September 4, 2025

Small Group market premiums rising, enrollment dropping

New Hampshire ranks among the healthiest states in the country – number one overall, in fact, according to a recent report from America’s Health Rankings. This includes top billing for the health of women and children among all states.

At the same time, small businesses rank health insurance affordability as their number one problem – and have for nearly 40 years, according to NFIB’s Small Business Problems & Priorities.

In this post, we look at the state of the two health insurance markets that primarily serve small businesses and their employees.

In the second post, we discuss several policy solutions that lawmakers should pursue in response to current and looming problems in these markets.

Small Business Struggles. Despite the high marks for good health, New Hampshire’s health insurance options for small business employee coverage are increasingly unaffordable.

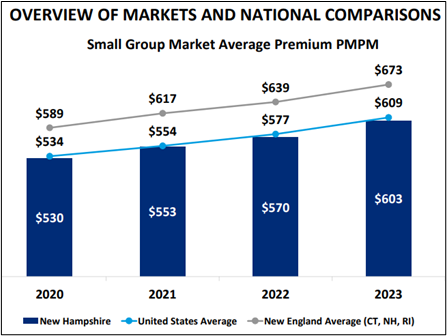

According to the most recent New Hampshire Insurance Department report on health insurance premium and claim cost drivers, the average small group premium increased by 20% from 2018 ($502) to 2023 ($603).

Over the same period, small group enrollment declined by 16% (70,330 to 59,010). The small group market serves small businesses offering fully insured health coverage to employees.

While New Hampshire’s small group market compares favorably to the rest of New England, that’s cold comfort for Main Street employers and employees who must grapple with average annual premium increases of 4-5% in this state.

Source: NHID, Oliver Wyman 2024 Final Report

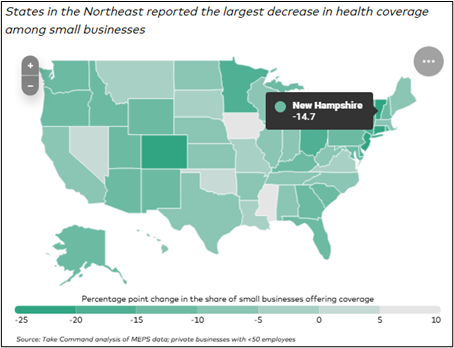

Small Business Coverage Slide. There has been a two-decade long decline in the small group market nationwide, leaving fewer small employers able to offer health coverage.

In New Hampshire, the share of small employers offering health coverage declined by 15% from 2008 to 2023.

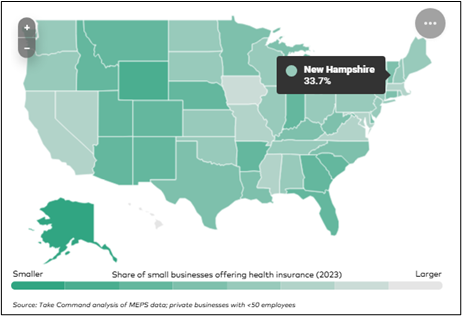

Source: Take Command

Only one third of Granite State small businesses offer health coverage because most cannot afford it.

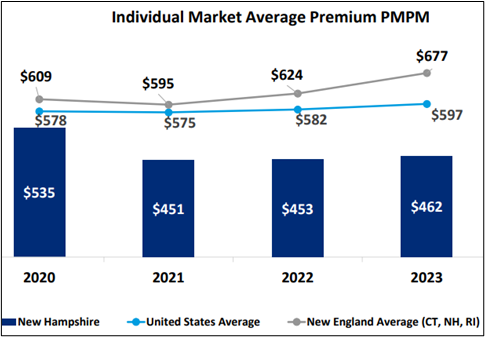

Individual Market Rebound. Small businesses also rely on a healthy individual market for health coverage. The individual market is where people buy coverage if they don’t get it from an employer or the government.

From 2018 to 2023, individual market premiums dropped by nearly 25% and enrollment grew by 45%. This is, in part, attributable to the creation of a state-federal reinsurance program that took effect in 2021.

Reinsurance covers a portion of very high-cost medical claims and serves as a financial buffer against the federal Affordable Care Act’s limitations on setting premiums based on health and age. The program covers 49% of claims between $60,000 and $400,000.

Source: NHID, Oliver Wyman 2024 Final Report

In 2024, the reinsurance program cost $42 million: $28 million from federal pass-through funding and $14 million from the state. The federal share represents money the program saves the federal government from reduced premium tax credits (lower premiums = lower federal tax credits = pass through savings to the state).

Federal IM Subsidies Expiring. While the reinsurance program has contributed to a more stable individual health insurance market, enhanced federal premium tax credits have also played a major role in boosting enrollment over the last five years.

Since 2021, enhanced federal premium tax credits have helped reduce costs for those making above 400% FPL and contributed to an increase in Individual Market enrollment. The subsidies cap the premium cost at 8.5% of household income for those above that level.

As a result, the actual cost of Individual Market Plans is well below the sticker price for most people.

However, the enhanced federal subsidies are set to expire at the end of 2025 and have not been reauthorized by Congress. If the enhanced subsidies played a major role in increased individual market enrollment, it is likely that their expiration will contribute to disenrollment starting next year.

Consumers in the individual market – in addition to the 65,000 uninsured Granite Staters – will be looking to policymakers for more affordable options.

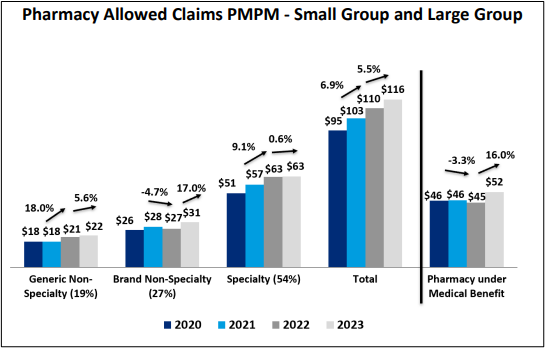

High Price Drugs, Hospital Markups, and Hidden Cost Shifts. As illustrated in the NHID report, prescription drug prices play a major role in health insurance premium increases.

In New Hampshire and the rest of the country, the cost of specialty drugs – in particular, injectable medications administered by a physician (data set right of line) – are driving up premiums. Physician-administered drugs include important infusion medications that treat cancer, rheumatoid arthritis and other serious conditions.

Source: NHID, Oliver Wyman 2024 Final Report

According to a UnitedHealth analysis of claims data, total prescription drug spending increased from $694 per enrollee in 2014 to $1,626 per enrollee in 2024 (+134%). Specialty drugs accounted for 63 percent of this growth.

While drug manufacturer price increases, artificial demand for branded patented drugs, and backroom negotiating among insurers, pharmacy benefit managers, and drug makers plays a role in increased pharmaceutical spending, the markup charged by healthcare providers is also an important factor.

Where injectable or intravenous drugs are administered has a huge impact on their final cost. In New Hampshire, nearly 80 percent of patients receive these specialty drugs in a hospital setting, where they cost 99 percent more than a non-hospital physician’s office – the largest price differential in New England.

This price differential is, in part, attributable to an enormous markup on specialty drugs that hospitals charge to individuals, families, and employees with commercial health insurance.

A December 2024 RAND report found that hospitals in New Hampshire charge nearly 300% of average sales price (ASP) for physician-administered drugs. That is triple the 106% of ASP paid by Medicare Part B.

A study published in the New England Journal of Medicine earlier in the year found similarly egregious hospital markups.

In Vermont, lawmakers took drastic action in response to the RAND report and other data showing massive hospital markups on specialty drugs that drive up insurance premiums. RAND found that Vermont hospitals had the highest markup in the nation (500% of ASP).

Calling it “price gouging,” lawmakers there leveled the playing field between public programs and commercial plans by bringing the markup for hospital-administered drugs much closer to the Medicare reimbursement level (120% of ASP for commercial compared to 106% of ASP for Medicare Part B). See 2025 Act 68. This law will save patients and policyholders at the state’s largest insurer $46 million per year and reduced requested premium increases by 4% for 2026.

Hospitals markup the prices on services and medications to commercial plans to make up for much lower payments from government programs like Medicaid and Medicare.

Nationally, private coverage pays double the Medicare rate for hospital services and over 40% more than Medicare for physician services (KFF, 2020). Recent research indicates the cost shift in New Hampshire is higher than the national average.

Medicaid reimbursement is even lower (30% less) than Medicare, putting further pressure on private coverage.

When the share of reimbursement from public health plans increases, health providers make up the difference by charging higher prices to private health plans.

This increases commercial insurance premiums, which in turn reduces enrollment in private coverage. For every one percent increase in health insurance premiums, there’s a four to six percent reduction in demand for employer-based individual and family coverage.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles