Jobs Report

The NFIB Research Foundation has collected Small Business Economic Trends data with quarterly surveys since 1974 and monthly surveys since 1986. Survey respondents are drawn from NFIB’s membership. The survey was conducted in January 2026 and reflects a random sample of 10,000 small-business owners/members.

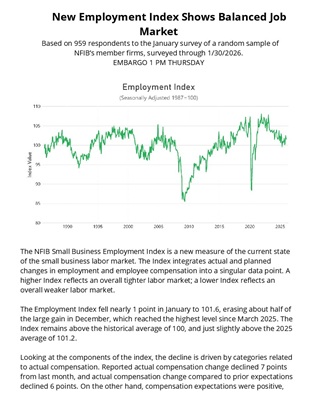

NFIB Jobs Report: New Small Business Employment Index Shows Balanced Job Market

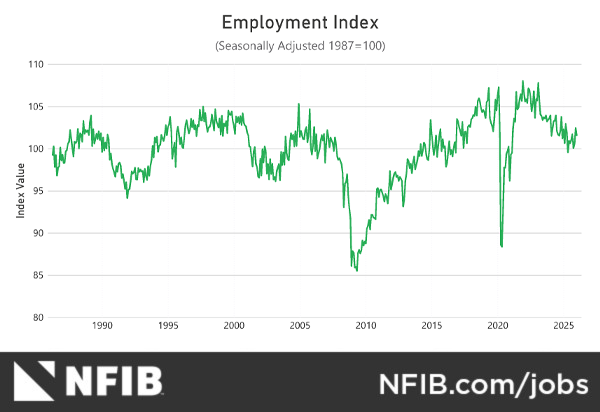

NFIB’s January Jobs Report includes the launch of the new Small Business Employment Index, which measures the current state of the small business labor market. The new index integrates actual and planned changes in employment and employee compensation into a singular data point. A higher Index reflects an overall tighter labor market; a lower Index reflects an overall weaker labor market.

Main Street continues to search for qualified workers for open positions. Owners reported increased wages over the last three months, alongside plans to increase them in the next three months as well.

– Bill Dunkelberg, NFIB Chief Economist

The Employment Index fell nearly 1 point in January to 101.6, erasing about half of the large gain in December, which reached the highest level since March 2025. The Index remains above the historical average of 100, and just slightly above the 2025 average of 101.2.

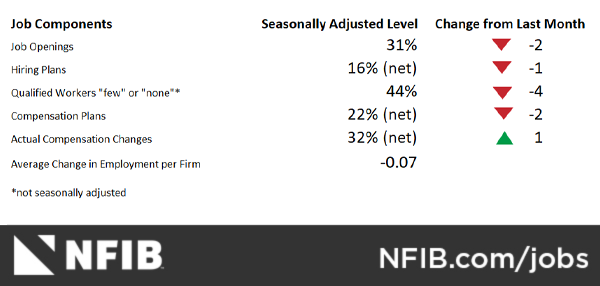

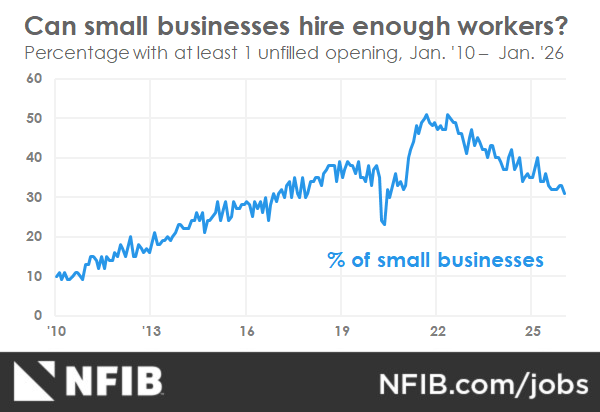

In January, 31% (seasonally adjusted) of small business owners reported job openings they could not fill in January, down 2 points from December. Unfilled job openings remain above the historical average of 24%. Twenty-five percent have openings for skilled workers (down 3 points), and 10% have openings for unskilled labor (unchanged).

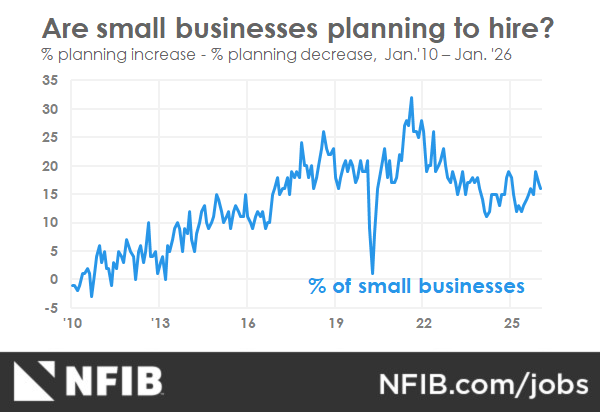

A seasonally adjusted net 16% of owners plan to create new jobs in the next three months, down 1 point from December.

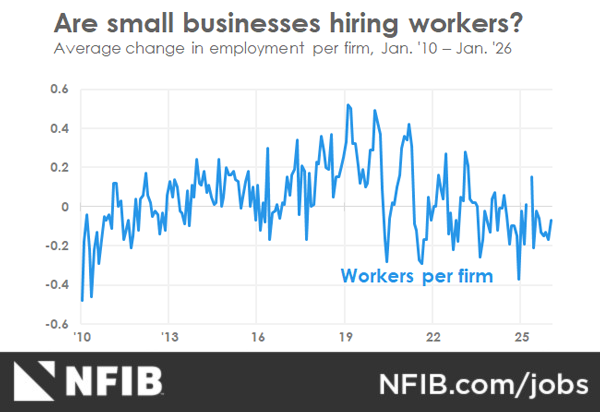

Overall, 50% of owners reported hiring or trying to hire in January, down 3 points from December and the lowest reading since May 2020. Forty-four percent of owners (88% of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill (down 4 points). Twenty-five percent reported few qualified applicants (unchanged), and 19% reported none (down 4 points).

In January, 16% of small business owners cited labor quality as their single most important problem, down 3 points from December. This is the third consecutive month that labor quality reported as the single most important problem, has declined.

Labor quality reported as the single most important problem was the highest in the construction, manufacturing, and professional services industries, and lowest in wholesale and finance. Thirty percent of small businesses in the construction industry reported labor quality as their single most important problem, 14 points higher than for all firms. Only 2% of businesses in the finance industry reported labor quality as their single most important problem. Labor costs reported as the single most important problem by small business owners, remained at 9%.

Seasonally adjusted, a net 32% of small business owners reported raising compensation in January, up 1 point from December. A net 22% (seasonally adjusted) plan to raise compensation in the next three months, down 2 points from December.

Click here to view the entire NFIB Jobs Report

The full Small Business Economic Trends report will be released on Tuesday, February 10th.