March 2, 2021 Last Edit: May 8, 2025

How Would A $15.00 Minimum Wage Affect Your State?

(click to enlarge)

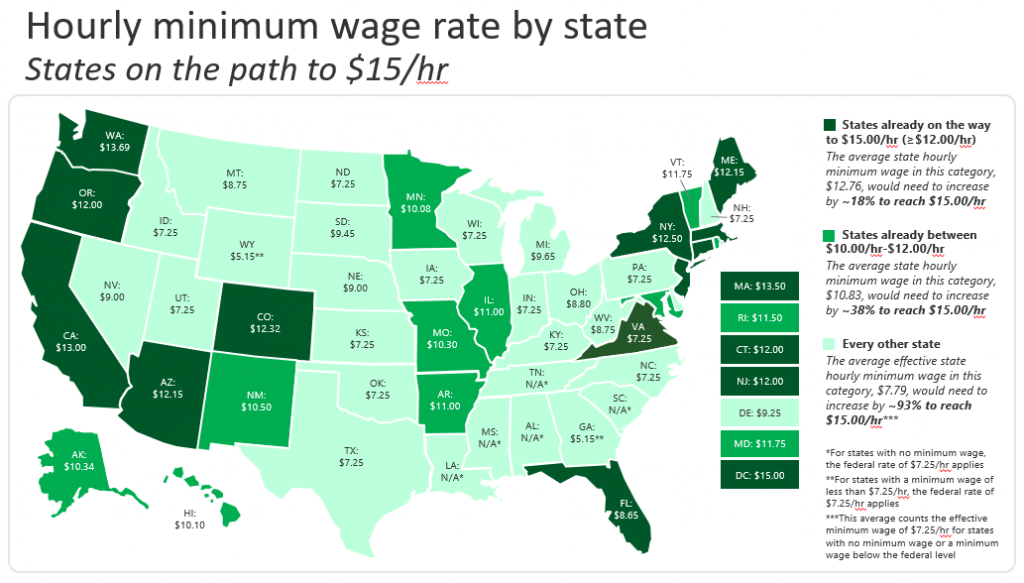

Congress is currently deliberating a raise of the federal minimum wage from $7.25 an hour to $15.00 an hour – more than doubling the current amount. NFIB research shows that such an increase would cost the economy 1.6 million jobs, primarily at small businesses. While many attempts to raise the federal minimum wage have been defeated in the past decade, it’s a different story in many state capitals.

Twenty-five states as well as the District of Columbia have increased or will increase their minimum wage in 2021. Of them, 10 are modestly raising their minimum wage to account for inflation and the other 16 have passed more substantial increases.

LOW-IMPACT STATES

These states already have high minimum wages. Their minimum wage is already over $12.00 per hour, or they intend to increase their minimum wage to $15.00 or close to it in the next few years. Small businesses in these states will experience much less if any increase in labor costs from a $15 per hour federal minimum wage increase because it will be a marginal increase if at all on the state minimum wage.

The cost of living tends to be higher in these states and increases in minimum wage have been implemented by state legislators over the years, bringing increases in the cost of labor along with them.

NFIB member Gianni Cracchiolo of New York testified before Congress this month that the increases in minimum wage were ruinous for his New York bakeries, causing them to close after 37 years.

“At some point, people who are used to paying a certain price for a loaf of bread are going to start to complain, and that is exactly what they did… Customers began to shop for their baked goods at supermarkets and large box stores like Target and Walmart. These stores offered lower quality versions of our products at a price point that customers were comfortable with.” The competition from enormous corporations eventually destroyed Gianni’s small business, a story that has played out in countless small businesses across the US.

Low-Impact States include Arizona, California, Colorado, Connecticut, the District of Columbia, Florida, Illinois, Maine, Maryland, Massachusetts, New Jersey, New York, Virginia, and Washington State.

MEDIUM- IMPACT STATES

These states either have a minimum wage that is currently between $10.00 and $12.00 per hour, or have passed laws that will increase minimum wage to levels below $15.00. A $15.00 federal minimum wage mandate would be a significant shock to small businesses in these states.

Medium-Impact States include Alaska, Arkansas, Delaware, Hawaii, Michigan, Missouri, Nevada, New Mexico, Oregon, Rhode Island, and Vermont.

HIGH- IMPACT STATES

These states currently have a minimum wage at or near the current federal level of $7.25 an hour, with no pending increases. For such states, a $15.00 minimum wage would be an increase of over 100%. Such a massive increase to labor costs would be catastrophic to many small businesses in those states.

Most states are in this category and would bear the greatest burden if the federal minimum wage is dramatically increased. Few of these states are likely to pass minimum wage increases themselves.

High-Impact States include Alabama, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Minnesota, Mississippi, Montana, Nebraska, New Hampshire, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, West Virginia, Wisconsin, and Wyoming.

Small business owners from across the country have spoken to NFIB about how a minimum wage increase would- or already has- adversely affect their business. “On the first increase, we, like many small businesses, will change our business model and eliminate 8 of our 17 jobs… We also recognize that the wages of our experienced staff will be devalued and unfortunately, because of the associated costs to our business, we won’t be able to make that right,” said Kelly, who runs a hot dog business in Zanesville, Ohio.

“My employees have full medical/dental/vision benefits along with a full 401k profit-sharing plan with a 4% dollar for dollar match. We also offer many other benefits including life insurance, disability insurance, and generous paid time off,” said Patrick, who owns a truck dealership in Clarion, Pennsylvania.

“All of these extra things that we offer to them will be jeopardized if the federal government enacts a $15 per hour minimum wage mandate... that forces us as owners to take it away simply because there isn’t enough money to pay the higher wage and keep the benefits.”

NFIB is advocating for small businesses in each of the nation’s 50 state legislatures as well as the federal government, fighting for pro-small business policies. Minimum wage increases disproportionately harm small businesses who have far more difficulty absorbing the increased costs of labor than their larger competitors. Our nationwide efforts have helped to defeat many statewide and national attempts to raise minimum wages.

Your voice and stories about the impact of minimum wage hike mandates will help legislators understand the potential small business job losses and closures on the horizon if a federal minim wage hike becomes law. Consider emailing your members of Congress with your story today. You can also learn more about NFIB’s work in your state at NFIB.com/nfib-in-my-state.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles