Topics:

September 14, 2022 Last Edit: June 5, 2025

The deadline for filing for the program is December 30, 2022

New Jersey Sends Out ANCHOR Tax Rebate Guidance

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

October 16, 2025

LISTEN: NFIB Texas Promotes Prop 9 on Y’all-itics & Smal…

Make your plan to vote ‘YES’ on Prop 9 today!

Read More

October 16, 2025

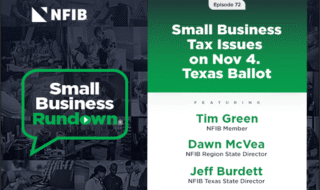

LISTEN: On The “Small Business Rundown” Podcast, NFIB Texas…

Prop 9’s passage would save Texas small businesses over $500 million annu…

Read More

October 16, 2025

Illinois SALT Workaround Provisions Set to Expire

Could impact S-CORPS and other small businesses in Illinois that file as pa…

Read More

October 16, 2025

San Antonio Express-News Editorial Board: ‘State Propositions…

The San Antonio Express-News recommends Texans vote ‘YES’ on Prop 9 as…

Read More