Topics:

October 30, 2023 Last Edit: June 5, 2025

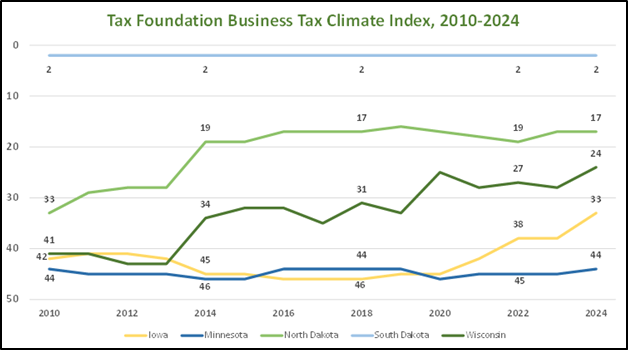

Minnesota’s business tax climate ranks in bottom 10 – again.

2024 Business Tax Rankings: Minnesota Fails Again

This session, Minnesota Democrats – who have complete control of state government – went on a spending spree. Fueled by a massive $18 billion budget surplus, Governor Walz and DFLers in the Minnesota Legislature increased state spending by nearly 40% and raised taxes by another $10 billion over the next years.

Meanwhile, neighboring states have taken a different approach.

In Iowa, where Republicans hold the governor’s office and state legislature, lawmakers have dramatically reduced taxes on corporate, individual, and retirement income. As a result, Iowa has pulled itself out of the bottom ten in the Business Tax Climate Index and is steadily moving up the ladder as tax reductions take effect.

Divided government in Wisconsin has produced less dramatic results than Iowa but the state’s ranking has continued to improve over the past decade.

The Tax Foundation analysis is based on objective metrics, including corporate and individual tax rates, sales taxes, property taxes, and unemployment insurance taxes. Minnesota ranks in the bottom half of states in every category.

CNBC’s Top States for Business rankings include non-business and subjective factors such as voting rights, worker protections, and social issues. Objective business factors like the cost of doing business and business friendliness are given less weight than these subjective factors.

This session, Minnesota Democrats – who have complete control of state government – went on a spending spree. Fueled by a massive $18 billion budget surplus, Governor Walz and DFLers in the Minnesota Legislature increased state spending by nearly 40% and raised taxes by another $10 billion over the next years.

Meanwhile, neighboring states have taken a different approach.

In Iowa, where Republicans hold the governor’s office and state legislature, lawmakers have dramatically reduced taxes on corporate, individual, and retirement income. As a result, Iowa has pulled itself out of the bottom ten in the Business Tax Climate Index and is steadily moving up the ladder as tax reductions take effect.

Divided government in Wisconsin has produced less dramatic results than Iowa but the state’s ranking has continued to improve over the past decade.

The Tax Foundation analysis is based on objective metrics, including corporate and individual tax rates, sales taxes, property taxes, and unemployment insurance taxes. Minnesota ranks in the bottom half of states in every category.

CNBC’s Top States for Business rankings include non-business and subjective factors such as voting rights, worker protections, and social issues. Objective business factors like the cost of doing business and business friendliness are given less weight than these subjective factors.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

January 12, 2026

NFIB Urges Legislature to Reject Governor Hobbs’ Tax Conformi…

“In turning a blind eye to Arizona’s small business owners, the Governor’s…

Read More

January 8, 2026

NFIB Commends New Hampshire House’s Tax Vote

House passage of HB 155 continues a decade of bipartisan reform aimed at im…

Read More

January 7, 2026

NFIB Commends Gov. Scott’s Urgent Call for Property Tax…

“Main Street is struggling under the weight of high business taxes, high pr…

Read More

January 7, 2026

NFIB Sets 2026 Legislative Priorities for Georgia Small Busines…

Tax relief, rising insurance costs and regulatory transparency will be on t…

Read More