NFIB Releases New Ads Thanking California Reps. David Valadao, Young Kim, and Ken Calvert for Making the 20% Small Business Tax Deduction Permanent

NFIB Releases New Ads Thanking California Reps. David Valadao, Young Kim, and Ken Calvert for Making the 20% Small Business Tax Deduction Permanent

August 25, 2025

New Radio and Digital Ads Start This Week in California Thanking Reps. Valadao, Kim, and Calvert for Stopping Massive Tax Hike on Small Business Owners

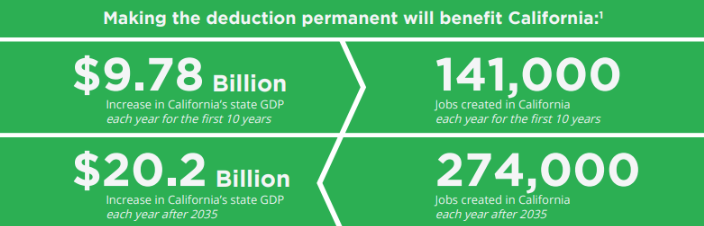

SACRAMENTO, Calif., (Aug. 25, 2025) – The National Federation of Independent Business (NFIB), the nation’s leading small business advocacy organization, today released new radio and digital advertisements thanking Rep. David Valadao (CA-22), Rep. Young Kim (CA-40), and Rep. Ken Calvert (CA-41) for taking action to make the 20% Small Business Tax Deduction permanent.

The multi-platform campaign, which represents a continuation of NFIB’s multi-year advocacy effort in support of the Small Business Deduction, is running throughout California’s 22nd District, 40th District, and 41st District. The ads thank Reps. Valadao, Kim, and Calvert for voting to make the deduction permanent and for stopping a massive tax hike on small business owners.

You can listen to the radio ads and view the digital ads here, here, and here.

“Making the 20% Small Business Tax Deduction permanent is a big win for Main Street,” said NFIB California State Director John Kabateck. “By voting to protect this tax relief, Representatives David Valadao, Young Kim, and Ken Calvert have given small business owners in California the certainty they need to grow their operations, continue creating jobs, and give back to their communities. NFIB appreciates their leadership in standing up for small businesses in our state.”

The 20% Small Business Tax Deduction, first passed as part of the 2017 Tax Cuts and Jobs Act, allows small business owners to deduct up to 20% of their qualified business income. This critical provision helps level the playing field between small firms and large corporations.

###

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles