Affordability: What does that mean?

Affordability: What does that mean?

December 16, 2025

Affordability: What does that mean?

“Affordability” is gearing up to be the top 2026 mid-term election issue that will dominate the airwaves. But what exactly is that? What does it mean? What are the politicians seeking office going to promise? Affordability is dependent on two things: the prices of goods and services, and the income available to pay those prices. Something is considered “affordable” if you can pay for it, whether in cash or credit. When credit is involved, the user agrees to a series of future payments, hoping that the income needed for them will materialize. If inflation causes prices to rise faster than your income grows, your purchasing power decreases and affordability is reduced. If the economy experiences a recession, your ability to make payments could be reduced if prices remain the same. For some politicians, promising price controls and/or income supplements are popular tools to address “affordability.”

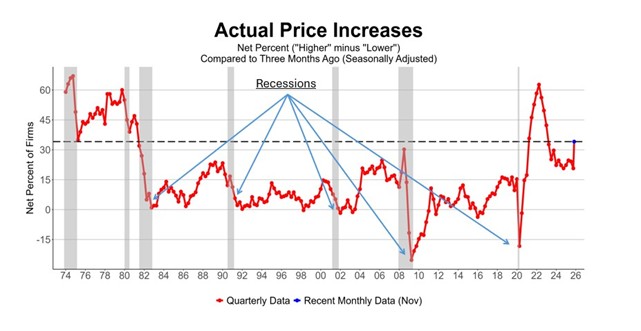

The prices we pay are ultimately set by businesses including roughly 23 million small businesses. Chart 1 shows the net percent of small firms that reported raising their selling prices quarterly since 1973.

What makes prices fall? Chart 1 tells part of the story: during recessions, there is a decline in spending that leaves goods and services sitting on the shelf, unsold. Producers (and workers) lower their prices to induce someone to buy. That’s a deficiency in demand.

What about supply? A good example is the market for oil and fuels. When oil producers increase the quantity of oil they release into the market, oil prices fall, as does the cost of gasoline, etc. When oil is in short supply (typically due to geopolitical factors), gas prices rise because oil prices are bid up. This principle applies to any good or service, including the supply of labor.

Firms are always looking for ways to make their products cheaper and increase sales (and profits). This involves investing in new equipment and employee training, which is currently growing at a 9% annual rate. Better tools and training raise worker productivity, increasing the supply of goods and services and lowering their cost.

If a person’s income grows faster than prices, more things become affordable and less affordable if incomes grow slower than prices. For some consumers everything is affordable but for most of us, lots of stuff is unaffordable. However, if our purchasing power grows faster than prices, life continues to improve. In 2025, U.S. personal incomes increased about 5%, while the CPI (consumer price index) rose by less than 3%.

So, what are politicians complaining about when they say the big issue is “affordability”? Incomes are rising faster than prices, and firms are investing heavily to produce more at lower costs. Inflation is now at 3%, well below income growth. Stock markets are at record levels, and market participation is at historic highs. Gasoline prices are at their lowest in four years. What people are really complaining about is the 21% increase in prices since 2022. House prices, food prices, and insurance prices have remained elevated, all contributing to many products being “unaffordable” to many consumers and businesses. These prices remain elevated, and consumers are waiting for the economy to display solid evidence that conditions have changed. In the meantime, we will need continued lower inflation and rising incomes for an extended amount of time for affordability to connect with more and more consumers.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles