February 13, 2026

New Report Shows Growing Divergence in State Income Tax Rates

The tax hike proposals are piling up in Montpelier, and a new report highlights how major income tax increases and other money grabs aimed at small businesses would make Vermont even more of a national outlier.

In early February, the nonpartisan Tax Foundation – an organization dedicated to advancing sound tax policy – released a new report on how state income tax rates have changed in the past fifty years: State Income Tax Trends: The State Income Tax Divergence.

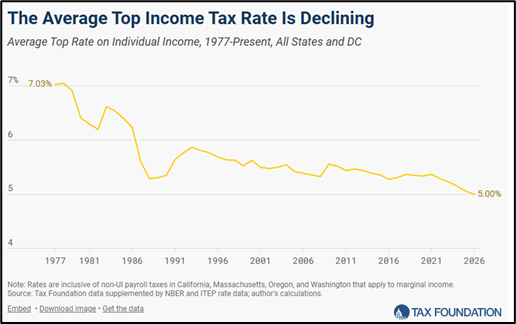

The Tax Foundation finds the average top income tax rate at the state level fell from 7.03% in 1977 to 5% in 2026.

Where is Vermont in All This? Vermont first adopted a personal income tax in 1931. According to a Vermont Historical Society report, the income tax was intended to replace the state highway and education taxes, intangibles tax, and general statewide property tax.

The state overhauled its personal income tax in the 1960s, creating a progressive tax structure that set a state tax liability based on a percentage of federal tax liability. According to a 1997 analysis commissioned by the Vermont Business Roundtable, the state tax liability ranged between 21% and 34% of federal tax obligation between 1968 and 1996.

Finally, in 2002, the state adopted the modern version of its income tax based on an adjusted gross income formula. According to the Vermont Joint Legislative Fiscal Office (LFO), the rates ranged from 3.6% to 9.5%. Those rates were gradually shaved down a bit to the current rates that range from 3.35% to 8.75%.

Vermont’s current top personal income tax rate starts at $260,225 in income for single filers and $323,825 for married filers.

This ranks as the 8th highest top personal income tax rate in the country, but it applies at a much lower income level than five other states ahead of it (including CA, HI, MA, NJ, NY).

The high personal income tax burden contributes to Vermont’s poor overall ranking (42nd of 50) in the Tax Foundation’s State Tax Competitiveness Index.

Where Are State Tax Rates Going? Like the Limbo, most states are going lower. The shift away from high state income tax rates came in waves over the past five decades.

10%+: The number of states with top income tax rates at or above 10% declined from 16 in 1977 to just 1 (CA) by 2017. Today, just six states have top rate at or above 10%.

7% to 10%: Ten states had top rates in this range in 1977. As states moved to cut top rates in the 1980s and early 1990s, that number grew to 19 by 1993. Today, only five states – including Vermont – have top rates in this range.

5% to 7%: Nine states had top rates in this range in 1977. That number grew to 18 in 1988 and declined to 12 by 2026.

In the early 2020s, many states found themselves flush with cash due to higher than expected revenue collections and large infusions of federal pandemic aid. Many used structural surpluses to drop their top rates below 5%.

Above 0% to 5%: This range held steady until the early 2020s, with seven to ten states in this range at various points between 1977 and 2021. Today, 20 states have top rates in this range.

No State Income Tax: This number has remained relatively constant over the past fifty years, ranging from a high of 10 states in the 1980s to 8 states today.

The last state to adopt a broad personal income tax was Connecticut, in 1991. Intended to stabilize state revenue during the early 1990s recession and offset a reduction in sales and other taxes, the Nutmeg State imposed a flat rate of 4.5%. Today, Connecticut has seven personal income tax brackets ranging from 3% to 6.99%.

Many view Connecticut’s decision to have been an abysmal failure and cautionary tale: state spending continued to grow, poverty rates increased, and the state lost jobs.

Why Does This Matter to Vermont? Top personal income tax rates matter to small businesses since most pay taxes on their personal tax returns. Ninety-two percent (92%) of all businesses in Vermont are small, pass through businesses with zero to 20 employees.

As the Tax Foundation reports, “almost invariably shows a negative relationship between income tax rates and gross domestic product (GDP).”

State tax burdens also influence where people decide to live and are a key factor in domestic migration. And population trends play a role in economic growth. Without more consumers and more workers, businesses struggle to grow, state revenue can stagnate, the tax burden per capita can grow, and economies lag.

Vermont’s population has been slow growing for decades and barely treading water since 2020. According to US Census data, Vermont grew by just 1,600 (0.2%) between 2020 and 2025.

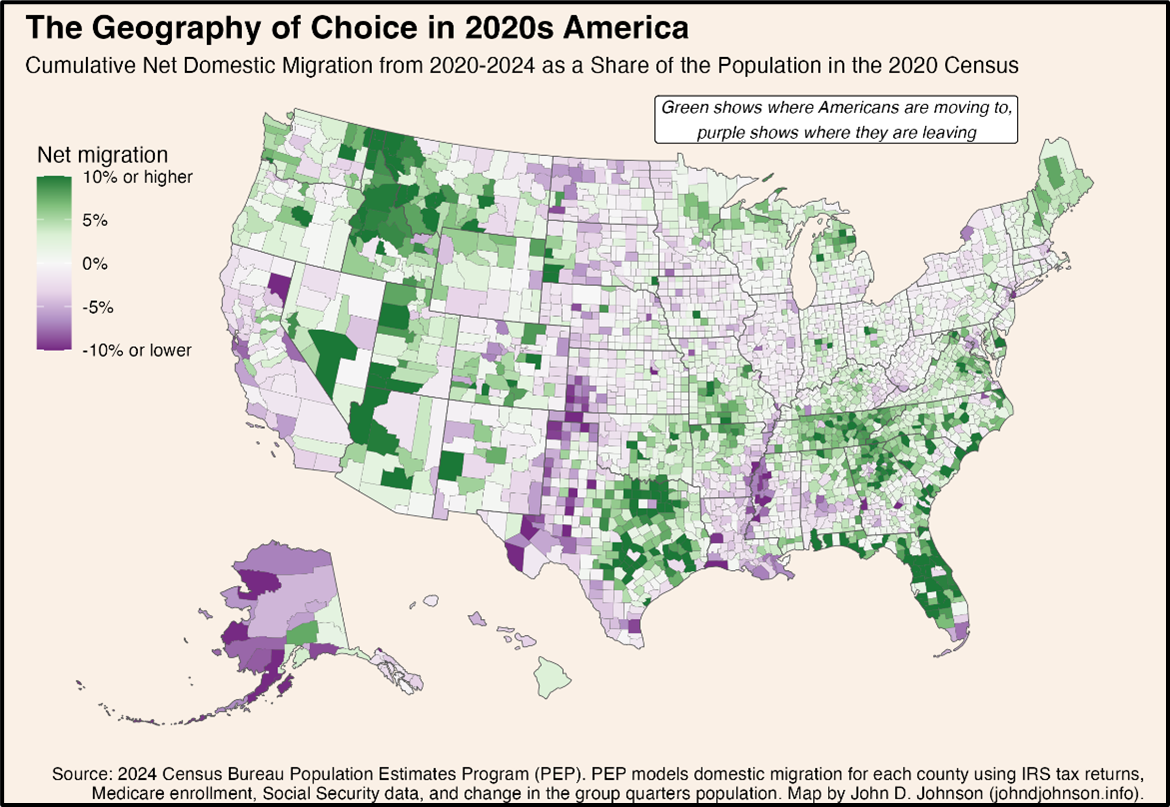

Meanwhile, the Tax Foundation finds that states with lower income tax rates have been the biggest winners in the post-pandemic population migration.

And a Marquette Law School analysis of domestic migration from 2020 to 2024 confirms that low-tax states are the clear preference for those picking up stakes (green = net gain, purple = net loss):

Taxes are not the only factor in domestic migration. The migration map also aligns with states that receive favorable grades on housing affordability and homebuilding.

In addition to taxes and housing, other key considerations include medical costs, weather, outdoor recreation, and social capital.

Vermont’s outdoor recreation and natural beauty are nearly unparalleled on the East Coast and its social capital ranks high by some measures. The migration map shows many Americans are willing to move to states with colder winter climates.

So, what’s left? Certainly housing, medical costs, and tax burden are all known problems in Vermont.

The Green Mountain state has the 8th highest state and local tax burden in the country and the highest health insurance premiums for individuals and families in the country. The UVM Medical Center, the state’s dominant hospital system, is regarded by some as one of the most expensive in the country.

How Can Vermont Change Course? As always, the first rule of holes is to stop digging.

The plethora of tax hike proposals will definitely hurt many small business owners and would likely, in the long run, exacerbate other key problems facing Vermonters.

Lawmakers should look to other states that have established contingent relief funds that divert surplus revenues into accounts that trigger broad tax relief when thresholds exceed statutory levels.

On healthcare, House Bill 585 is a serious attempt at reforming the state’s broken health insurance system. One of the key ways lawmakers can bring down costs across the board is by increasing the share of those with commercial health insurance enrollment.

Commercial coverage pays higher reimbursement for medical services than government programs, which will reduce the shift in medical costs onto those with private insurance.

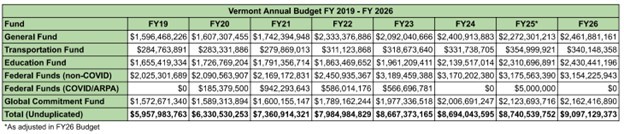

On spending, Vermont cannot sustain the rapid growth of the last seven years.

Source: VT Legislative Joint Fiscal Office

As seen in the chart above, from FY19 to FY26:

– Total (unduplicated) Spending increased by 53% (+$3.1 billion)

– General Fund Spending increased by 54% (+$865 million)

– Education Fund Spending increased by 47% (+$775 million)

Vermont’s problems are solvable, but more Vermont lawmakers need to let go of rigid ideological preconceptions to find the right solutions.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles