January 15, 2026

Reform package would mean new options, more affordable coverage

Two Vermont lawmakers have introduced a suite of health coverage reforms aimed at reducing costs and increasing affordable options in the state.

H.585 (2026) is sponsored by Rep. Patricia McCoy (Poultney) and Rep. Francis “Topper” McFaun (Barre Town). The bill includes many consumer and small business friendly reforms.

Small Business Healthcare Challenges. Affordable health coverage is a top concern for small businesses. For the past forty years, the cost of employee health coverage has ranked as the number one challenge for small business owners in NFIB’s Problems and Priorities.

Nearly all (98%) small business owners who currently offer coverage worry the cost will become unsustainable within the next five years.

In Vermont, the share of small businesses able to offer health coverage has declined precipitously. According to an analysis of federal data by Take Command, the share of small businesses offering coverage declined by 21.5% – the third largest drop of any state – from 2009 to 2023.

Now, only one quarter of small businesses in the state offer coverage. That share is the lowest in the northeast. Most don’t offer coverage because it is unaffordable and impractical.

Last year, NFIB Vermont outlined the ways in which small businesses are struggling and detailed reforms that would help improve health coverage options and affordability.

Big vs. Small. Health coverage is a crucial benefit for attracting and retaining employees, and an uneven regulatory landscape puts small businesses at a major disadvantage with big businesses.

Most large employers (500+ employees: 75%) self-insure for employee health coverage, meaning they bear the risk instead of using a traditional insurance plan. Large employers sometimes use stop loss policies to mitigate the risk of self-insuring. Self-insured coverage is governed under the federal Employee Retirement Income Security Act (ERISA) and is generally exempt from state and federal regulations that apply to individual and small group coverage.

This allows larger businesses to design more affordable, flexible policies that work for their employees and help them control costs. Seventy-six percent of Vermont businesses with more than 50 employees self-insure for health coverage.

Self-insuring is not always a viable option for small businesses, but Vermont’s restrictions on stop loss insurance put it even further out of reach for them compared to regulations in most states.

H.585 Improves Small Business and Consumer Options. Compounding the problem, Vermont has taken several steps over the past decade that have reduced options and increased costs for small businesses.

Taking away affordable options almost always results in higher costs. Sometimes well-intended regulations have the opposite effect.

House Bill 585 starts to reverse some of those mistakes and opens up new opportunities for small businesses.

Association Health Plans (Sec. 7). In 2019, Vermont effectively banned the formation of new Association Health Plans (AHP) and made it more difficult to renew or continue existing plans (Act 63).

AHPs are a vital tool for leveling the health coverage playing field with big businesses. They allow multiple small employers to band together and create a larger pool of employees to enhance purchasing power and lower costs. AHPs typically offer either a fully insured large group plan or a joint-self insured plan.

Both options remove some of the barriers to affordable coverage for small businesses and employees. Reforming Vermont’s stop loss regulations to bring them in line with other states would also help make AHPs a more realistic option for small business owners in the state.

H.585 removes the prohibition on new AHPs and eliminates inane regulations intended to hinder the ability of small employers to use this option. This is an important step in allowing more affordable options.

Giving small businesses the option to form an AHP is an important first step. Even with the changes proposed in H.585, forming an AHP is not a simple process. AHPs would remain heavily regulated and subject to strict disclosure requirements under both state and federal law.

Short-Term Health Plans (Sec. 9). Short-Term (ST) health plans are an important product for small business owners, workers of all ages, and early retirees. ST plans are often used by younger people entering the workforce, those between jobs, folks who strike out on their own to start a business, and early retirees.

Outside of Vermont, people who are priced out of the traditional insurance market have turned to ST plans as an affordable alternative. Except for their duration, these plans are lightly regulated at the federal level. This allows them to be tailored to fit the needs of individuals and families, rather than needing to comply with a rigid and expensive set of regulations that means higher premiums and higher out-of-pocket costs.

Short-Term plan prices often range from 25% to 75% less than traditional insurance. They can include coverages and terms anywhere from true catastrophic coverage to something close to a fully regulated individual market plan. People can choose and pay for the level of coverage they actually need, rather than pay exorbitant premiums for a product they may never use.

ST Plans are currently unavailable in Vermont due to strict limitations on how long people can have the policies. The state limits ST plan coverage to no more than three months in a twelve-month period and does not allow renewals.

Vermont’s restrictions on short-term health plans are out of step with the vast majority of states and historical federal regulations.

Thirty-five states allow ST plans to be issued for an initial term of up to six months, including roughly 30 that allow the plans to last for up to 364 days. States are mixed on renewability, but the majority allow them to be renewed for some additional period.

H.585 would allow short-term plans to have a total duration, including initial term, renewals or extensions, of up to 12 months. This proposal mirrors the longstanding federal regulation in place from 1997 until 2016.

Since 2016, ST plan limits have seesawed between being capped at an initial term of up to three months with an option to renew for one extra month and an initial term of up to two years with an option to renew for an additional two years.

Relaxing short-term plan rules also opens the door to novel health care plan designs, such as the successful “Enhanced Short-Term Plan” law passed by Idaho in 2019.

Critics of ST plans often argue these plans are deceptive, low-value, and can destabilize the individual and group markets. Certainly, ST plans are not the right fit for every consumer.

However, ST plans are subject to robust federal and state disclosure requirements, allow people to customize their insurance to fit their needs and budgets, and newer research shows that states with more consumer-friendly ST plan rules have healthier individual health insurance markets.

This makes sense because ST plans help people maintain a level of coverage, making it a shorter step up to a traditional insurance plan when individual circumstances allow or necessitate.

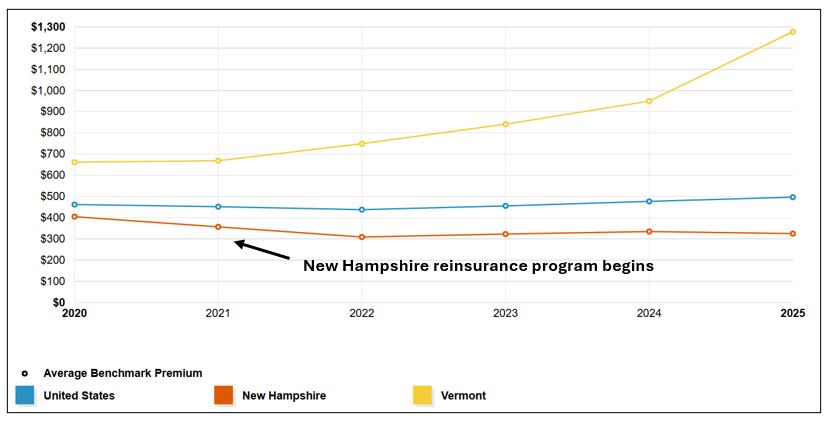

With the highest individual market premiums in the country – nearly $1,300 per month for a silver plan – and rates three times higher than New Hampshire, Vermont consumers deserve every option to find affordable coverage for themselves and their families.

Deriding ST plans as “junk” is a slap in the face to hardworking people paying over ten thousand per year for “regulated” coverage.

Individual Market Reinsurance (Sec. 13). As noted above, Vermont has the highest individual market premiums in the United States. According to the Kaiser Family Foundation, benchmark (silver plan) premium prices are three times higher than the same plan in New Hampshire and more than double the national average:

Beginning in 2016, many states across the country began to see drastic Individual Market premium spikes. As premiums increased people dropped their coverage, and the Individual Market began to spiral. Insurers pulled out of high-cost counties and, in some cases, the state entirely.

Since then, fourteen states have used ACA Innovation Waivers (Sec. 1332) to launch reinsurance programs that have helped reduce premiums and stabilize enrollment in the Individual Market. In contrast to the highly partisan debates that typically surround healthcare policy, reinsurance has been embraced by deep blue and deep red states alike.

Source: Kaiser Family Foundation

Individual Market Reinsurance is a fairly simple program in which the state program picks up a share of very high cost medical claims – serious car accidents, heart attacks, cancer, chronic disease, etc. Essentially, the program pays for the cost of guaranteed issue (no denial of coverage based on pre-existing conditions) and community rating (which prohibits rating based on health risk and most other factors).

The cost of the program is shared between the state and federal government. The federal share represents savings realized from the federal government paying out less in subsidies (lower premiums = lower subsidies). The savings are then passed through to the state and applied toward the total cost of the reinsurance program.

Minnesota: For example, Minnesota’s reinsurance program covers 80% of the portion of a medical claim between $50,000 and $250,000. These parameters are set to maximize the benefit in the form of lower premiums and are based on the original reinsurance program included in the ACA.

Minnesota’s reinsurance program has kept premiums 20% below what they would be without it. The program also succeeded in stabilizing Individual Market enrollment in the state, which plummeted in the years prior to the enactment of reinsurance:

2014: 293,400

2017: 149,400

2020: 153,100

2023: 163,500

Increased enrollment means more people in the risk pool, which further helps stabilize premiums.

The total cost of Minnesota’s program has varied over time depending on Individual Market enrollment and medical utilization.

In 2023, the most recent year for which complete payment data is available, the program cost $207 million – $119 million in pass-through funds from the federal government and $88 million from the state.

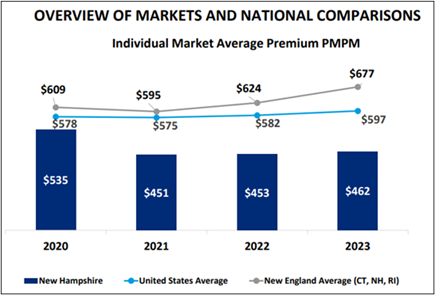

New Hampshire: Closer to home, New Hampshire has seen even greater success with its Individual Market reinsurance program. Launched in 2021, reinsurance helped lower the average individual market premium from a high of $613 per month in 2018 to $462 per month in 2023 (-25%).

This contributed to an increase in Individual Market enrollment of 44.6% (+23,600) between 2018 and 2023.

In 2024, New Hampshire’s reinsurance program cost $42 million – $28 million from federal pass-through funding and $14 million from the state. The program covers 49% of claims between $60,000 and $400,000.

H.585 authorizes Vermont to seek a waiver from the federal government to receive pass-through funding for a reinsurance program. With a $9+ billion annual budget, the state can likely manage its share of the program’s cost within existing funds.

Rate Setting Reform (Sec. 3). A good example of a well-meaning policy that ends up backfiring is the idea that people should not pay more or less for health insurance based on their age. Ultimately, overly severe limits on premium disparities ignore the reality of health risk and end up backfiring on people all ages.

This policy raises the floor price for young people and pushes them out of the insurance market. For every one percent increase in health insurance premiums, there’s a four to six percent reduction in demand for employer-based individual and family coverage.

When younger, healthier people drop coverage, it makes the risk pool less healthy and causes premiums to increase for everyone else. The cycle repeats itself until states intervene or the market collapses.

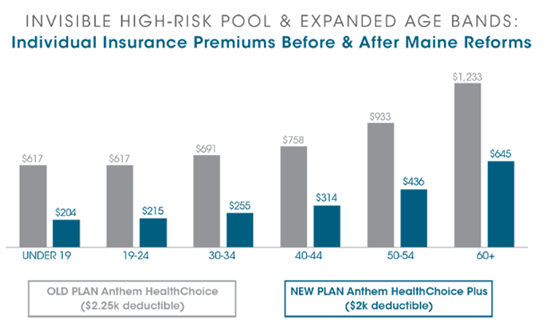

This is what happened in Maine during the 1990s and 2000s after the state adopted a series of stringent health coverage regulations, including restrictive age banding of 1.5:1. The fallout was severe, as described in a 2017 Health Affairs article:

As average claims increased, premiums and deductibles for everyone skyrocketed. Young and healthy individuals soon fled the market as premiums and deductibles rose, prompting even higher premium hikes. More premium hikes were followed by more exits, creating a death spiral in the individual market.

Insurers fled the market, and premiums more than doubled between 1995 and 2001 as the market deteriorated. The number of individuals covered dropped to just 36,000 by 2011 – a 65 percent decline from the 102,000 individuals enrolled in 1993.

In 2011, Maine lawmakers enacted a suite of reforms to lower premiums, stop the downward spiral, and restore health to its individual market. Many of the same reform concepts are found in H.585. The reforms were wildly successful:

The Affordable Care Act limited age-based rating to a 3:1 ratio. In general, this means rates for older policyholders in the individual and small group markets cannot be more than three times higher than those for younger people. Prior to the ACA, many states used an age band limit of 5:1 because it roughly reflected the disparity in healthcare utilization between older and younger populations.

Vermont is one of only two states that has gone beyond the ACA by banning the use of age as a rate setting factor. The state also departs from the ACA version of “community rating” by forbidding consideration of geography and tobacco use in rate setting.

Coupled with the state and ACA prohibition on rating based on health factors, this means that health insurance for individuals and small businesses is not risk based or actuarially justifiable.

H.585 would allow premiums to vary based on age by up to 5% above or below the community rate – the non-risk adjusted rate.

Other bills would go further. H.430, authored by Rep. Gina Galfetti (R-Barre Town) and Rep. Edward Waszazak (D-Barre City), would have the state follow the ACA’s rating rules for age (3:1) and tobacco (1.5:1). Premiums variance would be capped at 20% above or below the community rate.

Conclusion. H.585 is a serious effort at reforming Vermont’s broken health insurance market and making premiums more affordable for working families, small businesses and other consumers.

This bill will restore importance coverage options for Vermonters, including more affordable Association Health Plans and Short-Term Health Plans. It will reduce individual market premiums with reinsurance and could lead to a more stable, sustainable individual market with a healthier population mix.

We know from the experience in Maine between 1993 and 2011 that hard reforms are necessary but will pay off for people of all ages and from all walks of life.

With much of Vermont’s health coverage and healthcare systems on the brink, it is imperative that lawmakers from all parties look outside of rigid ideological boxes for fixes.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles