Topics:

August 15, 2024 Last Edit: June 5, 2025

New Radio, Digital, Video Ads are NFIB’s Latest Effort Calling on Congress to Make The 20% Small Business Deduction Permanent

NFIB Releases New Ads in North Dakota Urging Congress to Stop Massive Tax Hike on Small Businesses

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

October 20, 2025

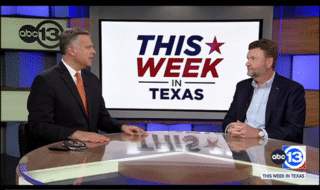

NFIB on This Week in Texas: Vote ‘YES’ on Prop 9 to Help Ma…

Early voting begins this week – make your plan to vote ‘YES’ on Prop…

Read More

October 20, 2025

NFIB Releases New Ads in Texas Urging Voters to Support Prop 9…

Statewide Radio, Digital Ads Urge Voters to Vote ‘YES’ on Prop 9 to Hel…

Read More

October 17, 2025

Maine Capitol Update: Taxes

Federal Tax Conformity Debate and the Property Tax Relief Task Force

Read More

October 17, 2025

Beacon Hill Update

Mass. lawmakers continue to file bills that will have significant impact on…

Read More