March 17, 2025

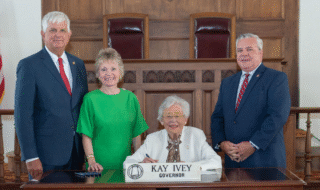

Gov. Kay Ivey declared a state of emergency that hit 52 of Alabama’s 67 counties

Officials say at least three people died in the wave of deadly storms that swept across Alabama on Saturday, March 15.

Gov. Kay Ivey declared a state of emergency, and Attorney General Steve Marshall reminded consumers of potential price gouging in areas affected by the storm. Alabama’s price gouging law is activated when a state of emergency is in effect. This law prohibits the “unconscionable pricing” of items for sale or rent. Click here to learn more.

Navigating the claims process

After a disaster, you may face many insurance coverage issues that need to be addressed. Here are some things to keep in mind if your business is disrupted or damaged by the storm:

Once it’s safe, call your insurance company.

Questions to ask:

■ What types of damage are covered?

■ How long will it take to process my claim?

■ Will I need to obtain estimates for repairs?

Make temporary repairs.

While it’s okay to take steps to protect your property from further damage, you should hold off on making extensive repairs until the claim adjuster has visited your business and assessed the damage. Make sure you save receipts for what you spend on repairs.

Prepare for the adjuster’s visit.

The more information you have about your damage property – descriptions of as many items as possible, approximate date of purchase and what it would cost to replace or repair them – the faster your claim can be settled.

To substantiate your loss, prepare an inventory of damage or destroyed items and give a copy to the adjuster, along with copies of any receipts. Don’t throw out damaged items until the adjuster has visited. You should also consider photographing or videotaping the damage. If your property was destroyed, or you no longer have any records, work from memory.

Identify structural damage to your business and any supporting structures.

Make a list of everything you want to show the adjuster, such as cracks in the walls and missing roof tiles. You should also get the electrical system checked. Most insurance companies pay for these inspections.

Get written bids from licensed contractors.

The bids should include details of the materials to be used and prices on a line-by-line basis. This makes adjusting the claim faster and simpler.

Keep copies of the lists and other documents you submit to your insurance company. Also, keep copies of whatever paperwork your insurance company gives you and record the names and phone numbers of everyone to whom you speak.

After your claim has been settled and the repair work is underway, take the time to re-evaluate your insurance coverage. Was your business adequately insured? Did you have replacement cost coverage for all of your assets? Talk to your insurance agent about possible changes.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles