August 4, 2025

VT should explore other options to stabilize health insurance costs for individuals, small businesses.

Despite Vermont generally ranking among the healthiest states in the country and having a high rate of health coverage, Vermont’s health insurance market is struggling and premiums are rising.

This is a result of many factors, including state and federal policy choices and many of the same demographic challenges that contribute to the broader affordability crisis in the state.

There is no silver bullet to fix health care at the state level. Layers of state and federal laws, rules, and regulations, along with the bureaucratic business processes of insurers and hospitals, put the problems beyond a simple fix.

In Part I, we looked at trends and reasons why health insurance is getting more expensive. In Part II, we looked at one no-cost change Vermont can make to give small businesses another option.

In Part III, we’ll look at two potentially low-cost options Vermont lawmakers could pursue to bring stability to the individual market and offer new options to small employers.

Individual Market Premium Spikes

The Individual Health Insurance Market serves individuals and families who do not get health insurance through the government or their employer. It is an important source of coverage for many entrepreneurs, small business owners, and their employees.

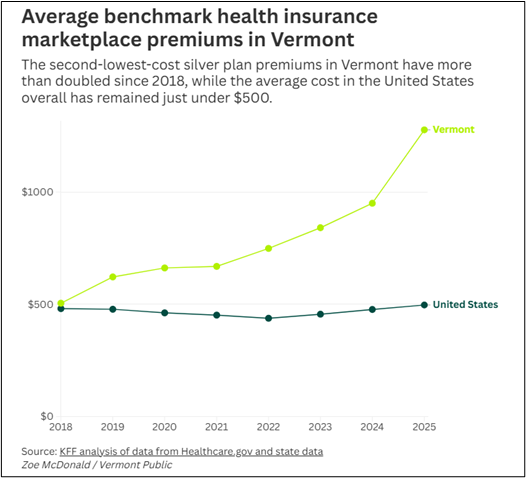

As discussed in Part I, Individual Market premiums have skyrocketed in Vermont. Since 2018, the average “benchmark” premium – the second lowest cost silver plan – has increased by more than 150%.

When the Affordable Care Act (ACA) was implemented and state health insurance markets were redesigned, health plans were grouped into “metal” tiers to denote their cost and benefit structure. For instance, platinum plans were very high cost plans that offered comprehensive benefits, broad access to physicians, and low deductibles. On the other end, bronze plans were low premium, slimmer benefits, narrower physician networks, and had very high deductibles.

Silver plans were intended to strike a balance between affordability, benefits, and access. Silver plans typically come with deductibles of around $3,500 to $4,000 for an individual and $7,000 to $8,000 for a family. Once the deductible is met, the insurer pays 70% of in-network medical costs. The policyholder is responsible for the premium, the deductible, and 30% of costs beyond the deductible.

Despite the original intention for silver plans, their cost has skyrocketed in Vermont over the past eight years. In 2018, the second-lowest cost silver plan premium was on par with the national average. Today, it is far more than double:

Source: Vermont Public Radio, 7/30/2025

ACA subsidies help reduce the cost of premiums, but only for those making below 400% of the federal poverty level (2025: individuals making up to $62,600 and families of 4 up to $128,600).

Additionally, Vermont offers state-based premium subsidies for those making les than 300% of the Federal Poverty Level. The state-based assistance averages $35 per month.

Since 2021, enhanced federal premium tax credits have helped reduce costs for those making above 400% FPL and contributed to an increase in Individual Market enrollment. The subsidies cap the premium cost at 8.5% of household income for those above that level.

As a result, the actual cost of Individual Market Plans is well below the sticker price for most people.

However, the enhanced federal subsidies are set to expire at the end of 2025 and have not been reauthorized by Congress – further adding to the pressure on states to adopt policies and programs that buffer consumers from major premium shock.

Federal-State Reinsurance Partnership

Beginning in 2016, many states across the country began to see drastic Individual Market premium spikes. As premiums increased people dropped their coverage, and the Individual Market began to spiral. Insurers pulled out of high-cost counties and, in some cases, the state entirely.

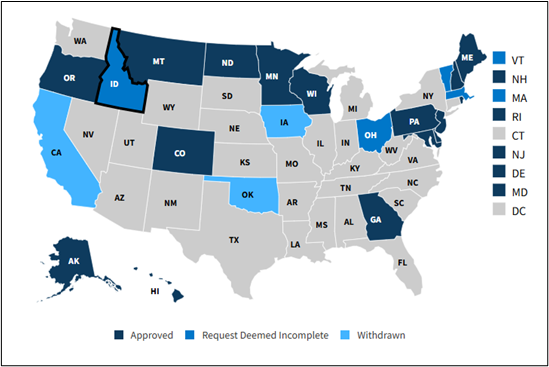

Since then, fourteen states have used ACA Innovation Waivers (Sec. 1332) to launch reinsurance programs that have helped reduce premiums and stabilize enrollment in the Individual Market. In contrast to the highly partisan debates that typically surround healthcare policy, reinsurance has been embraced by deep blue and deep red states alike.

Source: Kaiser Family Foundation

Individual Market Reinsurance is a fairly simple program in which the state program picks up a share of very high cost medical claims – serious car accidents, heart attacks, cancer, chronic disease, etc. Essentially, the program pays for the cost of prohibiting insurers from pricing based on pre-existing conditions and other factors aside from age, location, and smoking.

The cost of the program is shared between the state and federal government. The federal share represents savings realized from the federal government paying out less in subsidies (lower premiums = lower subsidies). The savings are then passed through to the state and applied toward the total cost of the reinsurance program.

Minnesota: For example, Minnesota’s reinsurance program covers 80% of the portion of a medical claim between $50,000 and $250,000. These parameters are set to maximize the benefit in the form of lower premiums and are based on the original reinsurance program included in the ACA.

Minnesota’s reinsurance program has kept premiums 20% below what they would be without it. The program also succeeded in stabilizing Individual Market enrollment in the state, which plummeted in the years prior to the enactment of reinsurance:

2014: 293,400

2017: 149,400

2020: 153,100

2023: 163,500

Increased enrollment means more people in the risk pool, which further helps stabilize premiums.

The total cost of Minnesota’s program has varied over time depending on Individual Market enrollment and medical utilization.

In 2023, the most recent year for which complete payment data is available, the program cost $207 million – $119 million in pass-through funds from the federal government and $88 million from the state.

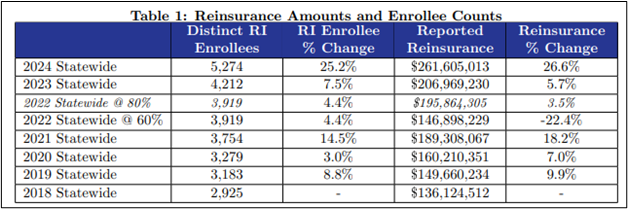

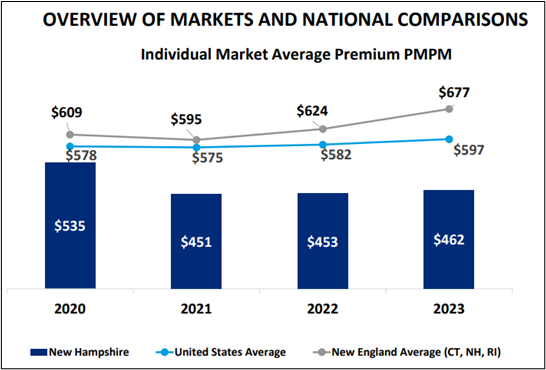

New Hampshire: Closer to home, New Hampshire has seen even greater success with its Individual Market reinsurance program. Launched in 2021, reinsurance helped lower the average individual market premium from a high of $613 per month in 2018 to $462 per month in 2023 (-25%).

This contributed to an increase in Individual Market enrollment of 44.6% (+23,600) between 2018 and 2023.

In 2024, New Hampshire’s reinsurance program cost $42 million – $28 million from federal pass-through funding and $14 million from the state. The program covers 49% of claims between $60,000 and $400,000.

While Vermont’s Individual Market is slightly less than half the size of the same market in New Hampshire (35,000 vs. 77,000), the total amount of premium paid in the market is comparable to New Hampshire due to much higher average plan cost. As a result, Vermont could expect a reinsurance program with comparable impact to cost about the same as New Hampshire’s program.

In June, Governor Scott and state lawmakers agreed on a $9 billion budget for 2026.

Criticisms of Reinsurance: The most common critique of reinsurance is that it doesn’t address the underlying cost of healthcare. This was raised when Vermont considered its own program several years ago.

However, current reinsurance programs are not intended to reduce underlying healthcare costs. They were designed to make it more affordable for people to buy coverage in the Individual Market and to stop the price/disenrollment death spiral in that market.

Further, states could use reinsurance as a tool to drive down healthcare costs by tying reinsurance payments to healthcare provider outcomes, quality, and price. For instance, reinsurance payments could be optimized to pay the full cost share for claims originating from providers with a track record of quality service and lower costs. For claims from high-cost providers and/or those with mixed quality records, reinsurance payments could be reduced by a certain percentage.

Critics also note that reinsurance is not income-restricted, unlike the current Vermont Premium Assistance program that caps state aid at those making less than 300% of the federal poverty level.

Like the claim about underlying healthcare costs, this misunderstands the purpose of the reinsurance program. A large concentration of high-cost medical claims impacts everyone in the Individual Market, not just low- or high-income people. While the lowest income enrollees don’t feel the full impact due to state and federal assistance, the claims still increase the cost of premiums and subsidies.

If the program succeeds in increasing enrollment, it should naturally reduce premiums by expanding the risk pool to include more health policyholders.

Individual Coverage Health Reimbursement Arrangements (ICHRAs).

Another way policymakers to increase options for small businesses to incentivize the adoption of Individual Coverage Health Reimbursement Arrangements (ICHRAs).

An ICHRA is a newer type of employer-funded healthcare account that carries significant tax and practicality advantages for both employer and employee. For employers, it is considered a business expense and contributions are deductible at the federal level.

For both employers and employees, employer contributions are not considered wages and not treated as taxable income or subject to SSI and Medicare taxes.

Importantly, an ICHRA can be used by the employee to pay for health insurance premiums and qualified medical expenses, rather than just qualified medical expenses like Health Savings Account (HSA).

Unlike an HSA, employees cannot contribute to an ICHRA but an ICHRA can be paired with an HSA to maximize tax-advantaged healthcare savings for an employee. And the employee can keep their health plan when they switch jobs.

As discussed in Part I, small businesses in Vermont and across the country are struggling to offer health coverage to their employees.

In response to the declining ability to offer a benefit that is vital to employee recruitment and retention, many states are considering targeted HRA incentives to help small employers compete with big business.

In Indiana, lawmakers established a tax credit for employers with fewer than 50 employees who contribute to an ICHRA:

– up to $400 per employee in year one; and

– up to $200 per employee in year two.

The credit is equal to the amount the employer contributes, up to the limits above, so long as the amount contributed is equal to or greater than the amount the employer paid toward premiums in the previous year (including if the employer didn’t offer insurance coverage and the amount contributed was $0.).

The credit can be taken against several business taxes but cannot exceed the employer’s tax liability. However, unused credits can be carried forward for up to ten years after the year in which it was claimed.

Indiana cuts off eligibility for the credit when annual claims exceed $10 million – those who filed a claim prior to the cutoff receive it, those who come after do not. If scaled based on population, the cost would be much lower in Vermont.

Another advantage to HRA tax credits is that it encourages more people to enroll in the Individual Market, which should help stabilize that market by growing the risk pool.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles