when they inherited it: $500 per acre.

But when the carry-over basis is used, things play out differently. When the owner’s child inherits the farm in 2020, the basis remains at $1,000 per acre, as the price was when the farm was bought in 1985. If the child sells the farmland right away for its market value of $4,000 per acre, they will pay capital gains tax on the increase in basis, $3,000 per acre. If they waited until 2030 to sell and sell at $4,500 per acre, they would pay capital gains on the combined increase in basis value: capital gains taxes on $3,500 per acre.

What happens if the stepped-up basis goes away?

In other words, a move to tax policy using the carry-over basis is a new additional death tax that happens when someone chooses to sell their inherited property. Under the stepped-up basis, if a family member passes away, no capital gains tax is imposed. Repealing it would be a significant tax increase on family-owned businesses.

Many family-owned businesses, such as farms, have very little cash that’s liquid or on-hand since their value comes from property or equipment. If hit with a large capital gains tax bill, many of these business owners would be forced to downsize or even sell their business just to pay.

The Administration’s proposed move to the carry-over basis also requires owners to track the appreciation of their assets, a time-consuming and complex process. Most small business owners don’t have accountants and lawyers on staff, meaning the time and money required to comply with this new rule would disproportionately harm small businesses when compared to their larger competitors. The AFP also contains proposals to increase the capital gains tax and the top marginal income tax.

If you’re concerned about your taxes going up, then take action by letting your U.S. Senators and Representative know that you oppose removing the stepped-up basis.

You also can read more about the most important tax relief news by clicking here.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles