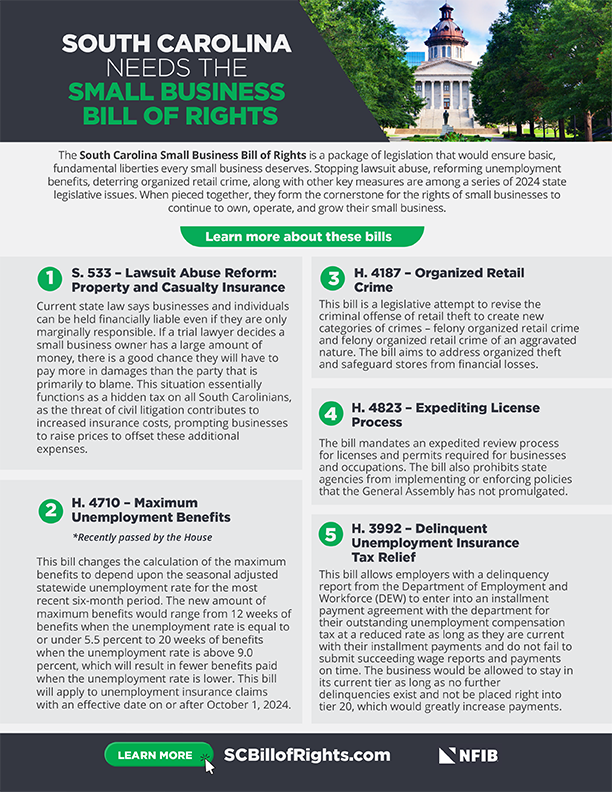

The South Carolina Small Business Bill of Rights is a package of legislation that would ensure basic, fundamental liberties every small business deserves. Stopping lawsuit abuse, reforming unemployment benefits, deterring organized retail crime, along with other key measures are among a series of 2024 state legislative issues. When pieced together, they form the cornerstone for the rights of small businesses to continue to own, operate, and grow their small business.

South Carolina Small Business Bill of Rights

South Carolina Small Business Bill of Rights

South Carolina Needs The Small Business Bill of Rights

Learn More About These Bills:

S.535 – Lawsuit Abuse Reform: Property and Casualty Insurance

Current state law says businesses and individuals can be held financially liable even if they are only marginally responsible. If a trial lawyer decides a small business owner has a large amount of money, there is a good chance they will have to pay more in damages than the party that is primarily to blame. This situation essentially functions as a hidden tax on all South Carolinians, as the threat of civil litigation contributes to increased insurance costs, prompting businesses to raise prices to offset these additional expenses. (The measure failed to pass in the Senate)

H. 4710 – Maximum Unemployment Benefits

*Recently passed by the House

This bill changes the calculation of the maximum benefits to depend upon the seasonal adjusted statewide unemployment rate for the most recent six-month period. The new amount of maximum benefits would range from 12 weeks of benefits when the unemployment rate is equal to or under 5.5 percent to 20 weeks of benefits when the unemployment rate is above 9.0 percent, which will result in fewer benefits paid when the unemployment rate is lower. This bill will apply to unemployment insurance claims with an effective date on or after October 1, 2024.

H. 4187 – Organized Retail Crime

This bill is a legislative attempt to revise the criminal offense of retail theft to create new categories of crimes – felony organized retail crime and felony organized retail crime of an aggravated nature. The bill aims to address organized theft and safeguard stores from financial losses.

H. 4823 – Expediting License Process

The bill mandates an expedited review process for licenses and permits required for businesses and occupations. The bill also prohibits state agencies from implementing or enforcing policies that the General Assembly has not promulgated.

H. 3992 – Delinquent Unemployment Insurance Tax Relief

This bill allows employers with a delinquency report from the Department of Employment and Workforce (DEW) to enter into an installment payment agreement with the department for their outstanding unemployment compensation tax at a reduced rate as long as they are current with their installment payments and do not fail to submit succeeding wage reports and payments on time. The business would be allowed to stay in its current tier as long as no further delinquencies exist and not be placed right into tier 20, which would greatly increase payments.