July 10, 2025

State Education Funding and Property Tax under have been under scrutiny for years.

Over the past two months, the New Hampshire Supreme Court has issued two consequential decisions regarding the Statewide Education Property Tax (SWEPT) and how much funding the state provides to local schools.

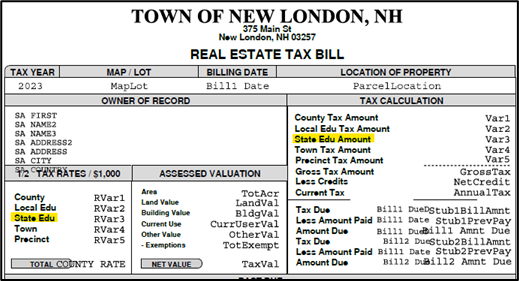

SWEPT is a state imposed, locally collected property tax that raises $363 million per year for the state’s Education Fund. It usually represents a small but meaningful portion of property tax bills.

Sample Property Tax Bill – New London, NH

These decisions could have significant tax implications for Main Street businesses.

SWEPT Constitutional… In early June, the New Hampshire Supreme Court affirmed the constitutionality of SWEPT, sparing lawmakers from having to come up with a way to replace more than 25% of the annual revenue in the state’s Education Fund.

While the SWEPT tax rate is uniform across the state, plaintiffs unsuccessfully argued the tax is unconstitutional because the effective rate varies significantly between communities with lower and higher property values.

Plaintiffs also argued that SWEPT is unequal because it allows municipalities that raise excess funds to keep those funds and offset other municipal tax rates, further skewing effective property tax rates.

The court rejected those arguments, reversing a 2023 New Hampshire Superior Court decision that found SWEPT unconstitutional.

However, plaintiffs were successful in challenging a feature of SWEPT that exempts properties in unincorporated communities from the tax. This change could have significant tax implications for businesses that were previously exempt.

… But Funding Is Inadequate. The state Supreme Court followed up on July 1, in a very split decision, finding the state’s current level of education funding inadequate. The court left it up to lawmakers to decide how to address the deficiency.

This partially affirms and partially reverses parts of the 2023 Superior Court ruling.

The earlier decision had ordered the state to provide a minimum of ~$7,350 per student in “Adequacy Aid.” Adequacy Aid is meant to satisfy earlier court decisions requiring the state to help local school districts fund an adequate education.

Adequacy Aid consists of a base amount ($4,265) and three types of differentiated aid. Combined, it currently amounts to $5,392.50 per pupil. After factoring in other forms of educational aid provided by the state, the total state share of education funding is $7,109 per pupil for FY 2026. Actual state funding levels vary widely by district, with some receiving more than $10,000 per pupil.

It remains to be seen whether the court expects lawmakers to come up with an additional ~$3,000 per pupil (the difference between the court’s funding level and the current Adequacy Aid base), or an additional ~$250 per pupil (the difference between the court’s funding level and total state aid).

Only one member of the state Supreme Court – Senior Associate Justice James Bassett – signed onto the entirety of the decision. Because two of the five justices could not participate in the case, the conclusion that state funding is inadequate was made by Bassett and two temporary justices appointed to sit in.

The other two permanent justices dissented from the bulk of the decision but agreed with Bassett that the lower court overstepped its authority in ordering the legislature to increase state education spending.

Justice Bassett is retiring at the end of August. Governor Ayotte was critical of the court’s decision, and any replacement she picks could alter future school funding legal battles.

Implications For Small Business Taxes. Had the state Supreme Court affirmed the lower court’s rulings, lawmakers would have had to redesign SWEPT and increase state funding for local schools. If the Supreme Court’s ruling means the state must increase base Adequacy Aid to a minimum of $7,350, lawmakers would have to come up with an additional $500+ million per year – at least.

This could have major implications for both small business property taxes and general business taxes. Currently, more than a third of Business Enterprise Tax and Business Profits Tax revenue goes to the state’s Education Fund.

Earlier this year, a group of lawmakers proposed rolling back all the business tax rate reductions (BET, BPT, I&D, Meals & Rooms) since 2015 to increase state education funding. This would have resulted in a $700 million tax increase over the next three years – and would still not have been enough to meet the lower court’s mandate.

NFIB NH strongly opposed the tax hike, and it was decisively defeated in a bipartisan vote of 345 to 27.

Education Funding and Business Taxes Over Time. In its most recent report, the U.S. Census Bureau ranks New Hampshire’s total per pupil education spending 11th highest among all states.

According to the New Hampshire Department of Education, schools spent an average of $21,545 per pupil in the 2023-24 school year. Of total per pupil spending in 2023-24: 8% came from the federal government, 29% from the state, 63% came from local property taxes.

Compared to ten years prior (2013-14), spending increased by 16% (+$2,921 per pupil) while public school enrollment declined by 11% (-20,225).

Meanwhile, over the past ten years, the state business taxes’ share of education funding increased by 80%.

The newly adopted state budget for Fiscal Years 2026-27 projects that nearly $2.6 billion of unrestricted revenue will flow into the state’s Education Fund. Of this, $945 million (36%) will come from the BET and BPT.

Looking back a decade to FY 2016-17, the state devoted $1.8 billion to the Education Fund with roughly $360 million (20%) coming from the BET and BPT.

As Andrew Cline, president of the Josiah Bartlett Center for Public Policy, explains: thanks to the ten year effort to reduce the state’s business tax burden, New Hampshire’s businesses are contributing a larger share toward the state’s general and education fund than any time in recent history.

New Hampshire’s School Funding Legal Saga. The adequacy of the state’s contribution to school funding and SWEPT have been the subject of court challenges dating back to the 1980s.

In Claremont School District et al vs New Hampshire (1993), also referred to as Claremont I, the state Supreme Court ruled that New Hampshire’s constitution established a right to an adequate education and obligated lawmakers to provide adequate funding.

Subsequent Claremont cases resulted in further clarification on what adequate education and adequate funding mean, the imposition of SWEPT in 1999, and more admonitions to increase state education funding. More recently, the Contoocook Valley School District and other challenges have picked up where Claremont left off.

Rulings in these cases have, at times, divided the court itself and been met with fierce resistance from many lawmakers and some legal scholars who view the decisions as a violation of the constitutional separation of powers. Governors and lawmakers from both parties have balked at turning over policymaking, as well as spending authority, to the judicial branch.

In this year’s state budget, lawmakers included a “Declaration of Authority” stating the legislature disagrees with the initial Claremont decisions. It further declares that “as the sole branch of government constitutionally competent to establish state policy and to raise and appropriate public funds to carry out such policy, the legislature shall make the final determination of what the state’s educational policies shall be and of the funding needed to carry out such policies.”

New Hampshire House Majority Leader Jason Osborne responded to the most recent court decision by saying it “changes nothing” and the legislature remains “steadfast in defining, funding, and protecting an excellent education for every child.”

Speaker of the House Sherman Packard and Senate President Sharon Carson described the decision as based on a “deeply flawed” premise and promised to “continue to reform our schools while avoiding a broad-based sales or income tax.”

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles