May 19, 2025

But Granite State Continues to Lag in Business Tax Competitiveness

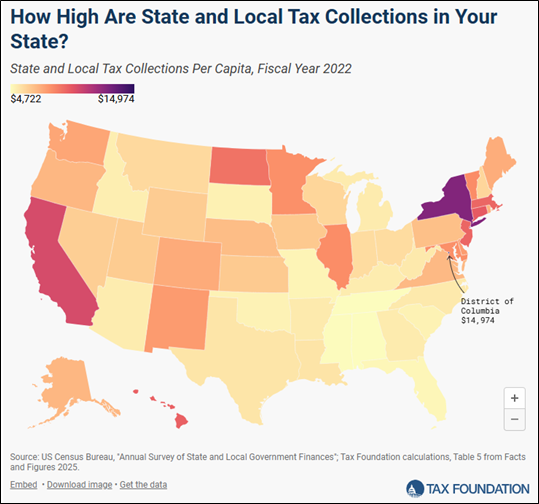

In May, the nonpartisan Tax Foundation released its annual ranking of combined state and local tax collections per capita. New Hampshire fared by far the best of Northeast states, coming in 29th with $5,949 in taxes per person.

Per capita state and local taxes in the Granite State totaled more than $700 less than the next closest state in the Northeast (Pennsylvania) and nearly $7,000 less than the highest state (New York).

New Hampshire is one of only two states in the nine-state region outside of the top 20 and one of only three below the national average ($7,109).

Here’s how New Hampshire stacks up against the region:

NH (29th): $5,949

PA (22nd): $6,644 (+12%)

RI (17th): $7,000 (+18%)

ME (16th): $7,216 (+21%)

VT (8th): $8,158 (+37%)

MA (6th): $9,341 (+57%)

NJ: (5th): $9,366 (+57%)

CT (3rd): $9,718 (+63%)

NY (1st): $12,685 (+112%)

Unsurprisingly, New Hampshire also led the region in lowest state and local tax burden in previous editions of the Tax Foundation analysis. This year’s ranking is an improvement over 2023 (NH: 25th highest) and 2019 (NH: 19th highest).

Out of seven states in the country without a tax on any individual income, two states (NV, WY) had higher state and local tax collections and four were lower (TN, FL, SD, TX) than New Hampshire.

However, New Hampshire continues to lag nationally on business taxes. While the Granite State ranks 6th best in overall Tax Competitiveness, business taxes are ranked 16th worst in the country.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles