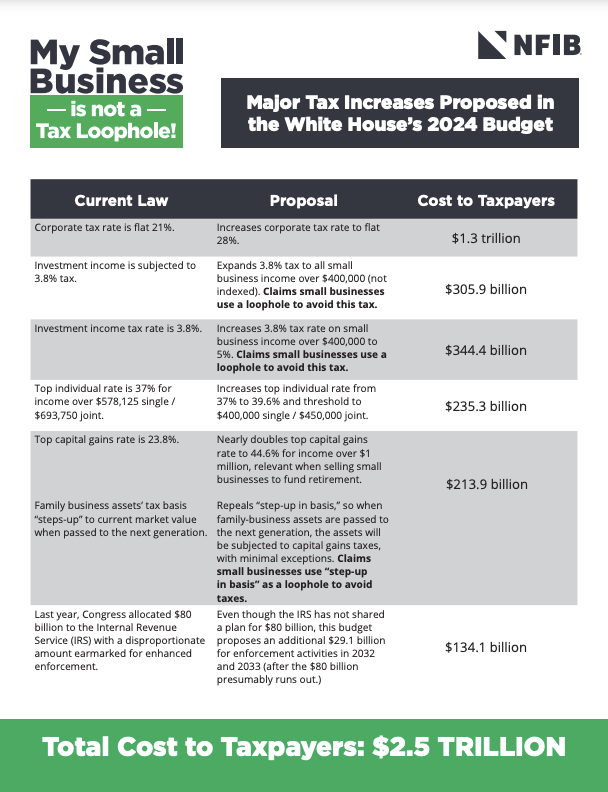

With surging inflation, high gas prices, and workforce shortages, small businesses have suffered enough. Despite being wrongly called “tax loopholes” by some members of Congress, NFIB members successfully fought the Small Business Surtax throughout 2022. Due to their advocacy, it was ultimately removed from the Inflation Reduction Act of 2022.