October 30, 2025

Vermont Ranks 42nd Overall, 38th for Business Tax Climate

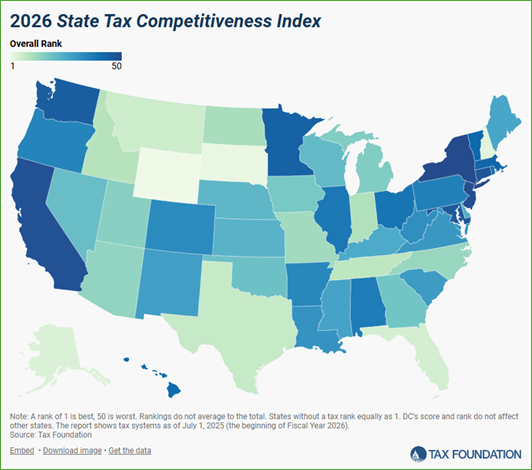

At the end of October, the Tax Foundation released its 2026 Tax Competitiveness Index and, despite a two spot improvement, Vermont still ranks in the bottom ten among all states.

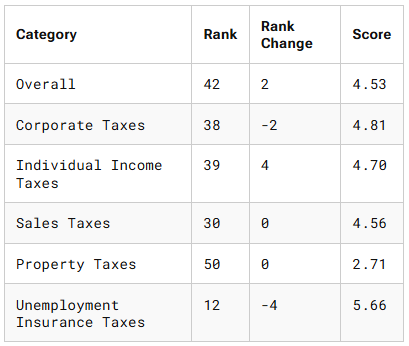

The Tax Competitiveness Index examines key components of each state’s tax system and compares them to the rest of the country. Vermont ranked 42nd out of 50, and finished comfortably in the bottom half in nearly every major tax category:

From the Tax Foundation’s Vermont profile:

“Vermont levies all major categories of taxation with comparatively high rates and an overall uncompetitive tax structure. As a result, the tax code makes the state both nationally and regionally uncompetitive, particularly compared to neighboring low-tax New Hampshire.”

The Index specifically calls out Vermont’s nation-leading property tax burden, high top individual and corporate rates, and high estate tax. All of these factors contribute to an economic climate that makes it harder for small businesses to succeed and grow, for the state to attract and keep workers, and for ordinary people to afford living here.

NFIB VT supports both broad based and targeted tax relief aimed at reducing the overall tax burden, helping small businesses invest and grow, and making Vermont a more affordable place for everyone.

About the Tax Foundation. The Tax Foundation is a nonprofit, nonpartisan organization dedicated to advancing simplicity, transparency, neutrality and stability in local, state, and federal tax systems.

The State Tax Competitiveness Index is intended to gauge how each state’s tax system compares across a range of factors and evaluate the structure their tax systems.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles